Alaska Partnership Information Return Form 6900 2019

What is the Alaska Partnership Information Return Form 6900

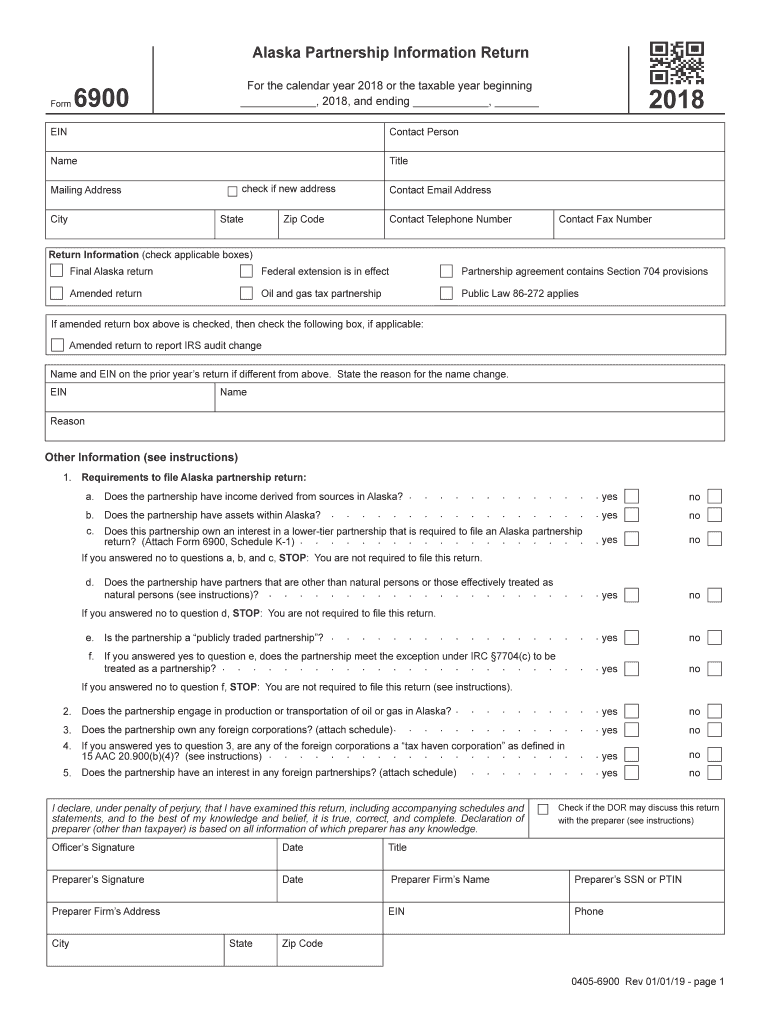

The Alaska Partnership Information Return Form 6900 is a tax document required for partnerships operating within the state of Alaska. This form is used to report the income, deductions, and credits of the partnership to the state tax authorities. It ensures that partnerships fulfill their tax obligations and provides necessary information for the state to assess tax liability accurately. The form must be completed by partnerships, which include general partnerships, limited partnerships, and limited liability partnerships (LLPs). Each partner's share of income must be reported on this form, which is crucial for both the partnership and individual partners' tax filings.

Steps to complete the Alaska Partnership Information Return Form 6900

Completing the Alaska 6900 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including profit and loss statements and balance sheets. Next, fill out the identification section, providing the partnership's name, address, and tax identification number. Then, report the partnership's total income, deductions, and credits in the appropriate sections. It is essential to ensure that each partner's share of income is correctly calculated and reported. Finally, review the form for accuracy, sign it, and submit it by the designated deadline to avoid penalties.

Legal use of the Alaska Partnership Information Return Form 6900

The Alaska 6900 form is legally binding and must be completed in accordance with state tax laws. To ensure its legal validity, partnerships must adhere to the guidelines set forth by the Alaska Department of Revenue. This includes accurate reporting of financial data and timely submission of the form. When filed correctly, the form serves as a declaration of the partnership's financial activities and can be used as evidence in case of audits or disputes. Utilizing a trusted electronic signature solution can further enhance the legal standing of the submitted document.

Filing Deadlines / Important Dates

Partnerships must be aware of the specific deadlines for filing the Alaska Partnership Information Return Form 6900 to avoid penalties. Typically, the form is due on the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by April 15. It is crucial to stay informed about any changes in deadlines, especially if extensions are needed. Filing on time ensures compliance with state regulations and helps maintain good standing with tax authorities.

Form Submission Methods (Online / Mail / In-Person)

The Alaska Partnership Information Return Form 6900 can be submitted through various methods, providing flexibility for partnerships. The form can be filed online through the Alaska Department of Revenue's website, which offers a streamlined process for electronic submissions. Alternatively, partnerships may choose to mail the completed form to the appropriate tax office. For those who prefer in-person submissions, visiting a local tax office is also an option. Regardless of the method chosen, it is important to keep a copy of the submitted form for record-keeping purposes.

Required Documents

To complete the Alaska 6900 form accurately, several documents are necessary. Partnerships should prepare financial statements that detail income and expenses, including profit and loss statements. Additionally, any documentation related to deductions and credits claimed should be gathered. Each partner's tax identification number and relevant information about their share of income must also be included. Having these documents ready will facilitate a smoother completion process and ensure that all required information is reported accurately.

Quick guide on how to complete for the calendar year 2018 or the taxable year beginning

Complete Alaska Partnership Information Return Form 6900 effortlessly on any gadget

Web-based document handling has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can easily access the right template and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Alaska Partnership Information Return Form 6900 on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest way to modify and eSign Alaska Partnership Information Return Form 6900 without any hassle

- Obtain Alaska Partnership Information Return Form 6900 and click on Get Form to initiate.

- Utilize the resources we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive details with features that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searching, or mistakes that require printing new copies. airSlate SignNow caters to all your document handling needs in just a few clicks from any device you choose. Modify and eSign Alaska Partnership Information Return Form 6900 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for the calendar year 2018 or the taxable year beginning

Create this form in 5 minutes!

How to create an eSignature for the for the calendar year 2018 or the taxable year beginning

How to generate an eSignature for your For The Calendar Year 2018 Or The Taxable Year Beginning in the online mode

How to generate an eSignature for the For The Calendar Year 2018 Or The Taxable Year Beginning in Google Chrome

How to generate an eSignature for signing the For The Calendar Year 2018 Or The Taxable Year Beginning in Gmail

How to create an electronic signature for the For The Calendar Year 2018 Or The Taxable Year Beginning straight from your smartphone

How to generate an electronic signature for the For The Calendar Year 2018 Or The Taxable Year Beginning on iOS

How to create an electronic signature for the For The Calendar Year 2018 Or The Taxable Year Beginning on Android devices

People also ask

-

What is the Alaska Form 6900 and how can airSlate SignNow help?

The Alaska Form 6900 is used for various business and government transactions in Alaska. airSlate SignNow provides an efficient way to fill out, sign, and manage this form electronically, streamlining the process and saving time.

-

How much does it cost to use airSlate SignNow for completing the Alaska Form 6900?

airSlate SignNow offers various pricing plans that are cost-effective for businesses of all sizes. You'll find flexible options designed to accommodate different needs when completing forms like the Alaska Form 6900.

-

What features does airSlate SignNow offer for the Alaska Form 6900?

With airSlate SignNow, users can easily fill, sign, and share the Alaska Form 6900 online. The platform also offers templates, automated workflows, and secure cloud storage to enhance the process.

-

Is airSlate SignNow compliant with state regulations for the Alaska Form 6900?

Yes, airSlate SignNow ensures that all electronic signatures comply with the legal requirements for documents like the Alaska Form 6900. This ensures that you can submit your form with confidence.

-

Can I integrate airSlate SignNow with other software for filing the Alaska Form 6900?

Absolutely! airSlate SignNow provides seamless integrations with popular software tools, which makes managing the Alaska Form 6900 simpler and more efficient as part of your existing workflow.

-

How does airSlate SignNow enhance the signing experience for the Alaska Form 6900?

airSlate SignNow offers a user-friendly interface that allows signers to complete the Alaska Form 6900 quickly and easily on any device. This convenience increases user satisfaction and accelerates the signing process.

-

What are the benefits of using airSlate SignNow for the Alaska Form 6900?

Using airSlate SignNow for the Alaska Form 6900 provides numerous benefits, including faster processing times, reduced paperwork, and improved accessibility. This digital approach helps businesses save time and resources.

Get more for Alaska Partnership Information Return Form 6900

- 403b7individual 401k corrective measures kit vanguard form

- Profit sharing plan amp trust hardship distribution here paychex form

- Trailer rental agreement apc equipment form

- Cp 575 a notice bible revival ministries form

- Word pro sample gross or modified gross lease dewitt londre form

- Tops form 3285

- Financial advisordealer change form calvert investments

- Form 4232

Find out other Alaska Partnership Information Return Form 6900

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF