MW506A AMENDED RETURN Maryland Tax Forms and Instructions 2016

What is the MW506A Amended Return Maryland Tax Forms and Instructions

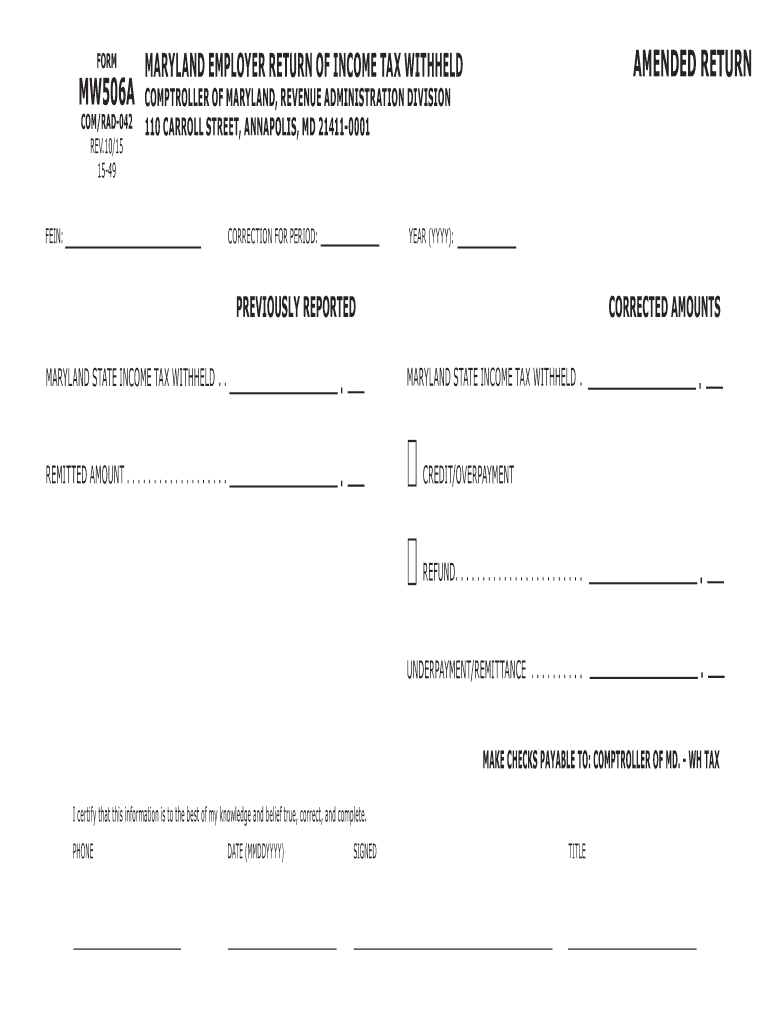

The MW506A Amended Return is a specific tax form used by Maryland taxpayers to correct previously filed tax returns. This form allows individuals and businesses to amend their tax information, ensuring accuracy in reporting income, deductions, and credits. By submitting the MW506A, taxpayers can rectify errors or omissions that may have occurred in their original filings, thereby aligning their tax obligations with the latest financial details.

Steps to Complete the MW506A Amended Return Maryland Tax Forms and Instructions

Completing the MW506A requires careful attention to detail. Here are the essential steps:

- Gather all relevant financial documents, including the original return and any supporting documentation for the changes.

- Clearly indicate the tax year you are amending at the top of the form.

- Fill out the form with accurate information, making sure to highlight the changes from the original return.

- Provide a thorough explanation of the reasons for the amendment in the designated section.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

How to Use the MW506A Amended Return Maryland Tax Forms and Instructions

Using the MW506A is straightforward. Taxpayers can access the form online or through designated state tax offices. Once obtained, the form can be filled out electronically or printed for manual completion. After filling out the necessary information, the form can be submitted either electronically through approved channels or via traditional mail. It is important to keep a copy of the completed form for personal records.

Filing Deadlines / Important Dates

Timely submission of the MW506A is crucial to avoid penalties. Generally, the amended return must be filed within three years from the original filing date or within two years from the date the tax was paid, whichever is later. Taxpayers should be aware of specific deadlines for each tax year to ensure compliance and avoid unnecessary complications.

Legal Use of the MW506A Amended Return Maryland Tax Forms and Instructions

The MW506A is legally recognized as a valid method for amending tax returns in Maryland. It is essential for taxpayers to ensure that their amendments comply with state tax laws and regulations. Submitting this form properly can protect taxpayers from potential legal issues related to inaccurate tax filings.

Required Documents

To complete the MW506A, taxpayers must have several documents on hand, including:

- The original tax return being amended.

- Any documentation supporting the changes, such as W-2s, 1099s, or receipts.

- Previous correspondence with the Maryland Comptroller's office, if applicable.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the MW506A Amended Return through various methods. The form can be filed electronically via the Maryland Comptroller's online portal, which is the preferred method for many due to its convenience and speed. Alternatively, taxpayers may choose to mail the completed form to the appropriate address provided in the instructions. In-person submissions are also accepted at designated tax offices, allowing for direct assistance if needed.

Quick guide on how to complete mw506a amended return maryland tax forms and instructions

Your assistance manual on how to prepare your MW506A AMENDED RETURN Maryland Tax Forms And Instructions

If you’re interested in learning how to produce and dispatch your MW506A AMENDED RETURN Maryland Tax Forms And Instructions, here are some brief pointers on how to simplify tax filing.

To begin, you just need to register your airSlate SignNow account to revolutionize how you manage documentation online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, generate, and complete your tax forms effortlessly. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures while returning to adjust information as necessary. Optimize your tax administration with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to finalize your MW506A AMENDED RETURN Maryland Tax Forms And Instructions in a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to obtain any IRS tax form; browse different versions and schedules.

- Click Obtain form to access your MW506A AMENDED RETURN Maryland Tax Forms And Instructions in our editor.

- Complete the essential fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Review your document and rectify any inaccuracies.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically using airSlate SignNow. Keep in mind that submitting on paper can lead to more mistakes and delay refunds. Naturally, before electronically filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct mw506a amended return maryland tax forms and instructions

FAQs

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

Create this form in 5 minutes!

How to create an eSignature for the mw506a amended return maryland tax forms and instructions

How to create an electronic signature for the Mw506a Amended Return Maryland Tax Forms And Instructions online

How to make an electronic signature for your Mw506a Amended Return Maryland Tax Forms And Instructions in Chrome

How to generate an electronic signature for putting it on the Mw506a Amended Return Maryland Tax Forms And Instructions in Gmail

How to create an electronic signature for the Mw506a Amended Return Maryland Tax Forms And Instructions from your mobile device

How to make an electronic signature for the Mw506a Amended Return Maryland Tax Forms And Instructions on iOS

How to create an electronic signature for the Mw506a Amended Return Maryland Tax Forms And Instructions on Android OS

People also ask

-

What is the MW506A AMENDED RETURN Maryland Tax Form?

The MW506A AMENDED RETURN Maryland Tax Form is used by taxpayers in Maryland to amend their previously filed income tax returns. This form allows individuals to make corrections or changes to their tax information, ensuring that they meet their state tax obligations accurately.

-

How can airSlate SignNow assist with the MW506A AMENDED RETURN Maryland Tax Forms And Instructions?

airSlate SignNow provides an easy-to-use platform that enables users to fill out and eSign the MW506A AMENDED RETURN Maryland Tax Forms And Instructions securely online. Our solution simplifies the process, allowing for quick, hassle-free submission of amended returns.

-

What are the pricing options for using airSlate SignNow for Maryland Tax Forms?

airSlate SignNow offers various pricing plans designed to suit different business needs. Users can take advantage of our affordable rates to efficiently manage the MW506A AMENDED RETURN Maryland Tax Forms And Instructions, ensuring they get the best value for their investment.

-

Are there any features that specifically benefit users filling out Maryland Tax Forms?

Yes, airSlate SignNow provides features such as document templates, real-time collaboration, and secure storage, all of which are essential for completing the MW506A AMENDED RETURN Maryland Tax Forms And Instructions. These functionalities streamline the tax filing process and enhance productivity.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow offers seamless integrations with popular tax software and productivity tools. This means you can easily combine our platform's capabilities with your existing solutions when dealing with MW506A AMENDED RETURN Maryland Tax Forms And Instructions.

-

What are the benefits of using airSlate SignNow for signing tax forms?

Using airSlate SignNow for signing tax forms like the MW506A AMENDED RETURN Maryland Tax Forms And Instructions provides numerous benefits, including increased accuracy, faster processing times, and enhanced security. Our platform protects sensitive information while offering a user-friendly experience.

-

How does airSlate SignNow ensure compliance with Maryland tax regulations?

airSlate SignNow is designed to keep up with the latest Maryland tax regulations, including those related to the MW506A AMENDED RETURN Maryland Tax Forms And Instructions. We regularly update our forms and templates to ensure that all users remain compliant with state laws.

Get more for MW506A AMENDED RETURN Maryland Tax Forms And Instructions

- The printed portions of this form have been approved by the colorado real estate commission lp 46 1 97 drop in center flyer

- The veldt vocabulary pdf form

- Resigned as a director sunbiz form

- Florissant police department form

- Vocabulary skills a cell crossword puzzle form

- Field trip behavior contract form

- Fill in mortgage application form online

- International student information and faq

Find out other MW506A AMENDED RETURN Maryland Tax Forms And Instructions

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure