Internal Revenue Service Department of the Treasury Small Form

What is the Internal Revenue Service Department Of The Treasury Small

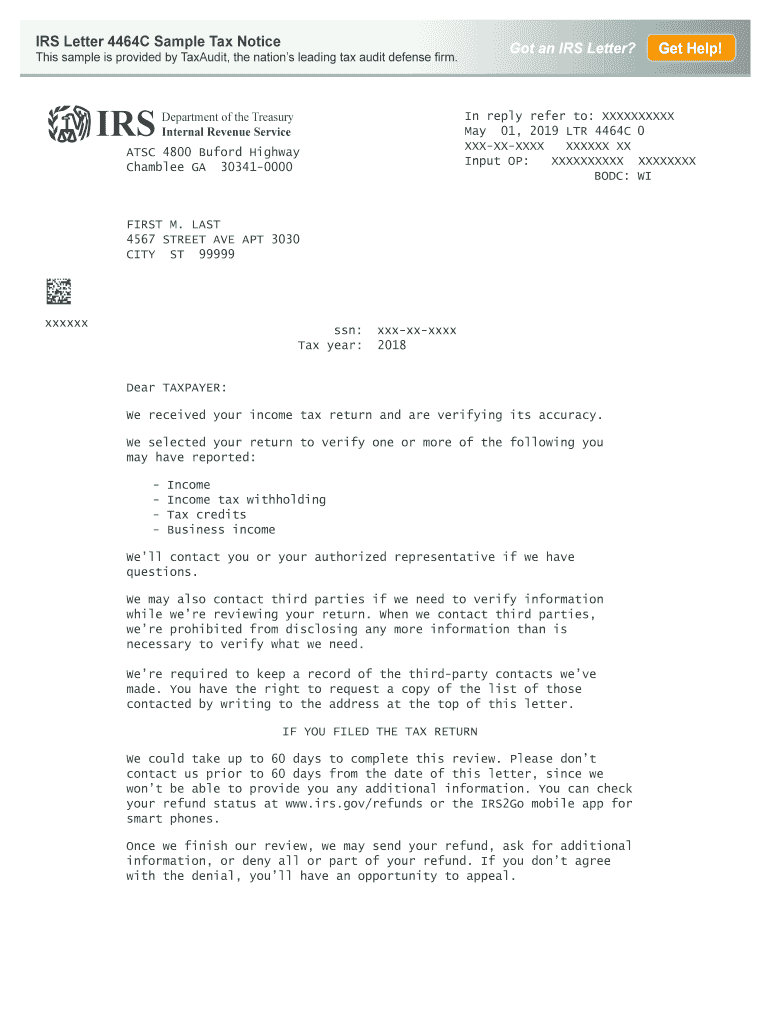

The Internal Revenue Service Department of the Treasury Small refers to a specific form or set of guidelines issued by the IRS, which is responsible for tax collection and enforcement of tax laws in the United States. This form is typically used for various tax-related purposes, including reporting income, claiming deductions, or applying for tax benefits. Understanding the purpose and function of this form is essential for taxpayers to ensure compliance with federal tax regulations.

How to use the Internal Revenue Service Department Of The Treasury Small

Using the Internal Revenue Service Department of the Treasury Small involves several steps. First, identify the specific purpose of the form, whether it is for reporting income, claiming a refund, or another tax-related matter. Next, gather all necessary information and documentation required to complete the form accurately. After filling out the form, review it for any errors before submission. Ensure that you follow the IRS guidelines for the specific form type to avoid any complications.

Steps to complete the Internal Revenue Service Department Of The Treasury Small

Completing the Internal Revenue Service Department of the Treasury Small requires careful attention to detail. Here are the general steps:

- Read the instructions provided with the form to understand the requirements.

- Collect all necessary documents, such as income statements, previous tax returns, and identification numbers.

- Fill out the form accurately, ensuring all fields are completed as required.

- Double-check your entries for accuracy and completeness.

- Submit the form according to the IRS guidelines, either electronically or by mail.

Required Documents

When preparing to complete the Internal Revenue Service Department of the Treasury Small, certain documents are typically required. These may include:

- W-2 forms from employers to report income.

- 1099 forms for other income sources, such as freelance work.

- Documentation for any deductions or credits you plan to claim.

- Identification numbers, such as Social Security numbers or Employer Identification Numbers.

Filing Deadlines / Important Dates

Filing deadlines for the Internal Revenue Service Department of the Treasury Small are crucial to adhere to in order to avoid penalties. Generally, individual tax returns are due by April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may shift to the next business day. It is important to check the IRS website or consult tax professionals for any specific deadlines related to your situation.

Penalties for Non-Compliance

Failure to comply with the requirements of the Internal Revenue Service Department of the Treasury Small can result in various penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal action for fraudulent submissions. It is essential to ensure that all forms are completed accurately and submitted on time to avoid these consequences.

Quick guide on how to complete internal revenue service department of the treasury small

Prepare Internal Revenue Service Department Of The Treasury Small effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Internal Revenue Service Department Of The Treasury Small on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Internal Revenue Service Department Of The Treasury Small with ease

- Locate Internal Revenue Service Department Of The Treasury Small and click Get Form to start.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your alterations.

- Select how you wish to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Internal Revenue Service Department Of The Treasury Small to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the internal revenue service department of the treasury small

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the Internal Revenue Service Department Of The Treasury Small?

airSlate SignNow is a powerful e-signature solution designed for businesses, including those dealing with the Internal Revenue Service Department Of The Treasury Small. It allows users to send, sign, and manage documents efficiently while ensuring compliance with federal regulations. This tool is particularly beneficial for organizations needing to streamline their interactions with various departments, including the IRS.

-

How does airSlate SignNow ensure compliance with the Internal Revenue Service Department Of The Treasury Small?

airSlate SignNow prioritizes compliance by adhering to industry standards and regulations, including those set by the Internal Revenue Service Department Of The Treasury Small. The platform’s robust security features, such as secure encryption and authentication methods, ensure that your documents meet the necessary legal requirements. Users can confidently sign and share crucial documents while maintaining compliance with IRS guidelines.

-

What pricing plans does airSlate SignNow offer for small businesses working with the Internal Revenue Service Department Of The Treasury Small?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of small businesses interacting with the Internal Revenue Service Department Of The Treasury Small. Users can choose from various subscription options based on their requirements, ensuring an affordable and cost-effective solution. The plans include essential features that facilitate streamlined document management and e-signature processes.

-

What key features does airSlate SignNow provide for managing documents related to the Internal Revenue Service Department Of The Treasury Small?

airSlate SignNow offers a range of features designed to simplify document management for organizations dealing with the Internal Revenue Service Department Of The Treasury Small. Key features include customizable templates, real-time tracking, and automated reminders. These capabilities help ensure that all essential documents are filed properly and in a timely manner, minimizing the risk of errors.

-

Can airSlate SignNow integrate with other tools and software for businesses interacting with the Internal Revenue Service Department Of The Treasury Small?

Yes, airSlate SignNow seamlessly integrates with various software platforms that are essential for businesses engaging with the Internal Revenue Service Department Of The Treasury Small. Users can connect with popular tools like Google Drive, Salesforce, and Dropbox, facilitating smooth workflows and enhanced productivity. These integrations help businesses ensure that their document handling process is efficient and straightforward.

-

What are the benefits of using airSlate SignNow for transactions related to the Internal Revenue Service Department Of The Treasury Small?

Using airSlate SignNow for transactions that involve the Internal Revenue Service Department Of The Treasury Small offers numerous benefits, including improved efficiency and reduced turnaround times. Businesses can send and e-sign documents quickly, which is crucial when dealing with tax-related matters. Additionally, the platform’s user-friendly interface enhances the overall experience, making it easier for teams to manage their documentation.

-

Is airSlate SignNow secure for handling sensitive documents linked to the Internal Revenue Service Department Of The Treasury Small?

Absolutely, airSlate SignNow employs top-notch security measures to protect sensitive documents associated with the Internal Revenue Service Department Of The Treasury Small. The platform utilizes advanced encryption and secure authentication, ensuring that all data remains confidential and compliant with legal standards. Users can trust airSlate SignNow to safeguard their information throughout the e-signature process.

Get more for Internal Revenue Service Department Of The Treasury Small

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497428978 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts effective 497428979 form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497428980 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts where 497428981 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective 497428982 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497428983 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497428984 form

- Vt llc 497428985 form

Find out other Internal Revenue Service Department Of The Treasury Small

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple