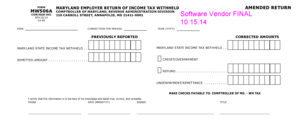

MW 506A Employer's Return of Income Tax Withheld Comptroller of 2015

What is the MW 506A Employer's Return Of Income Tax Withheld Comptroller Of

The MW 506A Employer's Return Of Income Tax Withheld is a tax form used by employers in the United States to report income tax withheld from employees' wages. This form is essential for ensuring compliance with federal and state tax regulations. It provides a summary of the total amount of income tax withheld during a specific reporting period, which is typically quarterly or annually. Employers must accurately complete this form to avoid penalties and ensure proper tax reporting.

Steps to complete the MW 506A Employer's Return Of Income Tax Withheld Comptroller Of

Completing the MW 506A form involves several key steps:

- Gather necessary information: Collect details such as employee wages, tax withheld, and employer identification information.

- Fill out the form: Enter the required data in the designated fields, ensuring accuracy to avoid discrepancies.

- Review for accuracy: Double-check all entries for correctness, including amounts and identification numbers.

- Sign and date the form: Ensure that the appropriate person within the organization signs the form, as required.

- Submit the form: Choose your preferred submission method, whether online or via mail, and ensure it is sent by the deadline.

How to obtain the MW 506A Employer's Return Of Income Tax Withheld Comptroller Of

Employers can obtain the MW 506A form through various channels. It is typically available on the official state tax authority's website, where it can be downloaded in a printable format. Additionally, many tax preparation software programs include the MW 506A form, allowing for easy completion and electronic filing. Employers should ensure they are using the most current version of the form to comply with any recent changes in tax regulations.

Legal use of the MW 506A Employer's Return Of Income Tax Withheld Comptroller Of

The MW 506A form serves a legal purpose in documenting the income tax withheld from employees. It is a crucial component of tax compliance for employers, as it ensures that the appropriate amounts are reported to the IRS and state tax authorities. Failure to accurately complete and file this form can result in legal penalties, including fines and increased scrutiny from tax authorities. Employers must understand the legal implications of this form to maintain compliance and protect their business interests.

Filing Deadlines / Important Dates

Filing deadlines for the MW 506A form vary based on the reporting period. Typically, employers must submit the form quarterly, with deadlines often falling on the last day of the month following the end of each quarter. For example, the deadline for the first quarter (January to March) is usually April 30. It is essential for employers to stay informed about these deadlines to avoid late filing penalties and ensure timely compliance with tax obligations.

Form Submission Methods (Online / Mail / In-Person)

The MW 506A form can be submitted through various methods, providing flexibility for employers. Common submission options include:

- Online submission: Many states allow electronic filing through their tax authority's website, which can expedite processing.

- Mail: Employers can print the completed form and send it via postal service to the designated tax office.

- In-person submission: Some employers may choose to deliver the form directly to their local tax office for immediate processing.

Quick guide on how to complete mw 506a employers return of income tax withheld comptroller of

Your assistance manual on how to prepare your MW 506A Employer's Return Of Income Tax Withheld Comptroller Of

If you’re curious about how to generate and submit your MW 506A Employer's Return Of Income Tax Withheld Comptroller Of, here are a few brief pointers on how to simplify tax submissions.

To start, you just need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, draft, and finalize your income tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and return to adjust answers as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to complete your MW 506A Employer's Return Of Income Tax Withheld Comptroller Of within moments:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to obtain any IRS tax form; browse through versions and schedules.

- Click Get form to access your MW 506A Employer's Return Of Income Tax Withheld Comptroller Of in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any discrepancies.

- Save changes, print a copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that filing on paper can heighten return errors and prolong refunds. Of course, prior to e-filing your taxes, consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct mw 506a employers return of income tax withheld comptroller of

FAQs

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How do I fill the income tax return form of India?

you can very easily file your income tax return online, but decide which return to file generally salaried individual files ITR 1 and businessmen files ITR 4S as both are very easy to file. First Fill the Details on First Page Name, Address, mobile no, PAN Number, Date of Birth and income from salary and deduction you are claiming under 80C and other sections. Then fill the details of TDS deduction which can be check from Form 16 as well as Form 26AS availbale online. Then complete the details on 3rd page like bank account number, type of account(saving), Bank MICR code(given on cheque book), father name. Then Click and Validate button and if there is any error it will automatically show. recity those error Then click on calculate button and finally click on generate button and save .xml file which you have to upload on income tax. This website I really found very good for income tax related problem visit Income Tax Website for Efiling Taxes, ITR Forms, etc. for more information.

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

Create this form in 5 minutes!

How to create an eSignature for the mw 506a employers return of income tax withheld comptroller of

How to generate an eSignature for the Mw 506a Employers Return Of Income Tax Withheld Comptroller Of in the online mode

How to generate an eSignature for the Mw 506a Employers Return Of Income Tax Withheld Comptroller Of in Google Chrome

How to generate an eSignature for putting it on the Mw 506a Employers Return Of Income Tax Withheld Comptroller Of in Gmail

How to generate an eSignature for the Mw 506a Employers Return Of Income Tax Withheld Comptroller Of straight from your smart phone

How to create an electronic signature for the Mw 506a Employers Return Of Income Tax Withheld Comptroller Of on iOS devices

How to generate an eSignature for the Mw 506a Employers Return Of Income Tax Withheld Comptroller Of on Android OS

People also ask

-

What is mw506a and how does it work with airSlate SignNow?

The mw506a is a specific feature within the airSlate SignNow platform that allows users to efficiently manage document workflows. By utilizing mw506a, you can send, receive, and eSign documents seamlessly, ensuring a streamlined process for your business needs.

-

What are the pricing options for mw506a in airSlate SignNow?

airSlate SignNow offers competitive pricing plans for the mw506a functionality, making it accessible for businesses of all sizes. You can choose from various subscription tiers that cater to different usage levels, ensuring you only pay for what you need.

-

What features does mw506a provide to enhance document management?

mw506a includes features like customizable templates, automated reminders, and tracking capabilities to enhance document management. These functionalities help keep your signing processes precise and on schedule, benefiting overall productivity.

-

How can mw506a benefit my business?

By integrating mw506a into your document management strategy, your business can accelerate the signing process and reduce turnaround times. This efficiency not only saves time but also improves customer satisfaction through quicker service.

-

Does mw506a integrate with other software applications?

Yes, mw506a within airSlate SignNow is designed to integrate seamlessly with various software applications, enhancing your existing tools. These integrations allow for better workflow automation and data management across your business operations.

-

Is mw506a suitable for small businesses?

Absolutely! The mw506a feature in airSlate SignNow is particularly advantageous for small businesses looking for cost-effective solutions. It provides powerful eSigning capabilities without the need for extensive resources, making it ideal for smaller teams.

-

What security measures are in place for mw506a users?

airSlate SignNow prioritizes security for mw506a users by implementing robust encryption protocols and compliance with industry regulations. This ensures that all your documents are securely handled, providing peace of mind during the signing process.

Get more for MW 506A Employer's Return Of Income Tax Withheld Comptroller Of

- Form 8589

- Epcc transcript request form

- Hoover ymca winter basketball team registration form

- The opioid risk tool ort score factor female mytopcare form

- Geocaching merit badge worksheet form

- Vehicle release form from police department

- Community organization and volunteer authorization letter form

- Alberta only certificate of notary public form

Find out other MW 506A Employer's Return Of Income Tax Withheld Comptroller Of

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word