Boone County Ky Occupational Tax , Jobs EcityWorks 2021

Filing Deadlines for Boone County Net Profit Tax Return 2021

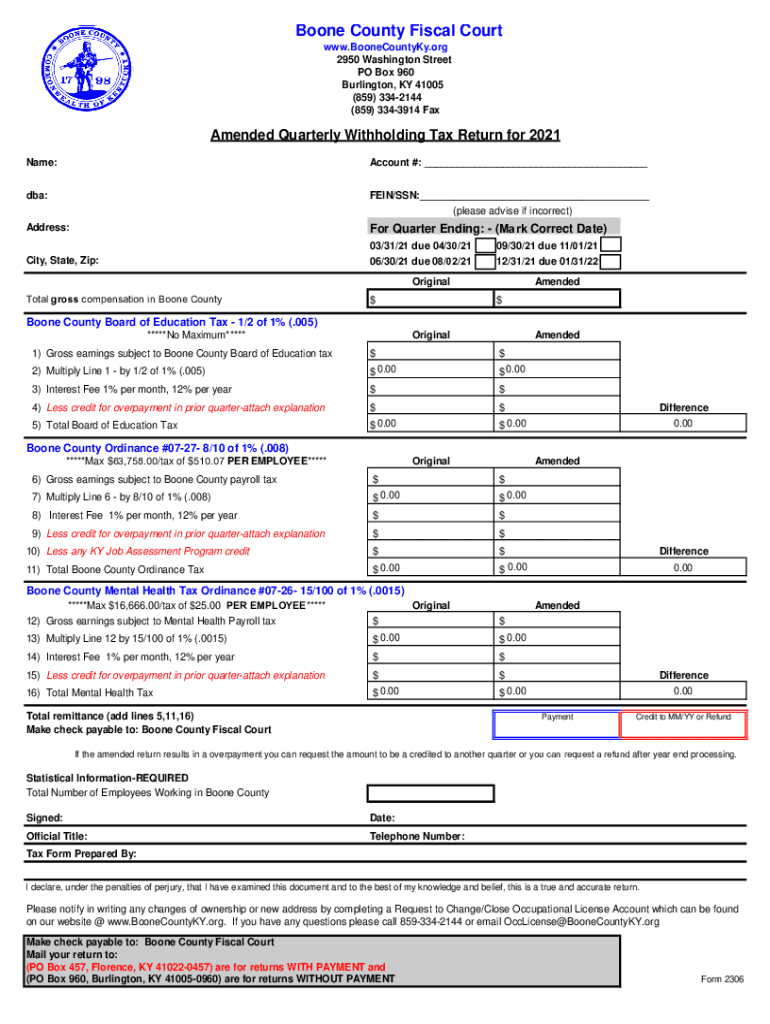

Understanding the filing deadlines for the Boone County net profit tax return 2021 is crucial for compliance. Typically, the deadline for filing the net profit tax return aligns with the federal tax return deadlines. For most businesses, this means the return is due on April 15, 2022. However, if you require additional time, you may submit a Boone County net profit extension request 2021. This extension allows you to file your return later, but it does not extend the time to pay any taxes owed. It is important to keep track of these dates to avoid penalties and interest on unpaid taxes.

Required Documents for Boone County Net Profit Tax Return 2021

When preparing your Boone County net profit tax return 2021, certain documents are essential to ensure accurate reporting. You will need:

- Financial statements, including profit and loss statements.

- Records of all income earned during the tax year.

- Documentation of business expenses to substantiate deductions.

- Previous year’s tax return for reference.

- Any relevant forms, such as the KY Form Net Profit.

Gathering these documents in advance can streamline the filing process and help avoid errors.

Form Submission Methods for Boone County Net Profit Tax Return 2021

You have various options for submitting your Boone County net profit tax return 2021. These methods include:

- Online Submission: Many businesses opt to file electronically through approved tax software or platforms that comply with state regulations.

- Mail: You can print your completed return and send it to the appropriate Boone County tax office address. Ensure you send it well before the deadline to allow for postal delays.

- In-Person: Some taxpayers prefer to deliver their returns directly to the tax office. This method allows for immediate confirmation of receipt.

Choosing the right submission method can enhance the efficiency of your filing process.

IRS Guidelines for Boone County Net Profit Tax Return 2021

Filing your Boone County net profit tax return 2021 requires adherence to IRS guidelines. These guidelines dictate how income should be reported and what expenses can be deducted. Key points include:

- All income must be reported, including cash and non-cash transactions.

- Only ordinary and necessary business expenses are deductible.

- Maintain accurate records to support your claims in case of an audit.

Following these IRS guidelines will help ensure that your return is compliant and accurate.

Penalties for Non-Compliance with Boone County Net Profit Tax Return 2021

Failing to file your Boone County net profit tax return 2021 on time can result in significant penalties. These may include:

- Late Filing Penalty: A percentage of the unpaid tax amount for each month the return is late.

- Interest Charges: Accrues on any unpaid taxes from the due date until payment is made.

- Possible Legal Action: Continued non-compliance can lead to legal repercussions, including liens on business assets.

Being aware of these penalties emphasizes the importance of timely and accurate filing.

Steps to Complete the Boone County Net Profit Tax Return 2021

Completing your Boone County net profit tax return 2021 involves several key steps:

- Gather all necessary financial documents and records.

- Complete the required forms, including the KY Form Net Profit.

- Calculate your total income and allowable deductions accurately.

- Review your return for accuracy and completeness.

- Select your preferred submission method and file your return.

Following these steps can help ensure that your tax return is filed correctly and on time.

Quick guide on how to complete boone county ky occupational tax jobs ecityworks

Prepare Boone County Ky Occupational Tax , Jobs EcityWorks effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly option to traditional printed and signed documents, as you can easily find the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Boone County Ky Occupational Tax , Jobs EcityWorks on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign Boone County Ky Occupational Tax , Jobs EcityWorks without hassle

- Obtain Boone County Ky Occupational Tax , Jobs EcityWorks and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal authority as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that mandate printing new copies of documents. airSlate SignNow fulfills all your document management needs with just a few clicks from any preferred device. Modify and eSign Boone County Ky Occupational Tax , Jobs EcityWorks and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct boone county ky occupational tax jobs ecityworks

Create this form in 5 minutes!

How to create an eSignature for the boone county ky occupational tax jobs ecityworks

How to generate an e-signature for a PDF file in the online mode

How to generate an e-signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to make an e-signature from your smartphone

The best way to create an e-signature for a PDF file on iOS devices

The best way to make an e-signature for a PDF file on Android

People also ask

-

What is the Boone County net profit tax return 2021?

The Boone County net profit tax return 2021 is a form that businesses operating within Boone County must file to report their earnings for the tax year. This return is essential for calculating the amount of net profit tax owed to the county. Properly completing the return ensures compliance and avoids potential penalties.

-

How can airSlate SignNow help with the Boone County net profit tax return 2021?

airSlate SignNow provides a streamlined way to eSign and send your Boone County net profit tax return 2021. With its easy-to-use platform, you can manage all your tax documents and signatures electronically, saving time and ensuring accuracy. This is especially beneficial during tax season when timely submissions are critical.

-

What are the pricing options for airSlate SignNow regarding tax document management?

airSlate SignNow offers flexible pricing plans that suit different business needs for managing tax documents like the Boone County net profit tax return 2021. From basic plans for startups to comprehensive solutions for larger businesses, there’s an option that fits your requirements. Investing in airSlate SignNow simplifies your tax documentation process and can reduce overall operational costs.

-

Can I integrate airSlate SignNow with my accounting software for the Boone County net profit tax return 2021?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your Boone County net profit tax return 2021. This enables you to sync data and reduce the manual entry of information across platforms, enhancing efficiency. Integration also helps maintain consistency in your financial records.

-

What features does airSlate SignNow offer that benefit tax filing for Boone County net profit tax return 2021?

airSlate SignNow offers features like secure eSigning, document templates, and automated reminders, which are ideal for preparing your Boone County net profit tax return 2021. These features ensure that your documents are signed on time and stored securely. Furthermore, the platform’s user-friendly interface simplifies document sharing and collaboration.

-

Is airSlate SignNow suitable for small businesses filing the Boone County net profit tax return 2021?

Absolutely! airSlate SignNow is a cost-effective solution perfect for small businesses handling the Boone County net profit tax return 2021. Its easy-to-navigate platform allows small businesses to manage their tax documents efficiently without a steep learning curve. This ensures that even businesses with limited resources can stay compliant.

-

What are the benefits of using airSlate SignNow for tax document signing?

Using airSlate SignNow for tax document signing, including the Boone County net profit tax return 2021, offers numerous benefits, such as enhanced security and reduced turnaround times. The platform ensures that your documents are securely stored and easily accessible. This convenience allows for speedy collaboration and compliance during tax filing seasons.

Get more for Boone County Ky Occupational Tax , Jobs EcityWorks

- Ct notice form

- Ct power attorney form

- Durable springing power of attorney connecticut form

- Demand for discharge by corporation or llc connecticut form

- Quitclaim deed from individual to two individuals in joint tenancy connecticut form

- Release lien 497300993 form

- Quitclaim deed by two individuals to husband and wife connecticut form

- Warranty deed from two individuals to husband and wife connecticut form

Find out other Boone County Ky Occupational Tax , Jobs EcityWorks

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy