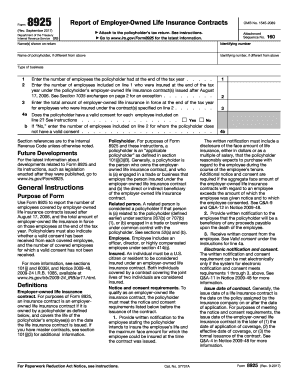

Form 8925 Rev January Report of Employer Owned Life Insurance Contracts

What is the Form 8925 Report of Employer Owned Life Insurance Contracts

The Form 8925 is a tax form used to report information regarding employer-owned life insurance contracts. Specifically, it is designed for employers who own life insurance policies on their employees. This form is essential for ensuring compliance with IRS regulations, as it provides the necessary details about the policies held by the employer. Employers must report the existence of these contracts and the benefits associated with them, which helps the IRS track and regulate the use of such policies.

How to Use the Form 8925

Using the Form 8925 involves several key steps. First, employers need to gather information about each life insurance contract, including the insured individuals and the policy details. Next, fill out the form accurately, ensuring that all required fields are completed. Once the form is filled out, it must be submitted to the IRS along with the employer's tax return. It is important to review the form for accuracy before submission to avoid any potential issues with compliance.

Steps to Complete the Form 8925

Completing the Form 8925 requires careful attention to detail. Begin by entering the employer's name, address, and Employer Identification Number (EIN). Then, list each life insurance policy, including the name of the insured, the policy number, and the amount of insurance. Ensure that all information is accurate and reflects the current status of the policies. After filling out the form, double-check for any errors or omissions before filing it with the IRS.

Filing Deadlines for Form 8925

The Form 8925 must be filed annually, typically by the due date of the employer's tax return. For most employers, this means the form should be submitted by April fifteenth of the following year. If an extension is filed for the tax return, the deadline for submitting Form 8925 will also be extended. It is crucial to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Legal Use of the Form 8925

The legal use of Form 8925 is mandated by the IRS for employers who own life insurance contracts on their employees. This form serves as a declaration of the existence of such contracts and is a requirement under the Internal Revenue Code. Failure to file this form can result in penalties, making it essential for employers to understand their obligations regarding employer-owned life insurance and to use the form correctly.

Key Elements of the Form 8925

Key elements of the Form 8925 include the identification of the employer, the details of each life insurance policy, and the information about the insured individuals. The form requires specific data such as the policy number, the face amount of the insurance, and the relationship of the insured to the employer. These elements are crucial for the IRS to evaluate the tax implications of employer-owned life insurance contracts.

Quick guide on how to complete form 8925 rev january report of employer owned life insurance contracts

Complete Form 8925 Rev January Report Of Employer Owned Life Insurance Contracts effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Form 8925 Rev January Report Of Employer Owned Life Insurance Contracts on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Form 8925 Rev January Report Of Employer Owned Life Insurance Contracts with ease

- Find Form 8925 Rev January Report Of Employer Owned Life Insurance Contracts and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow takes care of all your document management needs with just a few clicks from a device of your choice. Edit and eSign Form 8925 Rev January Report Of Employer Owned Life Insurance Contracts and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8925 rev january report of employer owned life insurance contracts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cost of the airSlate SignNow service with the 8925 feature?

The airSlate SignNow service offers competitive pricing, starting as low as $8.25 per month per user. The 8925 feature enhances the eSigning experience, providing advanced capabilities that are worth the investment for businesses of all sizes.

-

How does the 8925 feature improve document workflows?

The 8925 feature streamlines document workflows by allowing users to send, sign, and manage documents more efficiently. With airSlate SignNow, businesses can automate routine tasks, reduce turnaround times, and improve overall productivity, making it an essential tool for modern teams.

-

What key benefits does airSlate SignNow offer with the 8925 feature?

With the 8925 feature, airSlate SignNow provides enhanced security, easy document sharing, and robust tracking of eSignatures. These benefits not only ensure compliance but also build trust and transparency in your business processes.

-

Can I integrate airSlate SignNow with other applications using the 8925 feature?

Yes, airSlate SignNow supports integrations with various applications, which can be easily accessed through the 8925 feature. This capability allows businesses to connect their existing tools and optimize their workflows seamlessly.

-

Is the 8925 feature user-friendly for non-technical users?

Absolutely! The 8925 feature is designed to be intuitive and easy to use, making it accessible even for non-technical users. airSlate SignNow's straightforward interface ensures that anyone can quickly navigate the eSigning process without technical training.

-

What types of documents can be signed using the 8925 feature?

The 8925 feature allows you to eSign a wide variety of documents, including contracts, agreements, and forms. With airSlate SignNow, you can handle all your signing needs securely and efficiently, regardless of document type.

-

How does airSlate SignNow ensure the security of documents signed with the 8925 feature?

airSlate SignNow prioritizes security with the 8925 feature, offering advanced encryption and security measures. This ensures that your documents remain confidential and secure during the eSigning process, providing peace of mind for all parties involved.

Get more for Form 8925 Rev January Report Of Employer Owned Life Insurance Contracts

Find out other Form 8925 Rev January Report Of Employer Owned Life Insurance Contracts

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later