506A MARYLAND EMPLOYER RETURN of INCOME TAX WITHHELD 506A MARYLAND EMPLOYER RETURN of INCOME TAX WITHHELD 2024-2026

Understanding the MW506 Form 2024

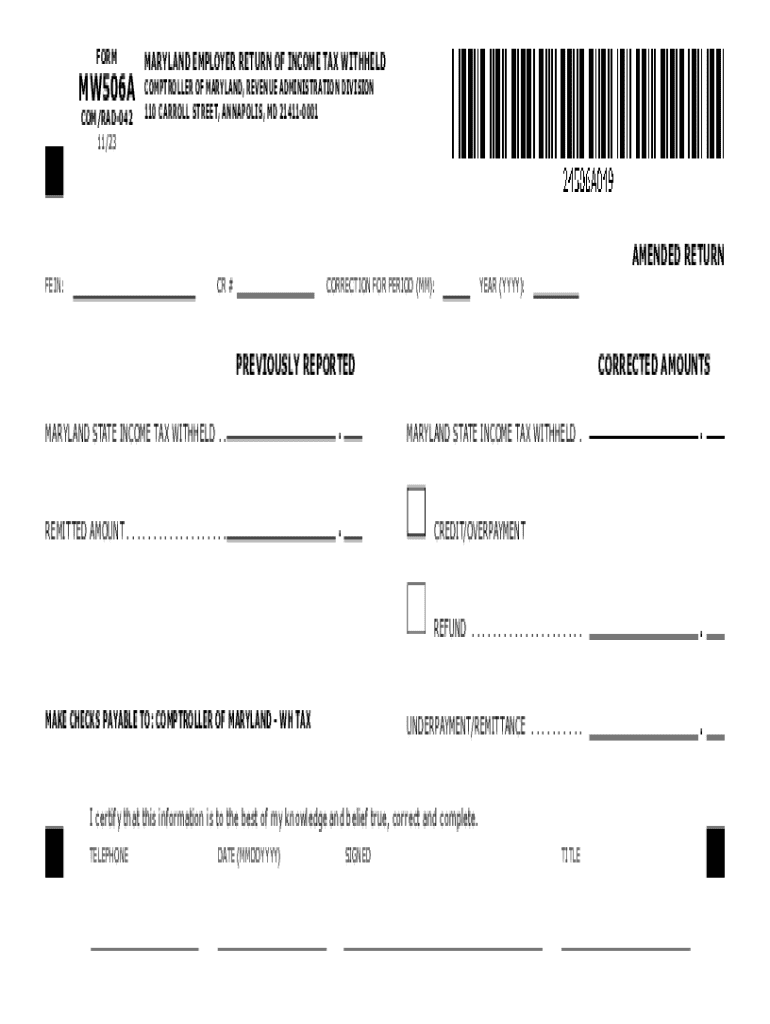

The MW506 form, also known as the Maryland Employer Return of Income Tax Withheld, is a critical document for employers in Maryland. It is used to report the income tax withheld from employees' wages and to remit these taxes to the state. This form is essential for compliance with Maryland tax laws and ensures that employers meet their withholding obligations accurately and timely.

Steps to Complete the MW506 Form 2024

Completing the MW506 form involves several key steps:

- Gather employee information, including names, Social Security numbers, and total wages paid.

- Calculate the total amount of income tax withheld for each employee during the reporting period.

- Fill out the MW506 form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Maryland Comptroller's office by the specified deadline.

Filing Deadlines for the MW506 Form

Employers must adhere to specific filing deadlines for the MW506 form to avoid penalties. Generally, the form is due on or before the 15th day of the month following the end of each quarter. For instance, the deadlines for the 2024 tax year are:

- First quarter: April 15, 2024

- Second quarter: July 15, 2024

- Third quarter: October 15, 2024

- Fourth quarter: January 15, 2025

Legal Use of the MW506 Form

The MW506 form is legally required for all employers in Maryland who withhold state income tax from employee wages. Failure to file this form can result in significant penalties, including fines and interest on unpaid taxes. It is important for employers to understand their legal obligations regarding tax withholding and reporting.

Obtaining the MW506 Form 2024

Employers can obtain the MW506 form through the Maryland Comptroller's website or by contacting their office directly. The form is available in PDF format, which can be filled out electronically or printed for manual completion. It is advisable to ensure that the most current version of the form is being used to comply with any updates or changes in tax law.

Key Elements of the MW506 Form

The MW506 form includes several key elements that employers must complete:

- Employer identification information, including name and address.

- Total wages paid to employees during the reporting period.

- Total income tax withheld from employee wages.

- Signature of the employer or authorized representative.

Quick guide on how to complete 506a maryland employer return of income tax withheld 506a maryland employer return of income tax withheld

Effortlessly Prepare 506A MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD 506A MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD on Any Device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without any hold-ups. Handle 506A MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD 506A MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD on any platform using the airSlate SignNow Android or iOS applications and streamline your document-oriented process today.

The Easiest Way to Modify and Electronically Sign 506A MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD 506A MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD

- Obtain 506A MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD 506A MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools designed by airSlate SignNow for this exact purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 506A MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD 506A MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 506a maryland employer return of income tax withheld 506a maryland employer return of income tax withheld

Create this form in 5 minutes!

How to create an eSignature for the 506a maryland employer return of income tax withheld 506a maryland employer return of income tax withheld

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mw506 form 2024 and why is it important?

The mw506 form 2024 is a crucial document for businesses in Maryland, used for reporting income tax withholding. Understanding its requirements ensures compliance and helps avoid penalties. airSlate SignNow simplifies the process of completing and submitting the mw506 form 2024 electronically.

-

How can airSlate SignNow help with the mw506 form 2024?

airSlate SignNow provides an easy-to-use platform for filling out and eSigning the mw506 form 2024. With its intuitive interface, users can quickly complete the form and send it securely. This streamlines the process, saving time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for the mw506 form 2024?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that facilitate the completion of the mw506 form 2024, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the mw506 form 2024?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for the mw506 form 2024. These tools enhance efficiency and ensure that your documents are handled securely and professionally. Additionally, users can collaborate in real-time, making the process seamless.

-

Can I integrate airSlate SignNow with other software for the mw506 form 2024?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the mw506 form 2024. This means you can connect with tools you already use, enhancing productivity and reducing manual data entry.

-

What are the benefits of using airSlate SignNow for the mw506 form 2024?

Using airSlate SignNow for the mw506 form 2024 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and easy document management, which can signNowly improve your business operations. Additionally, it helps ensure compliance with state regulations.

-

Is airSlate SignNow user-friendly for completing the mw506 form 2024?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the mw506 form 2024. The platform features a straightforward interface that guides users through the process, ensuring that even those with minimal technical skills can navigate it effectively.

Get more for 506A MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD 506A MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair texas form

- Texas letter notice form

- Texas repair form

- Letter with demand 497327485 form

- Texas landlord notice form

- Letter landlord demand template form

- Texas letter demand form

- Tx criminal records form

Find out other 506A MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD 506A MARYLAND EMPLOYER RETURN OF INCOME TAX WITHHELD

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will