Nm Affordable Housing Credit Claim Form Help 2013

What is the Nm Affordable Housing Credit Claim Form Help

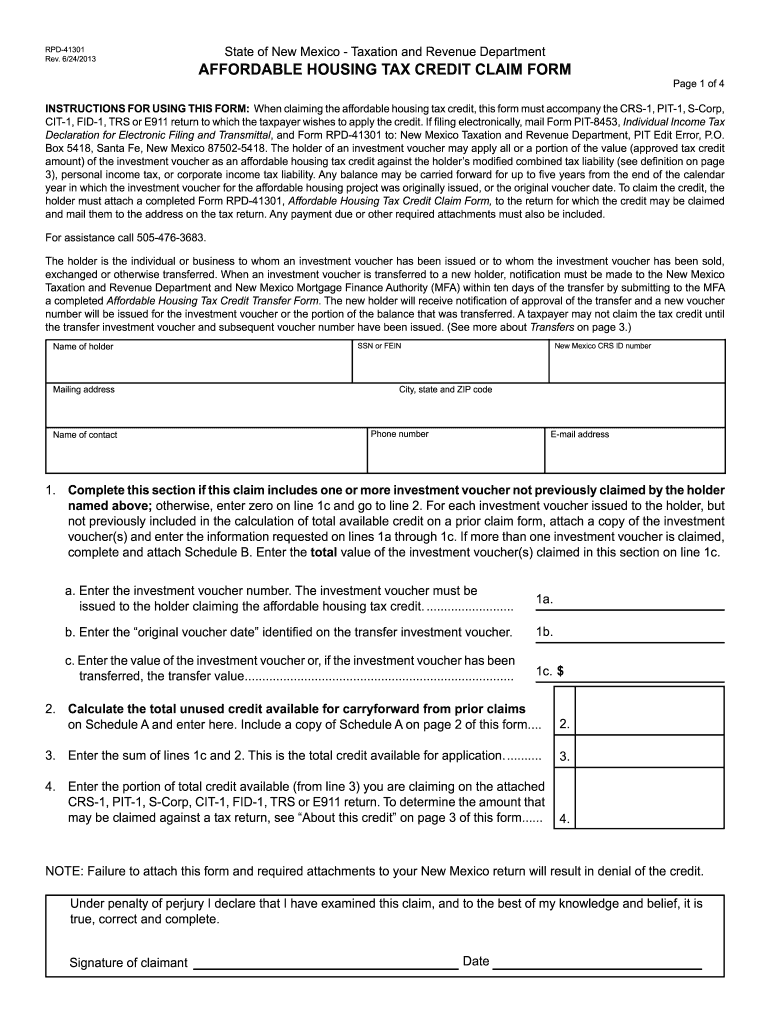

The Nm Affordable Housing Credit Claim Form Help is a specific document designed to assist individuals and entities in claiming affordable housing credits. These credits are part of a federal initiative aimed at promoting the development and rehabilitation of affordable housing across the United States. This form ensures that applicants can accurately report their eligibility and the amount of credits they are claiming, which can significantly reduce their tax liability. Understanding the purpose and requirements of this form is essential for anyone looking to benefit from these credits.

How to use the Nm Affordable Housing Credit Claim Form Help

Using the Nm Affordable Housing Credit Claim Form Help involves several straightforward steps. First, gather all necessary documentation that supports your claim, including income statements and proof of residency. Next, access the form through a reliable source, ensuring it is the most current version. Fill out the form with accurate information, paying close attention to each section to avoid errors. Once completed, review the form for accuracy before submitting it to the appropriate tax authority. Utilizing electronic signature options can streamline the submission process, making it more efficient.

Steps to complete the Nm Affordable Housing Credit Claim Form Help

Completing the Nm Affordable Housing Credit Claim Form Help requires careful attention to detail. Follow these steps for successful completion:

- Gather all required documents, including financial records and identification.

- Download or access the form online, ensuring you have the latest version.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your income and any other relevant financial information.

- Clearly indicate the amount of affordable housing credits you are claiming.

- Review the form thoroughly for any mistakes or missing information.

- Sign the form electronically or manually, depending on your submission method.

- Submit the completed form to the designated tax authority by the specified deadline.

Legal use of the Nm Affordable Housing Credit Claim Form Help

The legal use of the Nm Affordable Housing Credit Claim Form Help is governed by federal and state tax regulations. This form must be completed accurately and submitted in accordance with IRS guidelines to ensure compliance. Misrepresentation or errors in the form can lead to penalties or denial of the claimed credits. It is crucial to understand the legal implications of the information provided on the form, as it forms the basis for your tax return and potential credit eligibility.

Eligibility Criteria

To qualify for the Nm Affordable Housing Credit Claim, applicants must meet specific eligibility criteria. Generally, this includes being a resident of the state where the credits are being claimed, having a qualifying income level, and living in a property that meets the affordable housing standards set by the IRS. Additionally, applicants must ensure that the property has been certified as eligible for the affordable housing credit program. Understanding these criteria is vital for successful claims.

Filing Deadlines / Important Dates

Filing deadlines for the Nm Affordable Housing Credit Claim Form Help are critical to ensure timely submission and avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April fifteenth for most taxpayers. However, specific deadlines may vary based on individual circumstances or changes in tax law. It is advisable to stay informed about any updates to these deadlines to ensure compliance and maximize your benefits.

Quick guide on how to complete nm affordable housing credit claim form help 2013

Your assistance manual on how to prepare your Nm Affordable Housing Credit Claim Form Help

If you’re looking to learn how to create and submit your Nm Affordable Housing Credit Claim Form Help, here are a few brief guidelines to simplify tax submission.

To begin, you only need to register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, draft, and finalize your income tax documents effortlessly. With its editor, you can switch between text, checkboxes, and electronic signatures, allowing you to revisit and revise responses as necessary. Optimize your tax handling with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to finalize your Nm Affordable Housing Credit Claim Form Help in minutes:

- Sign up for your account and start working on PDFs within moments.

- Utilize our catalog to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to open your Nm Affordable Housing Credit Claim Form Help in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if applicable).

- Examine your document and rectify any inaccuracies.

- Save changes, print your version, submit it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper may lead to return errors and delays in refunds. It’s essential to check the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct nm affordable housing credit claim form help 2013

FAQs

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

Will the NEET 2018 give admission in paramedical courses and Ayush courses too? If yes, how do you fill out the form to claim a seat if scored well?

wait for notifications.

-

One of my friends lives far away from my school but he still wants to go to this school. He is using our address. How do we fill out the school form? We don't know what to exactly put on the form, we need massive help. We need to finish this today.

My district has a window of time that allows students to transfer to chosen schools. Almost all transfers are accepted.There is a specific procedure to do this correctly.If the student lives in a different district, they have to officially notify that district that they are planning on going to a neighboring district. Paperwork must be signed by both districts.Please contact all the districts involved. They can help you with the steps.Each year the student must reapply for the transfer. My district only denies transfers when attendance or behavior has been an issue.

-

How did you go to start your journey to the United States? What forms did you fill out? How long did it take? My best friend wants to come here and I will help him until he gets his green card.

I worked hard at school to get good grades, went to university, studied hard, graduated, got a series of better and better jobs, and finally transferred across as an international manager under an L1-A visa (executive management).After a year my lawyer submitted my green card paperwork, and a few months later I was approved.Your friends experience may differ - there are MANY ways of ending up with a green card - hard work, education, and business success is one of the easiest, but not the only way.You can be lucky (diversity lottery), rich (investment), talented (internationally recognised artists, athletes and scientists), or have family in the USA.ALL these options require you to either pay a lawyer, or actually learn the process yourself.Your friend should start by obtaining a visa which allows them to legally reside and work in the USA - that’s the first step in the process.Simply “wanting to come to the USA” isn’t enough - it’s a start. Now your friend needs to learn the process and apply themselves.U.S. Visas

Create this form in 5 minutes!

How to create an eSignature for the nm affordable housing credit claim form help 2013

How to create an electronic signature for your Nm Affordable Housing Credit Claim Form Help 2013 online

How to create an eSignature for your Nm Affordable Housing Credit Claim Form Help 2013 in Google Chrome

How to create an eSignature for putting it on the Nm Affordable Housing Credit Claim Form Help 2013 in Gmail

How to make an eSignature for the Nm Affordable Housing Credit Claim Form Help 2013 right from your smartphone

How to generate an electronic signature for the Nm Affordable Housing Credit Claim Form Help 2013 on iOS

How to create an electronic signature for the Nm Affordable Housing Credit Claim Form Help 2013 on Android OS

People also ask

-

What is the Nm Affordable Housing Credit Claim Form Help offered by airSlate SignNow?

The Nm Affordable Housing Credit Claim Form Help is a specialized service that assists users in completing the Affordable Housing Credit Claim Form efficiently. By utilizing airSlate SignNow, individuals can benefit from streamlined documentation processes and expert guidance tailored to their specific needs in navigating the credit claim.

-

How can airSlate SignNow help with the Nm Affordable Housing Credit Claim Form process?

airSlate SignNow provides an easy-to-use platform for preparing and signing the Nm Affordable Housing Credit Claim Form. Our solution simplifies document management, ensuring that all required fields are filled out correctly, thus reducing the chances of errors that could delay your claim.

-

Is there a cost associated with accessing Nm Affordable Housing Credit Claim Form Help?

Yes, there are costs associated with using airSlate SignNow for Nm Affordable Housing Credit Claim Form Help. However, our pricing is designed to be competitive and cost-effective, ensuring you receive excellent value for a service that saves you time and reduces complexities in document management.

-

What features does airSlate SignNow offer for users needing Nm Affordable Housing Credit Claim Form Help?

airSlate SignNow includes features such as document templates, electronic signatures, and collaboration tools to facilitate the completion of the Nm Affordable Housing Credit Claim Form. These features enhance user experience and ensure all necessary documentation is handled efficiently.

-

How does airSlate SignNow ensure the security of my Nm Affordable Housing Credit Claim Form?

Security is a top priority at airSlate SignNow. When working on Nm Affordable Housing Credit Claim Form Help, we use advanced encryption methods and secure cloud storage to protect your sensitive documents and personal information throughout the entire process.

-

Can I integrate airSlate SignNow with other software for Nm Affordable Housing Credit Claim Form Help?

Absolutely! airSlate SignNow offers seamless integrations with various software applications to enhance your workflow while handling the Nm Affordable Housing Credit Claim Form. This integration capability allows you to create a more streamlined approach to document management and signing.

-

What are the benefits of using airSlate SignNow for Nm Affordable Housing Credit Claim Form Help?

Using airSlate SignNow for Nm Affordable Housing Credit Claim Form Help provides signNow benefits such as streamlined workflows, reduced paperwork, and faster processing time. Our software is designed to simplify the user experience, making the claim process more efficient and stress-free.

Get more for Nm Affordable Housing Credit Claim Form Help

- Health history form ccusa

- Maryland asthma action plan 16953751 form

- Sample assistive technology evaluation report swaaac form

- Restitution payment form

- Renewal application for license for nursing home the tennessee health state tn form

- Form e24

- Georgia insurance commissioner form

- Field trip photo and directory approval form

Find out other Nm Affordable Housing Credit Claim Form Help

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile