This Information is Especially Prepared for the First Time Filer 2019

Understanding the Alaska Partnership Return Form

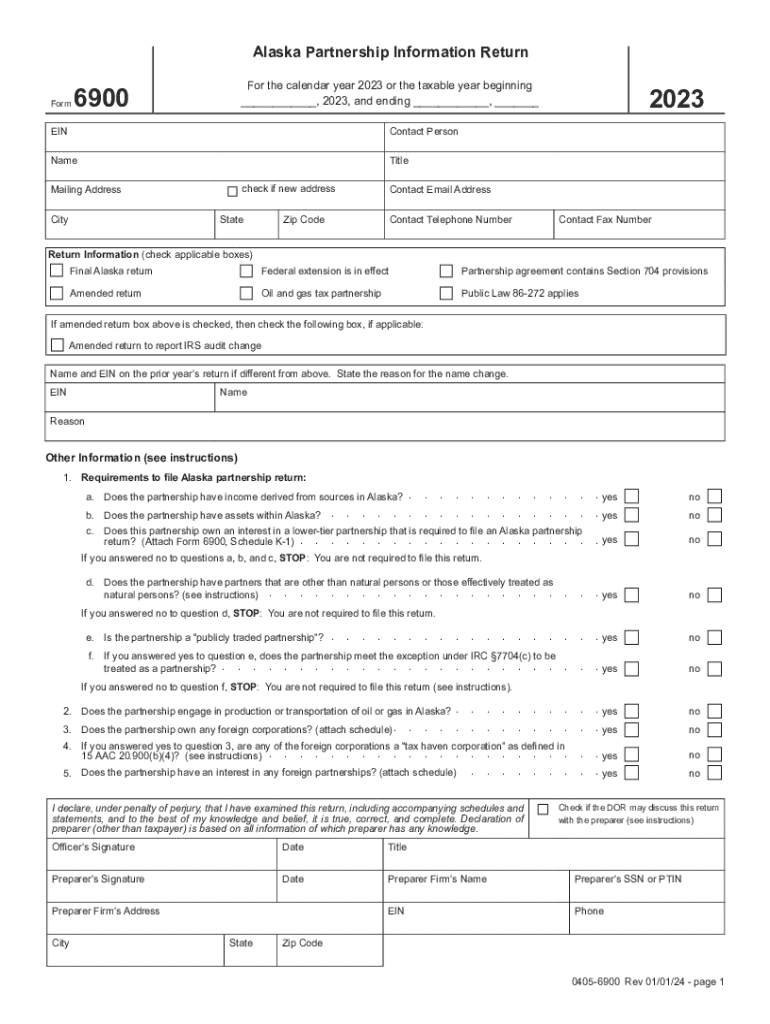

The Alaska partnership return form, known as the Alaska 6900, is essential for partnerships operating within the state. This form is used to report income, deductions, and credits for partnerships, ensuring compliance with state tax regulations. It is crucial for partnerships to accurately complete this form to avoid potential penalties and ensure proper tax reporting.

Steps to Complete the Alaska 6900 Partnership Return

Completing the Alaska 6900 partnership return involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the form accurately, providing details about the partnership's income, deductions, and credits.

- Ensure that all partners' information is correctly listed, including their share of income and deductions.

- Review the completed form for accuracy and completeness before submission.

Filing Deadlines and Important Dates

Partnerships must adhere to specific deadlines when submitting the Alaska 6900 return. The standard filing deadline is the 15th day of the fourth month following the end of the tax year. For partnerships operating on a calendar year, this typically falls on April 15. Extensions may be available, but it is essential to file for an extension before the original deadline.

Required Documents for Submission

When filing the Alaska partnership return form, partnerships must prepare several documents:

- Income statements detailing revenue generated during the tax year.

- Expense records to substantiate deductions claimed.

- Partner information, including Social Security numbers or Employer Identification Numbers (EINs).

- Any supporting documentation for credits claimed on the return.

Penalties for Non-Compliance

Failure to file the Alaska partnership return form on time or inaccurately can result in significant penalties. These may include fines based on the amount of tax owed or a percentage of the unpaid tax. Additionally, partnerships may face interest charges on any unpaid tax liabilities. It is vital for partnerships to adhere to filing requirements to avoid these financial repercussions.

Digital vs. Paper Version of the Alaska 6900 Form

The Alaska partnership return form can be submitted either digitally or via paper. Digital submissions are often processed more quickly and may reduce the likelihood of errors. However, some partnerships may prefer paper submissions for record-keeping purposes. It is essential to choose the method that best suits the partnership's needs while ensuring compliance with state regulations.

Quick guide on how to complete this information is especially prepared for the first time filer

Complete This Information Is Especially Prepared For The First time Filer seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage This Information Is Especially Prepared For The First time Filer on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign This Information Is Especially Prepared For The First time Filer effortlessly

- Find This Information Is Especially Prepared For The First time Filer and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your updates.

- Select how you would like to send your form, via email, text message (SMS), or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign This Information Is Especially Prepared For The First time Filer and ensure smooth communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct this information is especially prepared for the first time filer

Create this form in 5 minutes!

How to create an eSignature for the this information is especially prepared for the first time filer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alaska partnership return form?

The Alaska partnership return form is a tax document that partnerships must file to report income, deductions, and other tax-related information to the state of Alaska. It is essential for compliance with state tax regulations and ensures correct calculation of any tax liabilities.

-

How can airSlate SignNow assist with the Alaska partnership return form?

airSlate SignNow simplifies the process of completing and submitting the Alaska partnership return form by providing an intuitive platform for eSigning and document management. You can easily fill out the form online, ensuring accuracy and compliance with state requirements.

-

Is there a cost associated with using airSlate SignNow for the Alaska partnership return form?

Yes, airSlate SignNow offers various pricing plans tailored to businesses of different sizes. Each plan is cost-effective and provides comprehensive features to help you manage your Alaska partnership return form efficiently, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for the Alaska partnership return form?

airSlate SignNow includes features such as customizable templates, secure eSigning, document tracking, and integration with popular cloud storage solutions. These features make handling the Alaska partnership return form straightforward and enhance your overall workflow.

-

Can I integrate airSlate SignNow with other software for the Alaska partnership return form?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as CRM systems, cloud storage, and accounting software. This allows you to streamline the process of managing the Alaska partnership return form alongside your other business operations.

-

What are the benefits of using airSlate SignNow for eSigning the Alaska partnership return form?

Using airSlate SignNow for eSigning the Alaska partnership return form provides benefits such as enhanced security, faster turnaround times, and convenience. You can sign documents from anywhere, eliminating the need for physical paperwork and reducing processing time.

-

How secure is airSlate SignNow when handling the Alaska partnership return form?

airSlate SignNow employs industry-leading security measures to protect your data when completing the Alaska partnership return form. With encryption, secure data storage, and compliance with regulatory standards, your information remains safe and confidential.

Get more for This Information Is Especially Prepared For The First time Filer

- Tenant notice repair template form

- Maryland letter notice form

- Md tenant landlord form

- Letter tenant landlord demand 497310227 form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497310228 form

- Maryland tenant landlord agreement form

- Letter landlord demand sample form

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises maryland form

Find out other This Information Is Especially Prepared For The First time Filer

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter