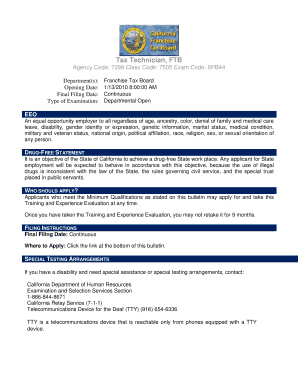

Tax Technician, FTB Form

What is the Tax Technician, FTB

The Tax Technician, FTB is a specific form used by the California Franchise Tax Board (FTB) to assist taxpayers in managing their tax obligations. This form is essential for individuals and businesses who need to report income, claim deductions, or seek refunds. It plays a crucial role in ensuring compliance with state tax laws and regulations.

How to use the Tax Technician, FTB

Using the Tax Technician, FTB involves several straightforward steps. First, gather all necessary financial documents, such as W-2s, 1099s, and any relevant receipts. Next, fill out the form accurately, ensuring that all information is complete and truthful. Once completed, review the form for any errors before submitting it to the FTB through the designated method, whether online, by mail, or in person.

Steps to complete the Tax Technician, FTB

Completing the Tax Technician, FTB requires careful attention to detail. Begin by entering your personal information, including your name, address, and Social Security number. Then, report your income sources and any applicable deductions. After filling in all sections, double-check your entries for accuracy. Finally, sign and date the form before submission to ensure it is processed without delays.

Required Documents

When preparing to complete the Tax Technician, FTB, certain documents are essential. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Previous year’s tax return for reference

- Any relevant schedules or additional forms required by the FTB

Legal use of the Tax Technician, FTB

The Tax Technician, FTB must be used in accordance with California tax laws. It is designed for legitimate tax reporting and compliance purposes. Filing this form accurately helps avoid penalties and ensures that taxpayers meet their legal obligations. Misuse of the form can lead to legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Tax Technician, FTB. Typically, the deadline for submitting the form aligns with the federal tax filing date, which is usually April 15 each year. However, taxpayers should verify specific dates for the current tax year, as extensions or changes may apply. Missing the deadline can result in penalties and interest on unpaid taxes.

Quick guide on how to complete tax technician ftb

Complete [SKS] seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, as you can acquire the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly and without interruption. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or black out confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to finalize your changes.

- Select how you wish to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Tax Technician, FTB

Create this form in 5 minutes!

How to create an eSignature for the tax technician ftb

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Tax Technician, FTB?

A Tax Technician, FTB is a professional specializing in California's tax regulations and principles. They help individuals and businesses comply with tax laws, ensuring accurate filings and optimal tax refunds. Utilizing tools like airSlate SignNow can streamline document handling for Tax Technicians, FTB.

-

How can airSlate SignNow assist Tax Technicians, FTB?

airSlate SignNow provides a simple platform for Tax Technicians, FTB to send, receive, and eSign important documents. This enhances efficiency by reducing the time spent on paperwork, allowing Tax Technicians to focus more on tax-related tasks. The solution is designed to ensure secure transactions, essential for sensitive tax documents.

-

What features does airSlate SignNow offer for Tax Technicians, FTB?

Key features of airSlate SignNow include customizable templates, automated reminders, and advanced security protocols. These features enable Tax Technicians, FTB to manage their documents effectively, ensuring compliance and timely submissions. Additionally, the platform’s mobile access ensures you can work from anywhere.

-

Is airSlate SignNow cost-effective for Tax Technicians, FTB?

Yes, airSlate SignNow is designed to be a cost-effective solution for Tax Technicians, FTB. With competitive pricing plans, it eliminates the need for expensive software or in-person consultations. By streamlining the eSigning process, you save both time and money, making it an ideal choice.

-

What integrations does airSlate SignNow offer for Tax Technicians, FTB?

airSlate SignNow integrates seamlessly with various accounting and tax software platforms, facilitating a smooth workflow for Tax Technicians, FTB. This allows users to pull in relevant data directly, minimizing manual data entry. The integration capabilities enhance productivity and ensure accuracy.

-

Can airSlate SignNow enhance client communication for Tax Technicians, FTB?

Absolutely! airSlate SignNow improves client communication for Tax Technicians, FTB by providing real-time document tracking and notifications. Clients can easily monitor the status of their documents, enhancing transparency and trust. This level of communication helps maintain strong client relationships.

-

What are the security features of airSlate SignNow for Tax Technicians, FTB?

Security is a priority for airSlate SignNow, especially for Tax Technicians, FTB handling sensitive tax information. The platform offers bank-level encryption, secure data storage, and comprehensive audit trails. These security measures ensure that all transactions and documents remain confidential and protected.

Get more for Tax Technician, FTB

Find out other Tax Technician, FTB

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe