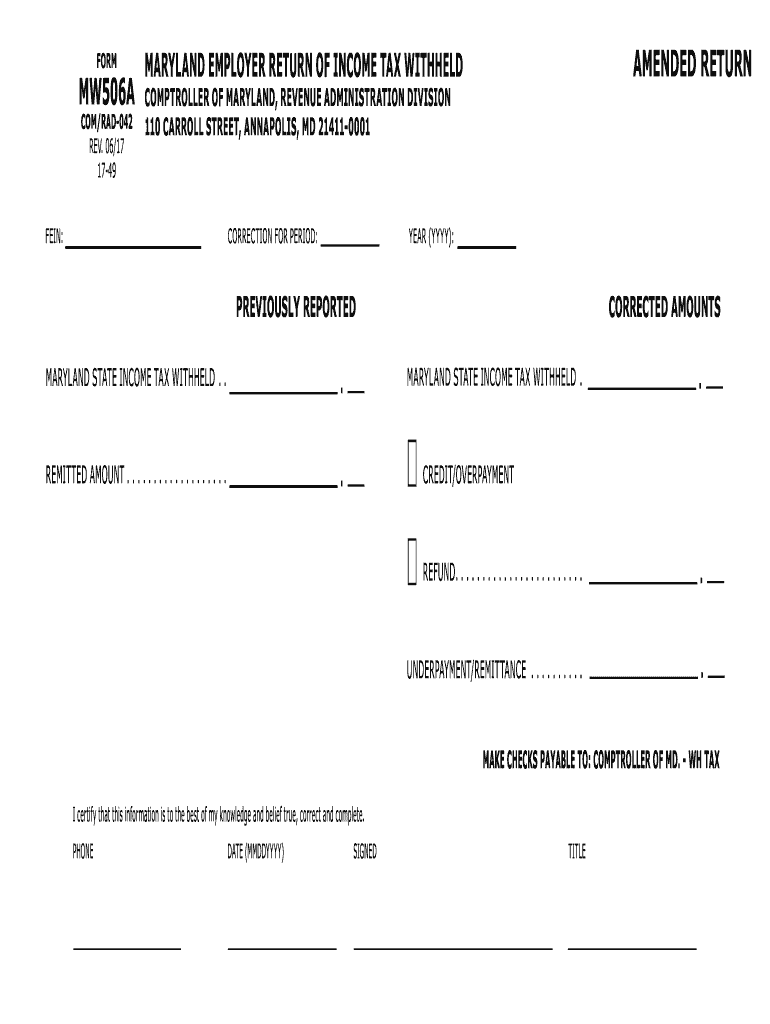

Maryland Mw506a Form 2017

What is the Maryland Mw506a Form

The Maryland Mw506a form is a tax document used by individuals and businesses to report income and calculate tax liabilities in the state of Maryland. It is specifically designed for non-residents and part-year residents who earn income in Maryland. This form allows taxpayers to accurately report their earnings and claim any applicable deductions or credits. Understanding the purpose of the Mw506a is essential for ensuring compliance with state tax laws and for avoiding potential penalties.

How to use the Maryland Mw506a Form

Using the Maryland Mw506a form involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, accurately fill out the form by entering your personal information, income details, and any deductions you may qualify for. After completing the form, review it for accuracy to ensure all information is correct. Finally, submit the form by the designated deadline to avoid late fees or penalties. Utilizing an eSignature solution can streamline this process, making it easier to sign and submit the form electronically.

Steps to complete the Maryland Mw506a Form

Completing the Maryland Mw506a form requires careful attention to detail. Follow these steps:

- Download the Mw506a form from an official source or access it through an online platform.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income earned in Maryland, including wages, salaries, and any other sources of income.

- Claim any deductions or credits you are eligible for, ensuring you have documentation to support your claims.

- Review the completed form for accuracy and completeness.

- Sign and date the form, either electronically or by hand, depending on your submission method.

- Submit the form by mail or electronically, following the instructions provided.

Legal use of the Maryland Mw506a Form

The Maryland Mw506a form is legally recognized for tax reporting purposes within the state. It must be completed accurately and submitted on time to comply with Maryland tax laws. Failure to use the form correctly can result in penalties, including fines or interest on unpaid taxes. It is important to ensure that all information provided is truthful and complete to avoid legal repercussions. Taxpayers should also be aware of the legal implications of electronic signatures, which are accepted under the ESIGN Act.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Mw506a form are crucial for taxpayers to keep in mind. Typically, the form must be submitted by April fifteenth for the previous tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to deadlines each tax year. Additionally, taxpayers should be aware of any extensions that may apply, which can provide additional time to file the form without incurring penalties.

Form Submission Methods (Online / Mail / In-Person)

The Maryland Mw506a form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Taxpayers can complete and submit the form electronically through approved platforms, which often streamline the process.

- Mail: The completed form can be printed and mailed to the designated address provided in the instructions.

- In-Person: Some taxpayers may choose to submit the form in person at local tax offices, where assistance may also be available.

Quick guide on how to complete mw506a 2017 2018 form

Your assistance manual on how to prepare your Maryland Mw506a Form

If you're interested in learning how to fill out and submit your Maryland Mw506a Form, here are some concise guidelines on how to simplify tax processing.

To begin, you just need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally intuitive and robust document solution that enables you to modify, draft, and finalize your tax documents effortlessly. Using its editor, you can toggle between text, checkboxes, and eSignatures and return to alter details as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Maryland Mw506a Form in just a few minutes:

- Create your account and start working on PDFs in minutes.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Click Get form to access your Maryland Mw506a Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkboxes).

- Utilize the Sign Tool to affix your legally-binding eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Make the most of this manual to file your taxes electronically using airSlate SignNow. Please keep in mind that submitting on paper may lead to increased return errors and delayed refunds. Naturally, before e-filing your taxes, check the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct mw506a 2017 2018 form

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

-

If I was unable to fill SSC Cgl 2017, can I fill SSC Cgl 2018 form?

Don’t wait till the last date, apply your form well in advance. If still you are unable to fill your form, you may fill in 2018.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the mw506a 2017 2018 form

How to generate an electronic signature for your Mw506a 2017 2018 Form in the online mode

How to generate an eSignature for the Mw506a 2017 2018 Form in Chrome

How to create an eSignature for signing the Mw506a 2017 2018 Form in Gmail

How to generate an eSignature for the Mw506a 2017 2018 Form straight from your smartphone

How to create an electronic signature for the Mw506a 2017 2018 Form on iOS devices

How to make an electronic signature for the Mw506a 2017 2018 Form on Android

People also ask

-

What is the Maryland Mw506a Form and why do I need it?

The Maryland Mw506a Form is a crucial document for businesses operating in Maryland, specifically used for reporting withholding tax. Completing this form accurately ensures compliance with state tax regulations and helps avoid penalties. With airSlate SignNow, you can easily manage and eSign your Maryland Mw506a Form, streamlining the process.

-

How can airSlate SignNow help me with the Maryland Mw506a Form?

airSlate SignNow provides a user-friendly platform for sending and eSigning documents, including the Maryland Mw506a Form. Our solution allows you to fill out, sign, and share the form electronically, saving you time and ensuring accuracy. Plus, our secure platform keeps your information safe throughout the process.

-

Is there a cost associated with using airSlate SignNow for the Maryland Mw506a Form?

Yes, airSlate SignNow offers various pricing plans to fit your business needs, making it a cost-effective solution for managing the Maryland Mw506a Form. Our plans include features like unlimited eSignatures and document storage, ensuring you get the best value. You can choose a plan that suits your frequency of use and team size.

-

What features does airSlate SignNow offer for managing the Maryland Mw506a Form?

airSlate SignNow offers numerous features to simplify the process of managing the Maryland Mw506a Form. These include customizable templates, real-time collaboration, secure cloud storage, and automated reminders for deadlines. Our platform is designed to enhance efficiency and ensure compliance with state regulations.

-

Can I integrate airSlate SignNow with other software to manage the Maryland Mw506a Form?

Absolutely! airSlate SignNow integrates seamlessly with popular business tools like Google Drive, Dropbox, and CRM systems. This integration allows you to easily access and manage your Maryland Mw506a Form alongside other important documents, enhancing your workflow and productivity.

-

How secure is my information when using airSlate SignNow for the Maryland Mw506a Form?

Security is a top priority at airSlate SignNow. When you use our platform to handle the Maryland Mw506a Form, your data is protected with advanced encryption and secure access protocols. We adhere to strict compliance standards, ensuring your sensitive information remains confidential.

-

Can I track the status of my Maryland Mw506a Form using airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities for your documents, including the Maryland Mw506a Form. You can easily monitor when the form is sent, viewed, and signed, giving you peace of mind and ensuring timely completion of your tax reporting requirements.

Get more for Maryland Mw506a Form

Find out other Maryland Mw506a Form

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now