C CorporationFiling Requirements 1998

Understanding C Corporation Filing Requirements

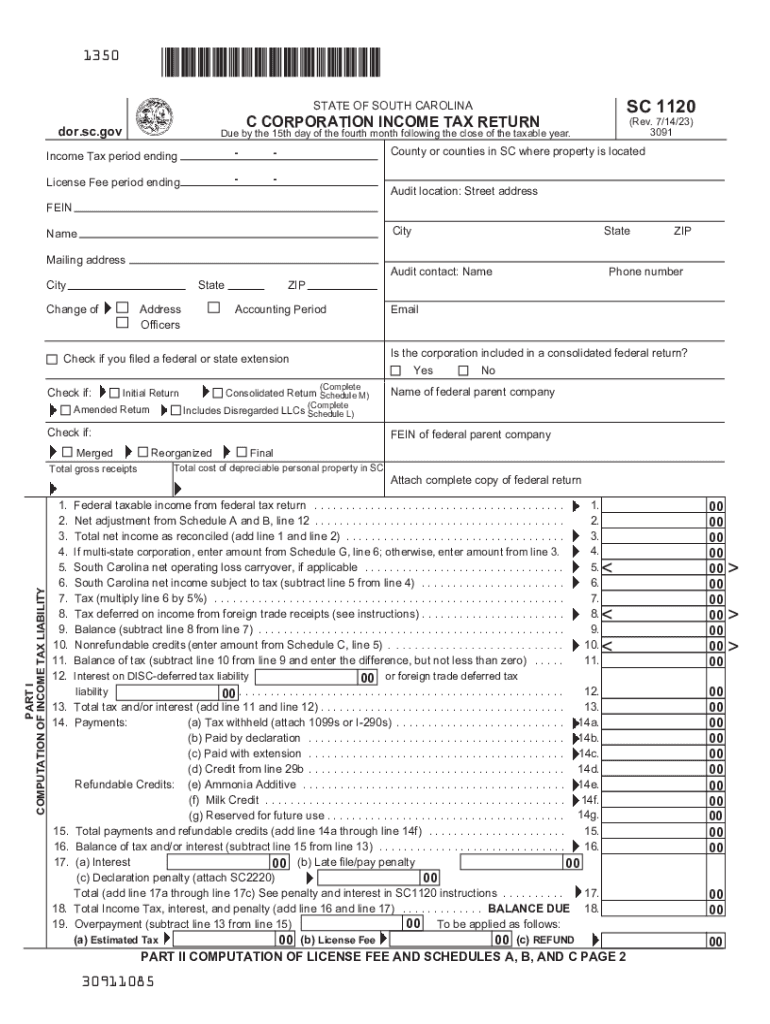

A C Corporation is a legal entity that is separate from its owners, providing limited liability protection. To maintain this status, it is essential to comply with specific filing requirements set by the IRS and state authorities. These requirements typically include filing an annual corporate income tax return, known as Form 1120, which reports the corporation's income, gains, losses, deductions, and credits. Additionally, corporations must adhere to state-specific regulations, which can vary significantly. For example, in South Carolina, the SC 1120 form must be filed along with the federal return.

Steps to Complete C Corporation Filing Requirements

Completing the filing requirements for a C Corporation involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and expense reports.

- Determine the applicable federal and state forms, such as Form 1120 for federal taxes and SC 1120 for South Carolina taxes.

- Complete the forms accurately, ensuring all income and deductions are reported.

- Review the forms for errors or omissions before submission.

- Submit the forms by the deadline, which is typically the fifteenth day of the fourth month after the end of the corporation’s tax year.

Required Documents for C Corporation Filing

To successfully file as a C Corporation, several documents are required. These include:

- Form 1120 for federal income tax reporting.

- SC 1120 form for state income tax reporting in South Carolina.

- Financial statements that detail the corporation's revenue and expenses.

- Records of any deductions or credits claimed.

- Documentation supporting any income reported, such as bank statements and invoices.

Filing Deadlines for C Corporations

Timely filing is crucial for compliance. The general deadline for submitting Form 1120 is the fifteenth day of the fourth month following the close of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. South Carolina also follows this timeline for the SC 1120 form. However, if the deadline falls on a weekend or holiday, the due date is extended to the next business day.

Penalties for Non-Compliance

Failure to comply with C Corporation filing requirements can result in significant penalties. The IRS imposes fines for late filings, which can accumulate quickly. For example, if a corporation fails to file Form 1120 on time, it may incur a penalty of $210 per month, up to a maximum of twelve months. Additionally, state penalties may apply for late submission of the SC 1120 form. These penalties can impact the corporation's financial standing and reputation, making compliance essential.

IRS Guidelines for C Corporations

The IRS provides comprehensive guidelines for C Corporations, outlining the necessary forms, filing procedures, and compliance requirements. Corporations should refer to the IRS website for the most current information regarding tax rates, allowable deductions, and credits. Understanding these guidelines is vital for accurate reporting and minimizing tax liabilities. Moreover, staying informed about changes in tax laws can help corporations adjust their strategies accordingly.

Quick guide on how to complete c corporationfiling requirements

Effortlessly Prepare C CorporationFiling Requirements on Any Device

The management of documents online has gained popularity among both organizations and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed materials, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage C CorporationFiling Requirements on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Modify and eSign C CorporationFiling Requirements with Ease

- Find C CorporationFiling Requirements and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management requirements in just a few clicks from any device you choose. Alter and eSign C CorporationFiling Requirements and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct c corporationfiling requirements

Create this form in 5 minutes!

How to create an eSignature for the c corporationfiling requirements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS revenue and how does it relate to my business?

IRS revenue refers to the total income collected by the Internal Revenue Service from various taxes. Understanding IRS revenue is crucial for businesses, as it affects tax planning and compliance. With airSlate SignNow, you can ensure that all your financial documents are signed and stored securely, helping you stay organized for IRS revenue reporting.

-

How does airSlate SignNow help with IRS revenue compliance?

AirSlate SignNow simplifies document management and eSigning, making it easier for businesses to maintain accurate records for IRS revenue compliance. By using our platform, you can create, send, and sign tax-related documents electronically, which can streamline your accounting processes and keep you aligned with IRS standards.

-

Is there a cost associated with using airSlate SignNow for IRS revenue-related documents?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution provides tools to manage, sign, and store IRS revenue documentation, ensuring that your investment in our services saves you time and supports compliance. Choose a plan that fits your budget and document requirements.

-

What features does airSlate SignNow offer that assist with IRS revenue documentation?

AirSlate SignNow provides features like customizable templates, advanced eSigning capabilities, and secure document storage that are essential for IRS revenue documentation. These tools help you collect signatures quickly while maintaining a clear record for tax and compliance purposes, making your processes more efficient.

-

Can I integrate airSlate SignNow with my current accounting software for IRS revenue tracking?

Absolutely! AirSlate SignNow integrates seamlessly with popular accounting software, allowing you to track IRS revenue without hassle. By linking our eSigning platform with your existing tools, you can streamline your documentation process while maintaining accurate financial records for IRS compliance.

-

How does using airSlate SignNow benefit my business when dealing with IRS revenue?

Using airSlate SignNow can signNowly benefit your business by reducing the time spent on manual paperwork related to IRS revenue. Our platform automates the eSigning process, ensuring that documents are always up-to-date and compliant. This efficiency allows you to focus on your core business activities while ensuring tax-related matters are handled properly.

-

What types of businesses can benefit from airSlate SignNow's IRS revenue solutions?

Any business, from small startups to large corporations, can benefit from airSlate SignNow's solutions for managing IRS revenue documentation. The platform is designed to be versatile, catering to various industries that require efficient document handling. By adopting our solution, businesses can enhance their compliance efforts and improve overall operational efficiency.

Get more for C CorporationFiling Requirements

Find out other C CorporationFiling Requirements

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet