Ar Dfa K 2020

What is the Ar Dfa K

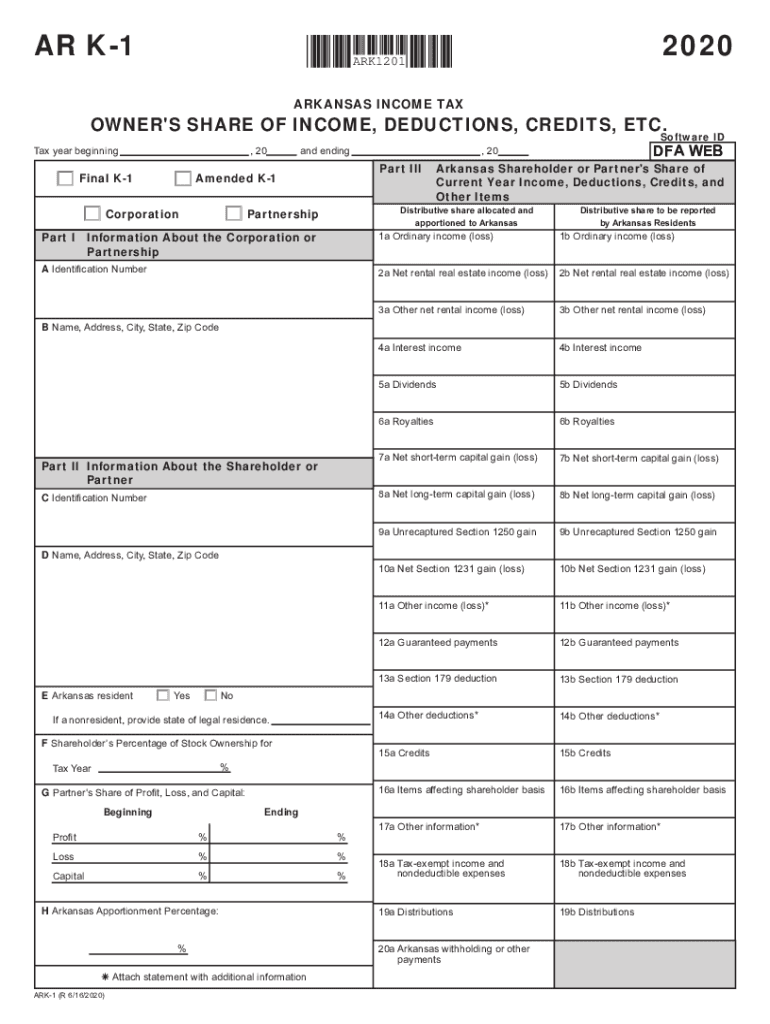

The Ar Dfa K is a tax form used in Arkansas for reporting income and deductions for various entities, including individuals and businesses. This form is essential for ensuring compliance with state tax regulations and accurately reporting financial information. It typically includes details about income, credits, and deductions applicable to the taxpayer's situation, making it a crucial document for both personal and business tax filings.

How to use the Ar Dfa K

Using the Ar Dfa K involves gathering the necessary financial information and filling out the form accurately. Taxpayers should start by collecting documentation related to income sources, deductions, and credits. Once all relevant information is compiled, the form can be completed, ensuring all sections are filled out correctly. After completion, the form must be submitted to the appropriate state tax authority, either electronically or via mail.

Steps to complete the Ar Dfa K

Completing the Ar Dfa K involves several key steps:

- Gather all necessary financial documents, including income statements and records of deductions.

- Fill out the form, ensuring that all fields are completed accurately.

- Double-check the information for any errors or omissions.

- Submit the completed form to the Arkansas Department of Finance and Administration by the deadline.

Legal use of the Ar Dfa K

The Ar Dfa K must be used in accordance with Arkansas state tax laws. This means that the information provided on the form must be truthful and accurate, as any discrepancies can lead to penalties or legal issues. Additionally, the form must be submitted by the designated deadlines to avoid late fees or additional penalties. Understanding the legal implications of the form ensures compliance and protects taxpayers from potential legal repercussions.

Required Documents

To complete the Ar Dfa K, taxpayers need to have several documents ready:

- Income statements, such as W-2s or 1099 forms.

- Documentation for any deductions or credits claimed.

- Previous year’s tax returns for reference.

Form Submission Methods

The Ar Dfa K can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Arkansas Department of Finance and Administration's website.

- Mailing a paper version of the completed form to the designated address.

- In-person submission at local tax offices, if preferred.

Quick guide on how to complete ar dfa k

Effortlessly Prepare Ar Dfa K on Any Device

Managing documents online has become increasingly popular among both companies and individuals. It offers a fantastic eco-friendly alternative to conventional printed and signed papers, as you can access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Ar Dfa K on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centric operation today.

How to Edit and eSign Ar Dfa K with Ease

- Find Ar Dfa K and click on Get Form to begin.

- Use the tools provided to fill out your form.

- Select important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all details carefully and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, frustrating document searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Ar Dfa K and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ar dfa k

Create this form in 5 minutes!

How to create an eSignature for the ar dfa k

The best way to make an e-signature for your PDF file online

The best way to make an e-signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is a DFA Revenue Services Division warrant check?

A DFA Revenue Services Division warrant check is a process to verify any outstanding warrants issued against an individual or business by the Division of Revenue Services. This check is essential for ensuring compliance with tax obligations and understanding potential legal repercussions. By conducting a DFA revenue services division warrant check, you can gain insights into any financial liabilities.

-

How can airSlate SignNow help with a DFA Revenue Services Division warrant check?

airSlate SignNow enables businesses to streamline the document signing process, which includes forms related to conducting a DFA revenue services division warrant check. Our platform allows for secure electronic signatures and document management, facilitating quicker submissions and processing with the Division of Revenue Services. This saves time and enhances efficiency in handling warrant checks.

-

What are the pricing plans for using airSlate SignNow when performing a DFA Revenue Services Division warrant check?

airSlate SignNow offers various pricing plans tailored to fit different business needs, including those needing to perform a DFA revenue services division warrant check. Our plans include features for document management, storage, and eSigning capabilities. We ensure that our pricing is competitive and provides signNow value for businesses looking to maintain compliance.

-

What features does airSlate SignNow provide for managing warrant checks?

airSlate SignNow provides essential features like secure eSigning, customizable templates, and cloud storage, making it easier to manage documents related to a DFA revenue services division warrant check. Our user-friendly interface allows users to track document status and receive notifications, ensuring that all necessary documents are submitted accurately and promptly. These features enhance compliance and efficiency.

-

Is airSlate SignNow suitable for small businesses needing to perform a DFA Revenue Services Division warrant check?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises that need to perform a DFA revenue services division warrant check. Our platform is cost-effective and easy to use, allowing small businesses to streamline their document workflows without needing extensive resources. Utilizing SignNow can help small businesses stay compliant with state requirements.

-

Are there any integrations available with airSlate SignNow for conducting DFA Revenue Services Division warrant checks?

airSlate SignNow supports various integrations with popular business applications, enhancing the workflow for conducting a DFA revenue services division warrant check. You can integrate with CRM systems, document management tools, and cloud storage services, allowing seamless access to your documents and ensuring a smoother process overall. This connectivity is essential for effective document management.

-

What are the benefits of using airSlate SignNow for warrant check processes?

Using airSlate SignNow for warrant check processes offers numerous benefits, including improved efficiency and accuracy in managing documents needed for a DFA revenue services division warrant check. The platform ensures secure, legally binding electronic signatures, reducing the time it takes to complete necessary paperwork. Additionally, our cloud-based service allows for easy access and collaboration.

Get more for Ar Dfa K

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles district of columbia form

- Letter from tenant to landlord about landlords failure to make repairs district of columbia form

- Landlord notice required form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession district of columbia form

- Letter from tenant to landlord about illegal entry by landlord district of columbia form

- Letter from landlord to tenant about time of intent to enter premises district of columbia form

- Letter notice rent form

- Letter from tenant to landlord about sexual harassment district of columbia form

Find out other Ar Dfa K

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors