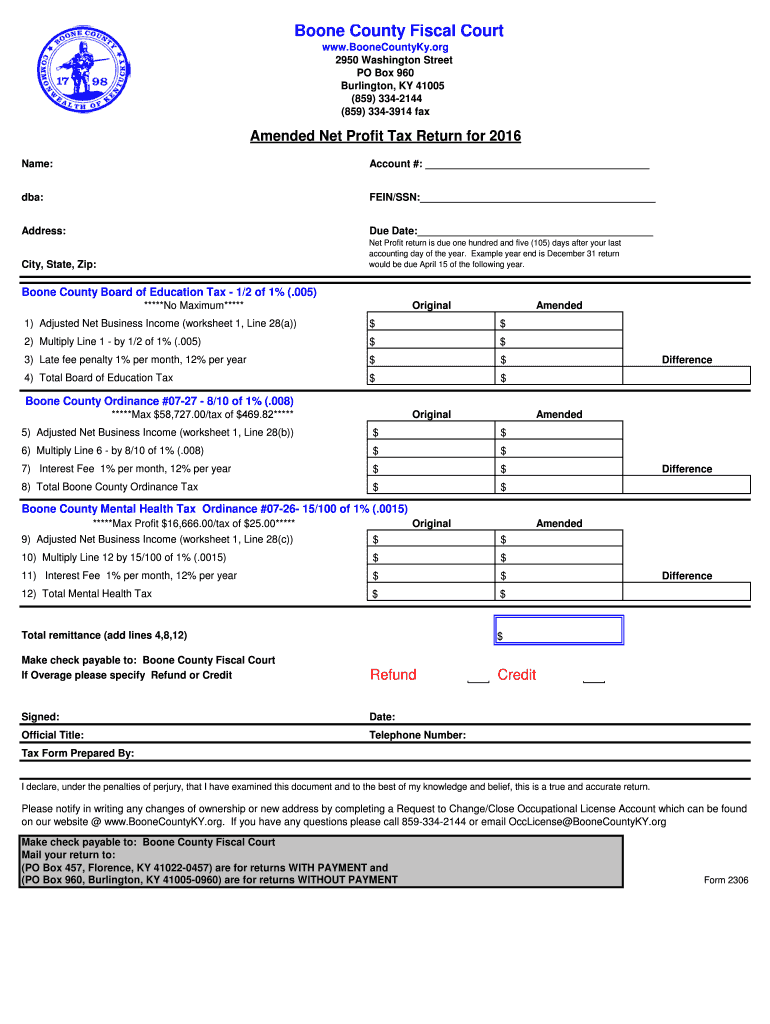

Net Profit Tax Return Form 2016

What is the Net Profit Tax Return Form

The Net Profit Tax Return Form is a crucial document used by businesses to report their income and calculate their tax obligations. This form allows taxpayers to declare their profits and losses, ensuring compliance with federal tax regulations. It is essential for various business entities, including sole proprietorships, partnerships, and corporations, to accurately complete this form to avoid penalties and ensure proper tax assessment.

Steps to complete the Net Profit Tax Return Form

Completing the Net Profit Tax Return Form involves several important steps:

- Gather financial records, including income statements and expense receipts.

- Determine the reporting period for the income and expenses.

- Fill in the form with accurate figures, ensuring all income and allowable deductions are included.

- Review the completed form for accuracy and completeness.

- Sign the form electronically or by hand, depending on the submission method chosen.

- Submit the form by the designated deadline to avoid late fees.

How to use the Net Profit Tax Return Form

The Net Profit Tax Return Form is designed to help businesses report their earnings and calculate taxes owed. To use this form effectively, follow these guidelines:

- Ensure you have the most current version of the form, as tax laws may change.

- Fill out all required fields accurately, providing detailed information about income and expenses.

- Utilize accounting software or templates if available to streamline the process.

- Consider consulting a tax professional if you have questions or complex financial situations.

Filing Deadlines / Important Dates

Filing deadlines for the Net Profit Tax Return Form vary based on the business structure and the fiscal year. Generally, the due date for most businesses is April fifteenth for the previous calendar year. However, partnerships and S corporations may have different deadlines. It is important to stay informed about these dates to avoid penalties and interest on unpaid taxes.

Penalties for Non-Compliance

Failure to file the Net Profit Tax Return Form on time can result in significant penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, inaccuracies or omissions can lead to audits and further penalties. It is crucial for businesses to file accurately and on time to maintain compliance and avoid financial repercussions.

Required Documents

When preparing to complete the Net Profit Tax Return Form, several documents are necessary to ensure accuracy:

- Income statements detailing all sources of revenue.

- Expense receipts for all business-related costs.

- Prior year tax returns for reference.

- Any relevant financial statements or accounting records.

Quick guide on how to complete net profit tax return 2016 form

Your assistance manual on how to prepare your Net Profit Tax Return Form

If you’re curious about how to generate and dispatch your Net Profit Tax Return Form, here are some brief guidelines on how to simplify tax processing.

To begin, you just need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to edit, create, and finish your tax paperwork with ease. With its editor, you can navigate between text, check boxes, and eSignatures, and return to alter information as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and convenient sharing.

Follow the instructions below to complete your Net Profit Tax Return Form in just a few minutes:

- Create your account and commence working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through different versions and schedules.

- Click Get form to open your Net Profit Tax Return Form in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and rectify any errors.

- Save updates, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Remember that submitting on paper may result in more return errors and delay refunds. Naturally, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct net profit tax return 2016 form

FAQs

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

How do I fill the income tax return form of India?

you can very easily file your income tax return online, but decide which return to file generally salaried individual files ITR 1 and businessmen files ITR 4S as both are very easy to file. First Fill the Details on First Page Name, Address, mobile no, PAN Number, Date of Birth and income from salary and deduction you are claiming under 80C and other sections. Then fill the details of TDS deduction which can be check from Form 16 as well as Form 26AS availbale online. Then complete the details on 3rd page like bank account number, type of account(saving), Bank MICR code(given on cheque book), father name. Then Click and Validate button and if there is any error it will automatically show. recity those error Then click on calculate button and finally click on generate button and save .xml file which you have to upload on income tax. This website I really found very good for income tax related problem visit Income Tax Website for Efiling Taxes, ITR Forms, etc. for more information.

-

How do I submit income tax returns online?

Here is a step by step guide to e-file your income tax return using ClearTax. It is simple, easy and quick.From 1st July onwards, it is mandatory to link your PAN with Aadhaar and mention it in your IT returns. If you have applied for Aadhaar, you can mention the enrollment number in your returns.Read our Guide on how to link your PAN with Aadhaar.Step 1.Get startedLogin to your ClearTax account.Click on ‘Upload Form 16 PDF’ if you have your Form 16 in PDF format.If you do not have Form 16 in PDF format click on ‘Continue Here’Get an expert & supportive CA to manage your taxes. Plans start @ Rs.799/-ContinueWhat are you looking for?Account & Book KeepingCompany RegistrationGST RegistrationGST Return FilingIncome Tax FilingTrademark RegistrationOtherStep 2.Enter personal infoEnter your Name, PAN, DOB and Bank account details.Step 3.Enter salary detailsFill in your salary, employee details (Name and TAN) and TDS.Tip: Want to claim HRA? Read the guide.Step 4.Enter deduction detailsEnter investment details under Section 80C(eg. LIC, PPF etc., and claim other tax benefits here.Tip: Do you have kids?Claim benefits on their tuition fees under Section 80CStep 5.Add details of taxes paidIf you have non-salary income,eg. interest income or freelance income, then add tax payments that are already made. You can also add these details by uploading Form 26ASStep 6.E-file your returnIf you see “Refund” or “No Tax Due” here, Click on proceed to E-Filing.You will get an acknowledgement number on the next screen.Tip: See a “Tax Due” message? Read this guide to know how to pay your tax dues.Step 7: E-VerifyOnce your return is file E-Verify your income tax return

Create this form in 5 minutes!

How to create an eSignature for the net profit tax return 2016 form

How to generate an eSignature for your Net Profit Tax Return 2016 Form online

How to generate an electronic signature for your Net Profit Tax Return 2016 Form in Chrome

How to make an electronic signature for signing the Net Profit Tax Return 2016 Form in Gmail

How to create an electronic signature for the Net Profit Tax Return 2016 Form right from your smart phone

How to generate an electronic signature for the Net Profit Tax Return 2016 Form on iOS devices

How to make an eSignature for the Net Profit Tax Return 2016 Form on Android OS

People also ask

-

What is the Net Profit Tax Return Form and why is it important?

The Net Profit Tax Return Form is a crucial document used by businesses to report their profits and calculate their tax obligations. Accurately completing this form ensures compliance with tax regulations, helping to avoid penalties. It's an essential tool for understanding your business's financial health and tax responsibilities.

-

How does airSlate SignNow simplify the process of submitting a Net Profit Tax Return Form?

airSlate SignNow streamlines the submission of the Net Profit Tax Return Form by allowing users to create, send, and eSign documents easily. With its user-friendly interface and robust features, businesses can ensure that their tax forms are completed accurately and submitted promptly. This convenience promotes efficiency and helps businesses stay organized during tax season.

-

Are there any costs associated with using airSlate SignNow for the Net Profit Tax Return Form?

Yes, there are various pricing plans available for using airSlate SignNow, which can accommodate businesses of any size. The pricing is competitive and designed to provide value by simplifying the process of eSigning and managing documents, including the Net Profit Tax Return Form. You can choose a plan that best fits your budget and business needs.

-

What features of airSlate SignNow are beneficial for filing the Net Profit Tax Return Form?

Key features of airSlate SignNow that benefit users dealing with the Net Profit Tax Return Form include electronic signatures, templates for quick setup, and secure document storage. These features ensure compliance and ease of access, allowing businesses to manage their tax documents seamlessly and securely. Automation tools further enhance efficiency in document handling.

-

Can I integrate airSlate SignNow with accounting software for the Net Profit Tax Return Form?

Absolutely! airSlate SignNow offers integrations with various accounting and financial software, making it easy to manage your Net Profit Tax Return Form alongside other financial documents. This integration facilitates seamless data transfer, reducing the time spent on manual entry. Users benefit from a more cohesive workflow, enhancing productivity.

-

What are the benefits of securely eSigning the Net Profit Tax Return Form with airSlate SignNow?

Using airSlate SignNow for eSigning the Net Profit Tax Return Form provides security, legality, and convenience. Electronic signatures are legally binding and streamline the signing process, allowing for quicker transactions. This ensures that your tax forms can be finalized and submitted without unnecessary delays.

-

Is it easy to track the status of my Net Profit Tax Return Form with airSlate SignNow?

Yes, airSlate SignNow includes tracking features that allow you to monitor the status of your Net Profit Tax Return Form throughout the signing process. You can receive notifications when documents are viewed and signed, ensuring you remain informed. This visibility promotes better communication and efficiency in document management.

Get more for Net Profit Tax Return Form

- 48830 ngoe form

- Import permit application ministry of agriculture of barbados form

- Utah contractor license form

- Histocompatibility lab testing requisition form university of utah healthcare utah

- Ldss 4281 form

- Illinois statutory short form power of attorney for property mwrdrf

- Cincinnati bar association notary form

- Bersicht ber die straengterverkehrsrechtlichen form

Find out other Net Profit Tax Return Form

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer