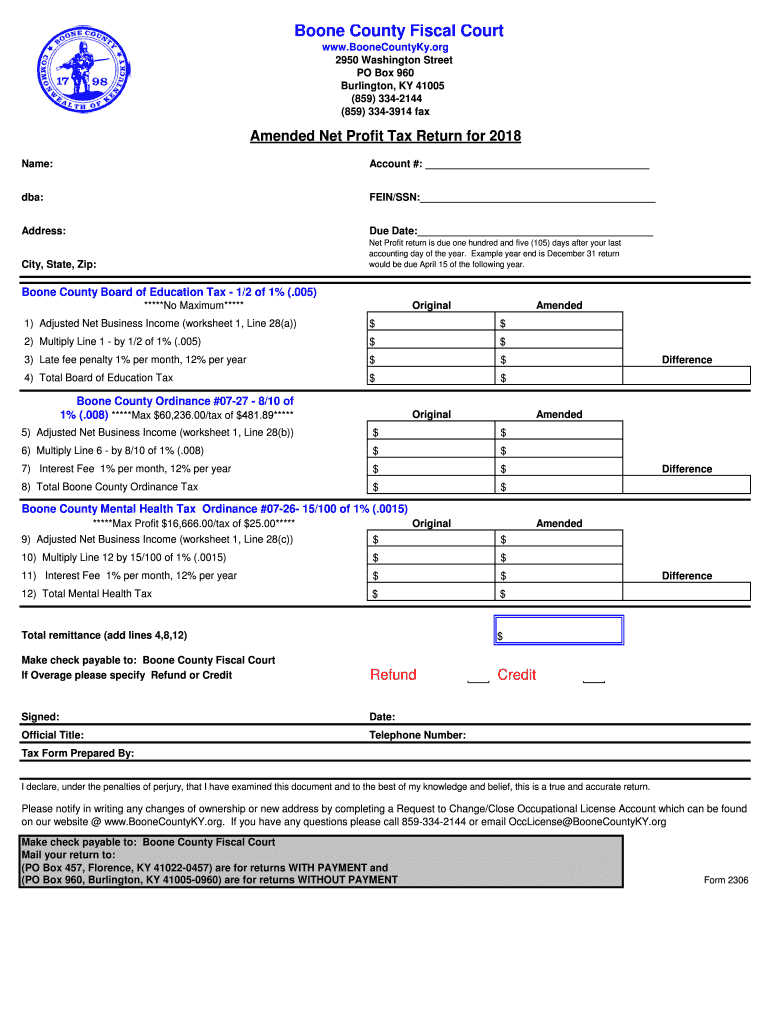

Net Profit Tax Return 2018

What is the Net Profit Tax Return

The net profit tax return is a crucial document that businesses use to report their income and calculate the taxes owed to the federal and state governments. This form captures the net profit generated from business activities, allowing the IRS and state tax authorities to assess the tax liability accurately. It is essential for various business entities, including sole proprietorships, partnerships, and corporations, to ensure compliance with tax regulations.

Steps to complete the Net Profit Tax Return

Completing the net profit tax return involves several key steps:

- Gather all relevant financial documents, including income statements, expense reports, and receipts.

- Calculate total income by summing up all revenue streams.

- Deduct allowable business expenses to determine the net profit.

- Fill out the appropriate sections of the tax return form, ensuring accuracy in reporting figures.

- Review the completed form for any errors or omissions before submission.

Legal use of the Net Profit Tax Return

The legal use of the net profit tax return is vital for ensuring compliance with tax laws. Businesses must accurately report their income and expenses to avoid penalties. The IRS recognizes eSignatures on tax documents, which enhances the legal validity of electronically filed returns. It is crucial to adhere to federal and state regulations when completing and submitting this form.

Filing Deadlines / Important Dates

Filing deadlines for the net profit tax return vary based on the business structure and tax year. Generally, most businesses must file their returns by April fifteenth of the following year. However, extensions may be available. It is essential to be aware of specific state deadlines, as they may differ from federal requirements. Marking these dates on a calendar can help ensure timely submissions.

Required Documents

To accurately complete the net profit tax return, certain documents are necessary:

- Income statements detailing all revenue sources.

- Expense records, including receipts and invoices.

- Previous tax returns for reference.

- Any applicable schedules or additional forms required by the IRS or state authorities.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting their net profit tax return. The most efficient method is online filing, which allows for quicker processing and confirmation. Alternatively, forms can be mailed to the appropriate tax authority, although this method may lead to delays. In-person submissions are also an option at designated tax offices, providing immediate assistance if needed.

Quick guide on how to complete net profit tax return 2018 2019 form

Your assistance manual on preparing your Net Profit Tax Return

If you’re looking to learn how to complete and submit your Net Profit Tax Return, here are some concise guidelines to streamline tax processing.

To begin, you simply need to create your airSlate SignNow account to alter how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document management solution that allows you to modify, draft, and finalize your tax documents effortlessly. With its editor, you can switch between text, checkboxes, and electronic signatures while being able to revise responses as necessary. Enhance your tax handling with sophisticated PDF editing, electronic signing, and easy sharing.

Follow these steps to complete your Net Profit Tax Return in just a few minutes:

- Create your account and start editing PDFs in no time.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Click Get form to access your Net Profit Tax Return in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to insert your legally-binding electronic signature (if needed).

- Examine your document and correct any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Leverage this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can lead to errors and delay reimbursements. Naturally, before electronically filing your taxes, visit the IRS website for filing regulations applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct net profit tax return 2018 2019 form

FAQs

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

I am filling income tax return for AY 2018–19. How do I download ITR-1 form?

You can fill it online ate-Filing Home Page, Income Tax Department, Government of IndiaCreate a user id and file all your returns from here only. No need to do offline

-

How the new Form 16 will change income tax return filing this FY 2018-19 (AY 2019-20)?

The new format of the Form 16 and the ITR for AY 2019–20 will allow the tax department to view a detailed break up of the salary and tax exemptions claimed by an employee. Any discrepancy in the Form 16 versus the ITR filed by the person will be easily traced by the tax department.Hence, the salary part of the ITR will need to be carefully filed to provide all details such that there is no mismatch with the Form 16 and the Form 26AS. Any discrepancy could result in a notice situation.

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

Create this form in 5 minutes!

How to create an eSignature for the net profit tax return 2018 2019 form

How to create an eSignature for the Net Profit Tax Return 2018 2019 Form in the online mode

How to make an eSignature for the Net Profit Tax Return 2018 2019 Form in Chrome

How to make an eSignature for putting it on the Net Profit Tax Return 2018 2019 Form in Gmail

How to create an eSignature for the Net Profit Tax Return 2018 2019 Form straight from your smartphone

How to make an eSignature for the Net Profit Tax Return 2018 2019 Form on iOS

How to create an eSignature for the Net Profit Tax Return 2018 2019 Form on Android

People also ask

-

What is a net profit tax return?

A net profit tax return is a document that businesses must file to report their net profits to tax authorities. It summarizes income, expenses, and deductions, determining the taxable profit that the business needs to pay taxes on. Understanding this process is crucial for maintaining compliance and ensuring accurate tax reporting.

-

How can airSlate SignNow assist with filing my net profit tax return?

airSlate SignNow simplifies the process of preparing and eSigning your net profit tax return documents. With our platform, you can create, fill out, and securely send your tax documents digitally, ensuring accuracy and quick turnaround. Our solution is designed to help businesses streamline their tax filing processes with ease.

-

What features are included in the airSlate SignNow platform for net profit tax returns?

The airSlate SignNow platform includes features such as document templates for net profit tax returns, electronic signatures, and real-time tracking of documents. You can also collaborate with team members to gather necessary information before submission. These features enhance efficiency and reduce the chance of errors in your tax return preparation.

-

Is airSlate SignNow a cost-effective solution for net profit tax returns?

Yes, airSlate SignNow provides a cost-effective solution for managing your net profit tax returns. Our pricing plans are designed for businesses of all sizes, enabling you to choose a plan that fits your budget while benefiting from powerful document management and eSigning features. This helps you save both time and money on tax preparation.

-

Can I integrate airSlate SignNow with my accounting software for net profit tax returns?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, making it easier to sync your financial data for accurate net profit tax returns. This integration minimizes manual data entry, streamlining the process and enhancing your overall efficiency when preparing tax documents.

-

What are the benefits of using airSlate SignNow for my net profit tax return?

Using airSlate SignNow for your net profit tax return offers numerous benefits, including increased accuracy, secure document storage, and faster processing times. With our intuitive interface, you can navigate through your documents easily and ensure all required signatures are collected promptly. This ultimately helps in reducing stress during tax season.

-

Is it safe to use airSlate SignNow for sensitive tax return documents?

Yes, airSlate SignNow prioritizes the security of your sensitive tax return documents. We use industry-standard encryption and adhere to strict compliance regulations to ensure that your data remains confidential and secure. You can confidently manage your net profit tax returns knowing that your information is protected.

Get more for Net Profit Tax Return

- Turo incident card form

- Ime form

- Oklahoma hunting and fishing license form

- Worksheet land form

- Mymemory translated netengermansehr geehrte kundin sehr geeh in english with examples form

- Orientierungshilfe zu nachweisen atm consulting com form

- Praktikumsbescheinigung vorlage word form

- Examiner report for instrument rating a skill test form

Find out other Net Profit Tax Return

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document