SC1120S WH SC Department of Revenue 2016

What is the SC1120S for South Carolina?

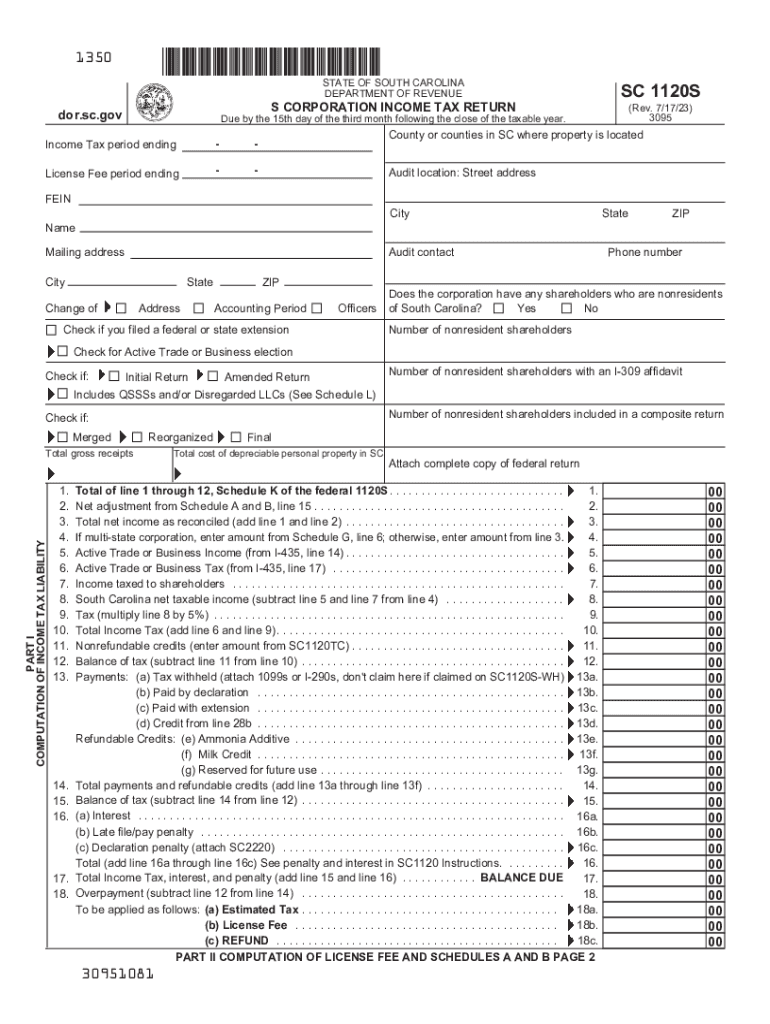

The SC1120S is a tax form specifically designed for S Corporations operating in South Carolina. This form is used to report income, gains, losses, deductions, and credits for the corporation. The South Carolina Department of Revenue requires S Corporations to file this form annually to ensure compliance with state tax regulations. Understanding the SC1120S is crucial for business owners to accurately report their financial activities and fulfill their tax obligations.

Steps to Complete the SC1120S

Completing the SC1120S involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the identification section, providing details about the corporation, such as name, address, and federal employer identification number (EIN).

- Report income and deductions accurately, ensuring all figures are supported by documentation.

- Calculate the South Carolina tax due, if applicable, based on the corporation's taxable income.

- Review the completed form for accuracy before submission.

Filing Deadlines for the SC1120S

The filing deadline for the SC1120S typically aligns with the federal tax return due date for S Corporations. Generally, this is the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, the deadline is March 15. It is essential for business owners to be aware of these deadlines to avoid penalties and interest on late submissions.

Required Documents for the SC1120S

When filing the SC1120S, corporations must prepare and submit several supporting documents:

- Federal Form 1120S, which serves as the basis for the state form.

- Financial statements, including profit and loss statements and balance sheets.

- Any relevant schedules that detail deductions and credits claimed.

- Documentation supporting income and expenses reported on the form.

Penalties for Non-Compliance with the SC1120S

Failure to file the SC1120S on time or inaccuracies in the submitted information can lead to significant penalties. South Carolina imposes fines for late filings, which can accumulate daily. Additionally, incorrect information may result in further scrutiny from the SC Department of Revenue, leading to potential audits and additional tax liabilities. It is crucial for S Corporations to ensure timely and accurate submissions to avoid these consequences.

Form Submission Methods for the SC1120S

The SC1120S can be submitted through various methods to accommodate different preferences:

- Online filing through the South Carolina Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate address provided by the SC Department of Revenue.

- In-person submission at designated state revenue offices, if preferred.

Quick guide on how to complete sc1120s wh sc department of revenue

Complete SC1120S WH SC Department Of Revenue seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct version and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents swiftly without delays. Manage SC1120S WH SC Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and electronically sign SC1120S WH SC Department Of Revenue effortlessly

- Obtain SC1120S WH SC Department Of Revenue and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, through email, text (SMS), an invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searching, or mistakes that necessitate creating new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign SC1120S WH SC Department Of Revenue and guarantee effective communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc1120s wh sc department of revenue

Create this form in 5 minutes!

How to create an eSignature for the sc1120s wh sc department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's pricing structure for users in tax carolina state?

airSlate SignNow offers a variety of pricing plans that cater to different business needs in tax carolina state. Your choice will depend on factors like the number of users and specific features required. Generally, the plans are competitively priced, ensuring a cost-effective solution for document signing needs.

-

What features does airSlate SignNow offer that benefit businesses in tax carolina state?

airSlate SignNow provides an array of features tailored for efficiency, such as document templates, tracking, and advanced security measures. These features are particularly beneficial for organizations in tax carolina state that require streamlined workflows for eSigning. Utilizing these features can signNowly enhance productivity and compliance.

-

Is airSlate SignNow compliant with laws in tax carolina state?

Yes, airSlate SignNow is designed to comply with local laws and regulations in tax carolina state. The platform adheres to electronic signature standards, ensuring that your eSigned documents are legally binding and secure. This compliance provides peace of mind for businesses operating in the state.

-

Can I integrate airSlate SignNow with other tools I use in tax carolina state?

Absolutely! airSlate SignNow supports integrations with popular applications and platforms widely used in tax carolina state. This includes tools for project management, customer relationship management, and cloud storage, allowing you to streamline your document processes seamlessly.

-

How does airSlate SignNow enhance document security for users in tax carolina state?

airSlate SignNow employs robust security measures to protect sensitive information for users in tax carolina state. This includes encryption, multi-factor authentication, and audit trails for tracking document access. These features ensure that your eSigned documents are secure and compliant with best practices.

-

What are the benefits of using airSlate SignNow for sending tax-related documents in carolina state?

Using airSlate SignNow for tax-related documents in carolina state allows for fast, secure, and legally compliant eSigning. Businesses can reduce turnaround times signNowly, improving efficiency during tax season. Additionally, the ability to manage documents digitally cuts down on paperwork and associated costs.

-

Is there a free trial available for airSlate SignNow for potential users in tax carolina state?

Yes, airSlate SignNow offers a free trial for users in tax carolina state to explore its features. This allows prospective customers to evaluate how the platform can meet their needs without any initial investment. It’s a great way to experience the benefits firsthand before committing to a plan.

Get more for SC1120S WH SC Department Of Revenue

- Enclosed please find the original and three copies of the complaint to reform deed of trust

- Virginia amended and restated security instrument doc form

- Assignment of leases rents income form

- In an effort to compromise this matter without the expense of litigation my clients are form

- Motion to transfer form

- I am in receipt of your d a t e correspondence regarding the above entitled cause of form

- This letter is in relation to a seizure action on the piece of property described in the enclosed form

- City d a t e form

Find out other SC1120S WH SC Department Of Revenue

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement