Schedule K 1 Form 1041 2020

What is the Schedule K-1 Form 1041

The Schedule K-1 Form 1041 is a tax document used to report income, deductions, and credits from estates and trusts. This form is issued to beneficiaries of an estate or trust, detailing their share of the income generated by the entity. Each beneficiary receives a separate Schedule K-1, which they must include when filing their personal income tax returns. Understanding this form is crucial for beneficiaries to accurately report their income and comply with tax regulations.

How to use the Schedule K-1 Form 1041

Using the Schedule K-1 Form 1041 involves several steps. Beneficiaries should first carefully review the information on the form, which includes details about the income received, deductions, and credits allocated to them. This information must be transferred to the appropriate sections of the beneficiary's individual tax return, typically on Form 1040. It is important to ensure that all figures are accurate to avoid discrepancies with the IRS.

Steps to complete the Schedule K-1 Form 1041

Completing the Schedule K-1 Form 1041 requires attention to detail. Here are the steps involved:

- Gather all necessary financial documents related to the estate or trust.

- Fill out the top section with the trust or estate's information, including name, address, and tax identification number.

- Report the income received by the beneficiary, including dividends, interest, and capital gains.

- Include any deductions or credits that apply to the beneficiary.

- Ensure all information is accurate and complete before submitting.

Legal use of the Schedule K-1 Form 1041

The Schedule K-1 Form 1041 has specific legal implications for both the estate or trust and the beneficiaries. It serves as an official record of income distribution and is required for tax compliance. Beneficiaries must use this form to report their share of the income on their tax returns. Failure to report the income as indicated on the K-1 can lead to penalties and interest from the IRS.

Who Issues the Form

The Schedule K-1 Form 1041 is issued by the fiduciary of the estate or trust, which can be an individual or an entity responsible for managing the estate's assets and affairs. The fiduciary must prepare the form and distribute it to all beneficiaries by the IRS deadline, ensuring that each beneficiary receives their copy in time to file their tax returns accurately.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1 Form 1041 align with the tax return deadlines for estates and trusts. Generally, the fiduciary must file Form 1041, along with the K-1s, by the fifteenth day of the fourth month following the end of the estate's or trust's tax year. For estates and trusts operating on a calendar year, this typically means April 15. Beneficiaries should be aware of these dates to ensure timely filing of their personal tax returns.

Quick guide on how to complete schedule k 1 form 1041

Effortlessly prepare Schedule K 1 Form 1041 on any device

Digital document management has gained immense popularity among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Schedule K 1 Form 1041 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to edit and eSign Schedule K 1 Form 1041 with ease

- Obtain Schedule K 1 Form 1041 and then click Get Form to get started.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Leave behind the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Schedule K 1 Form 1041 and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form 1041

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form 1041

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

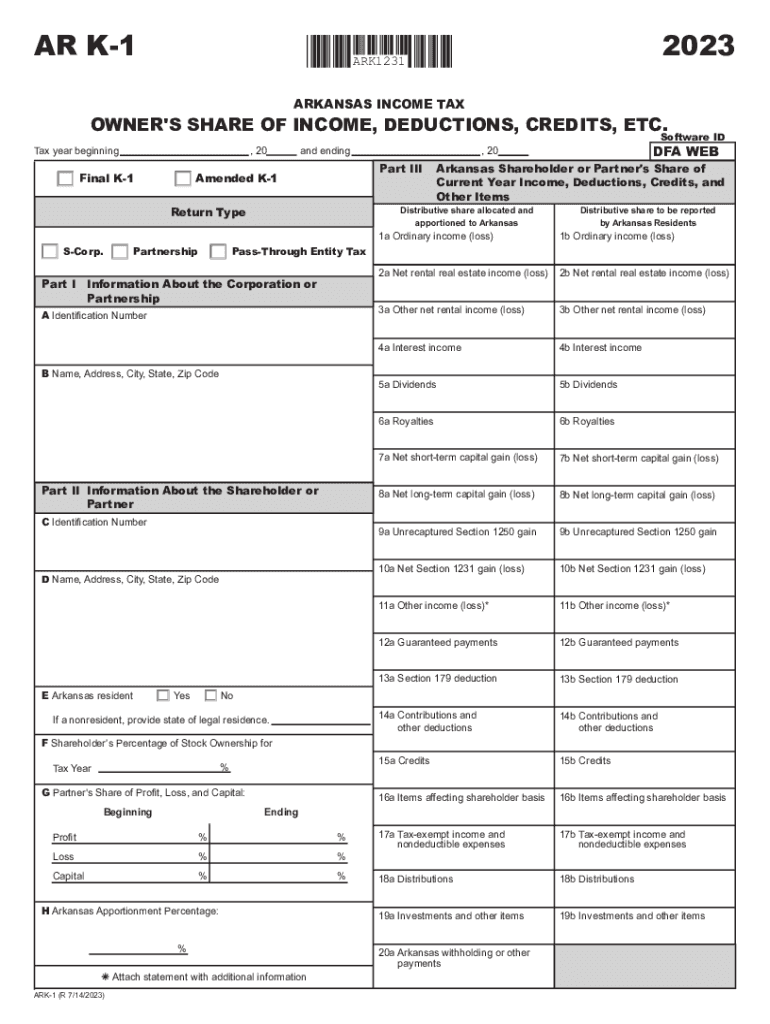

What is the AR K income form, and how can airSlate SignNow help?

The AR K income form is a crucial document for reporting income in Arkansas. With airSlate SignNow, you can easily prepare, send, and eSign your AR K income form, ensuring that your tax documentation is compliant and professionally managed.

-

How does airSlate SignNow ensure the security of my AR K income form?

AirSlate SignNow offers robust security features such as encryption and secure data storage to protect sensitive information, including your AR K income form. You can trust that your documents are safe and confidential while using our platform.

-

Can I integrate airSlate SignNow with other accounting software for my AR K income form?

Yes, airSlate SignNow seamlessly integrates with various accounting software, allowing you to streamline the process of creating and managing your AR K income form. This integration saves time and enhances accuracy, making tax season less stressful.

-

What are the pricing options for using airSlate SignNow to manage my AR K income form?

AirSlate SignNow offers flexible pricing plans based on your business needs. Whether you're a small business or a large enterprise, you can find a plan that suits your requirements for efficiently managing AR K income forms and other documents.

-

Is it easy to eSign my AR K income form with airSlate SignNow?

Absolutely! airSlate SignNow features a user-friendly interface that simplifies the eSigning process for your AR K income form. You can sign documents from anywhere, on any device, making it convenient for busy professionals.

-

What are the main features of airSlate SignNow for handling AR K income forms?

AirSlate SignNow includes essential features such as document templates, eSignature capabilities, and automated reminders, all designed to simplify the management of your AR K income form. These tools help enhance efficiency and reduce errors in your documentation process.

-

How does airSlate SignNow improve the workflow for AR K income forms?

By using airSlate SignNow, you can automate various steps in the workflow for your AR K income form, from creation to final signatures. This helps to streamline the process, reducing turnaround time and ensuring all parties stay informed throughout the document lifecycle.

Get more for Schedule K 1 Form 1041

Find out other Schedule K 1 Form 1041

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast