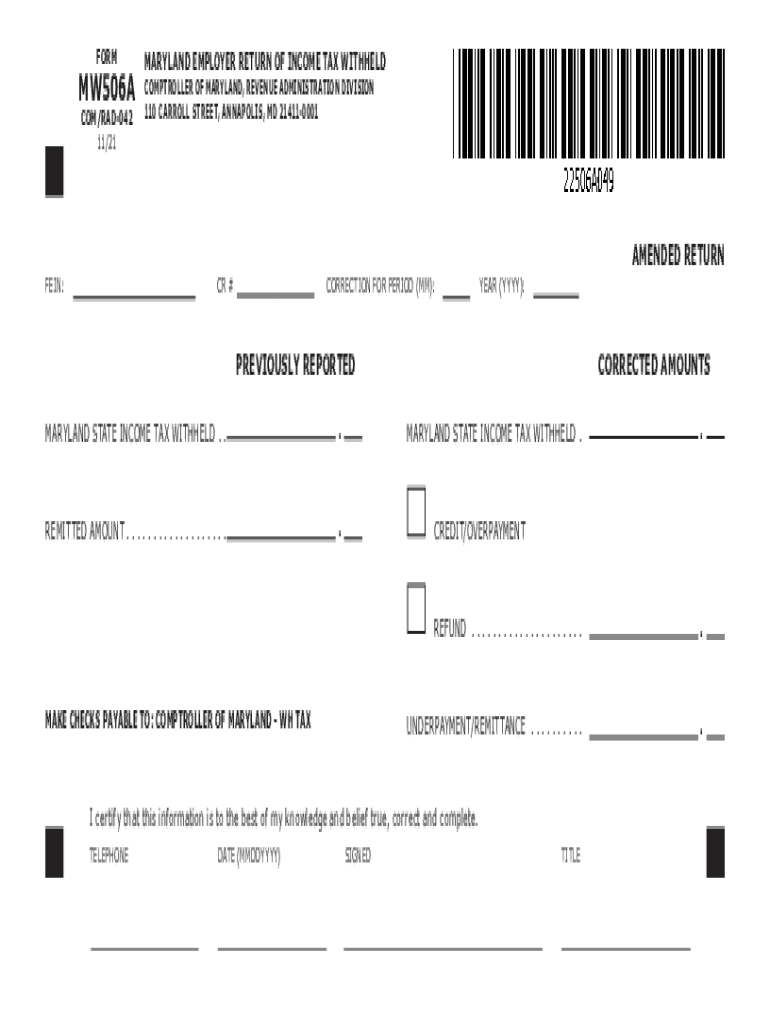

FORM MARYLAND EMPLOYER RETURN of INCOME TAX WITHHELD MW506A 2022

What is the Maryland Employer Return of Income Tax Withheld MW506?

The Maryland Employer Return of Income Tax Withheld MW506 is a crucial tax document that employers in Maryland must complete and submit to report income tax withheld from employees' wages. This form is essential for ensuring compliance with state tax regulations and helps the Maryland Comptroller's office track tax contributions accurately. The MW506 form includes detailed information about the employer, including their identification number, as well as the total income tax withheld for the reporting period. Understanding the purpose of this form is vital for employers to fulfill their tax obligations effectively.

Steps to Complete the Maryland Employer Return of Income Tax Withheld MW506

Completing the MW506 form requires careful attention to detail to ensure accuracy and compliance. Here are the steps to follow:

- Gather necessary information, including your employer identification number and total income tax withheld from employees.

- Access the MW506 form, either in paper format or digitally through a secure platform.

- Fill in your business information, including the name, address, and identification number.

- Report the total amount of income tax withheld for the specified period.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, ensuring compliance with state regulations.

Legal Use of the Maryland Employer Return of Income Tax Withheld MW506

The MW506 form is legally binding and serves as a formal declaration of the income tax withheld by employers. To ensure its legal validity, employers must adhere to specific guidelines set forth by the Maryland Comptroller's office. This includes accurate reporting of withheld amounts and timely submission of the form. The legal framework surrounding the MW506 ensures that employers fulfill their tax responsibilities and contribute to state revenue effectively.

Filing Deadlines for the Maryland Employer Return of Income Tax Withheld MW506

Employers must be aware of important deadlines for submitting the MW506 form to avoid penalties. The filing deadlines typically align with the end of each quarter, requiring employers to submit the form by the 15th day of the month following the end of the quarter. For example, the deadlines for the 2023 tax year are as follows:

- First Quarter: April 15

- Second Quarter: July 15

- Third Quarter: October 15

- Fourth Quarter: January 15 of the following year

Who Issues the Maryland Employer Return of Income Tax Withheld MW506?

The MW506 form is issued by the Maryland Comptroller's office, which is responsible for overseeing tax collection and ensuring compliance with state tax laws. Employers can obtain the form directly from the Comptroller's website or through authorized tax preparation software. The office provides guidance and resources to assist employers in completing and submitting the MW506 accurately and on time.

Penalties for Non-Compliance with the Maryland Employer Return of Income Tax Withheld MW506

Failure to submit the MW506 form on time or inaccuracies in reporting can result in significant penalties for employers. These penalties may include fines and interest on unpaid taxes. The Maryland Comptroller's office actively enforces compliance, making it essential for employers to adhere to filing requirements. Understanding the consequences of non-compliance can motivate employers to prioritize accurate and timely submissions.

Quick guide on how to complete form maryland employer return of income tax withheld mw506a

Complete FORM MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD MW506A effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage FORM MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD MW506A on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and eSign FORM MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD MW506A effortlessly

- Locate FORM MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD MW506A and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choice. Edit and eSign FORM MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD MW506A and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form maryland employer return of income tax withheld mw506a

Create this form in 5 minutes!

How to create an eSignature for the form maryland employer return of income tax withheld mw506a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mw506 in relation to airSlate SignNow?

The term mw506 refers to a specific feature set within the airSlate SignNow platform that allows businesses to streamline their document management processes. With mw506, users can easily upload, send, and eSign documents, ensuring a smooth workflow. This feature contributes to a more efficient business operation.

-

How does pricing for mw506 work?

airSlate SignNow offers competitive pricing for its mw506 feature set, designed to meet various business needs. Pricing plans are flexible and scale with your usage, catering to both small and large teams. Businesses can choose from monthly or annual subscriptions to find the best fit.

-

What are the key features of mw506?

The mw506 feature set includes electronic signatures, document templates, and advanced security measures to protect sensitive information. Additionally, it provides options for in-person signing and real-time collaboration, making document management seamless. Overall, mw506 is designed to enhance efficiency and user experience.

-

Can mw506 integrate with other software?

Yes, the mw506 feature set in airSlate SignNow can seamlessly integrate with various software tools such as CRM systems, cloud storage, and productivity applications. This integration capability allows businesses to streamline their workflows and maintain a consistent user experience across platforms. Integrating mw506 with your existing tech stack can optimize document handling processes.

-

What benefits does mw506 provide to businesses?

By using the mw506 feature set, businesses can signNowly reduce the time spent on document workflows. Enhanced security features ensure that sensitive information remains protected. Moreover, the ease of use fosters greater team collaboration and improves overall productivity, making it a valuable asset for any organization.

-

Is mw506 suitable for small businesses?

Absolutely! The mw506 feature set in airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises. Its user-friendly interface and cost-effective plans make it an ideal choice for small businesses looking to improve their document management processes. With mw506, even small teams can operate efficiently and professionally.

-

How secure is the mw506 feature set?

The mw506 feature set prioritizes security with advanced encryption and compliance with industry standards such as GDPR and HIPAA. airSlate SignNow implements robust measures to ensure that all documents signed through mw506 are secure and tamper-proof. Your business can confidently use mw506, knowing that sensitive information is well protected.

Get more for FORM MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD MW506A

- Employment employee personnel file package rhode island form

- Assignment of mortgage package rhode island form

- Assignment of lease package rhode island form

- Lease purchase agreements package rhode island form

- Satisfaction cancellation or release of mortgage package rhode island form

- Premarital agreements package rhode island form

- Painting contractor package rhode island form

- Framing contractor package rhode island form

Find out other FORM MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD MW506A

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS