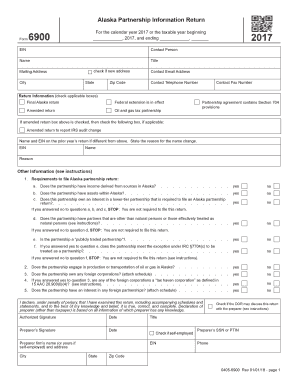

for the Calendar Year or the Taxable Year Beginning 2017

What is the For The Calendar Year Or The Taxable Year Beginning

The form for the calendar year or the taxable year beginning is a crucial document used primarily for tax reporting purposes in the United States. This form helps taxpayers specify the time frame for which they are reporting income and expenses. Understanding this form is essential for ensuring compliance with IRS regulations and accurately reflecting financial activities within the designated period. It is particularly important for individuals and businesses that may have different accounting periods or unique tax situations.

Steps to complete the For The Calendar Year Or The Taxable Year Beginning

Completing the form for the calendar year or the taxable year beginning involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, receipts, and previous tax returns. Next, identify the correct tax year for reporting, whether it is the calendar year or a fiscal year. Fill in the required information on the form, ensuring that all figures are accurate and correspond to your financial records. Finally, review the completed form for any errors before submission to avoid delays or penalties.

Legal use of the For The Calendar Year Or The Taxable Year Beginning

The legal use of the form for the calendar year or the taxable year beginning is governed by IRS guidelines. This form must be filled out accurately to reflect the taxpayer's financial situation during the specified period. Failure to comply with the legal requirements can result in penalties or audits. It is advisable to consult tax professionals if there are uncertainties regarding the form's completion or legal implications. Ensuring that the form adheres to IRS regulations helps protect taxpayers from potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the form for the calendar year or the taxable year beginning are critical for compliance. Typically, individual taxpayers must file their forms by April 15 of the following year, while businesses may have different deadlines based on their structure. It is essential to stay informed about any changes to these dates, as missing a deadline can lead to penalties or interest charges. Keeping a calendar of important tax dates can help ensure timely submissions.

Who Issues the Form

The form for the calendar year or the taxable year beginning is issued by the Internal Revenue Service (IRS). The IRS provides guidelines and updates regarding the use of this form, including any changes in reporting requirements or procedures. Taxpayers can access the form and any related instructions directly from the IRS website or through tax preparation software that complies with IRS standards.

Examples of using the For The Calendar Year Or The Taxable Year Beginning

Examples of using the form for the calendar year or the taxable year beginning include various taxpayer scenarios. For instance, a self-employed individual may use this form to report income earned throughout the calendar year, while a corporation may use it to report income for its fiscal year, which does not align with the calendar year. Understanding these examples helps clarify how different entities utilize the form based on their unique financial situations.

Quick guide on how to complete for the calendar year 2017 or the taxable year beginning

Accomplish For The Calendar Year Or The Taxable Year Beginning effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the features needed to create, modify, and eSign your documents swiftly without delays. Manage For The Calendar Year Or The Taxable Year Beginning on any platform with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to modify and eSign For The Calendar Year Or The Taxable Year Beginning with ease

- Locate For The Calendar Year Or The Taxable Year Beginning and then click Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), or an invite link, or download it to your computer.

Wave goodbye to lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Alter and eSign For The Calendar Year Or The Taxable Year Beginning and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for the calendar year 2017 or the taxable year beginning

Create this form in 5 minutes!

How to create an eSignature for the for the calendar year 2017 or the taxable year beginning

How to create an eSignature for the For The Calendar Year 2017 Or The Taxable Year Beginning in the online mode

How to generate an eSignature for your For The Calendar Year 2017 Or The Taxable Year Beginning in Google Chrome

How to make an electronic signature for putting it on the For The Calendar Year 2017 Or The Taxable Year Beginning in Gmail

How to make an eSignature for the For The Calendar Year 2017 Or The Taxable Year Beginning straight from your smart phone

How to create an electronic signature for the For The Calendar Year 2017 Or The Taxable Year Beginning on iOS

How to create an eSignature for the For The Calendar Year 2017 Or The Taxable Year Beginning on Android devices

People also ask

-

How does airSlate SignNow handle documents for the calendar year or the taxable year beginning?

With airSlate SignNow, you can easily manage and eSign documents for the calendar year or the taxable year beginning. Our platform allows you to organize and store your documents securely, ensuring that your important tax-related paperwork is always accessible when you need it. Plus, our user-friendly interface simplifies the process of tracking documents across different years.

-

What pricing options are available for using airSlate SignNow for the calendar year or the taxable year beginning?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes that need document solutions for the calendar year or the taxable year beginning. Our plans range from individual to enterprise-level options, providing you with the necessary features at a price point that makes sense for your organization. You can choose the plan that best fits your budget and requirements.

-

What features of airSlate SignNow are beneficial for handling documents for the calendar year or the taxable year beginning?

airSlate SignNow offers a variety of features that are ideal for managing documents for the calendar year or the taxable year beginning. Our platform includes templates, automated workflows, and robust security measures to ensure compliance and efficiency. Additionally, our advanced tracking and reporting tools allow you to monitor document statuses and ensure timely submissions.

-

How does airSlate SignNow integrate with other tools for the calendar year or the taxable year beginning?

airSlate SignNow seamlessly integrates with various tools and software that can assist with the calendar year or the taxable year beginning. Whether it's an accounting software, CRM, or other business applications, our integrations enhance your workflow, allowing you to send, sign, and manage documents effortlessly. This compatibility ensures that you can maintain your existing processes without interruption.

-

Can airSlate SignNow help with compliance for the calendar year or the taxable year beginning?

Yes, airSlate SignNow is designed with compliance in mind, especially for the calendar year or the taxable year beginning. Our platform adheres to industry regulations and standards, ensuring that your eSigned documents hold legal validity. This feature is particularly important for businesses looking to avoid compliance issues during tax seasons.

-

Is airSlate SignNow easy to use for managing documents for the calendar year or the taxable year beginning?

Absolutely! airSlate SignNow is built for ease of use, allowing anyone to manage documents for the calendar year or the taxable year beginning without extensive training. Its intuitive design simplifies the eSigning process, making it accessible for users of all skill levels, which is especially beneficial during busy tax periods.

-

What benefits can businesses expect from using airSlate SignNow for the calendar year or the taxable year beginning?

Businesses can expect numerous benefits from using airSlate SignNow for the calendar year or the taxable year beginning. Our platform not only saves time and reduces paperwork, but it also enhances collaboration between teams by allowing real-time document access. Ultimately, you'll see improved efficiency and accuracy in your document management processes.

Get more for For The Calendar Year Or The Taxable Year Beginning

Find out other For The Calendar Year Or The Taxable Year Beginning

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word