Arkansas K 1 2019

What is the Arkansas K-1?

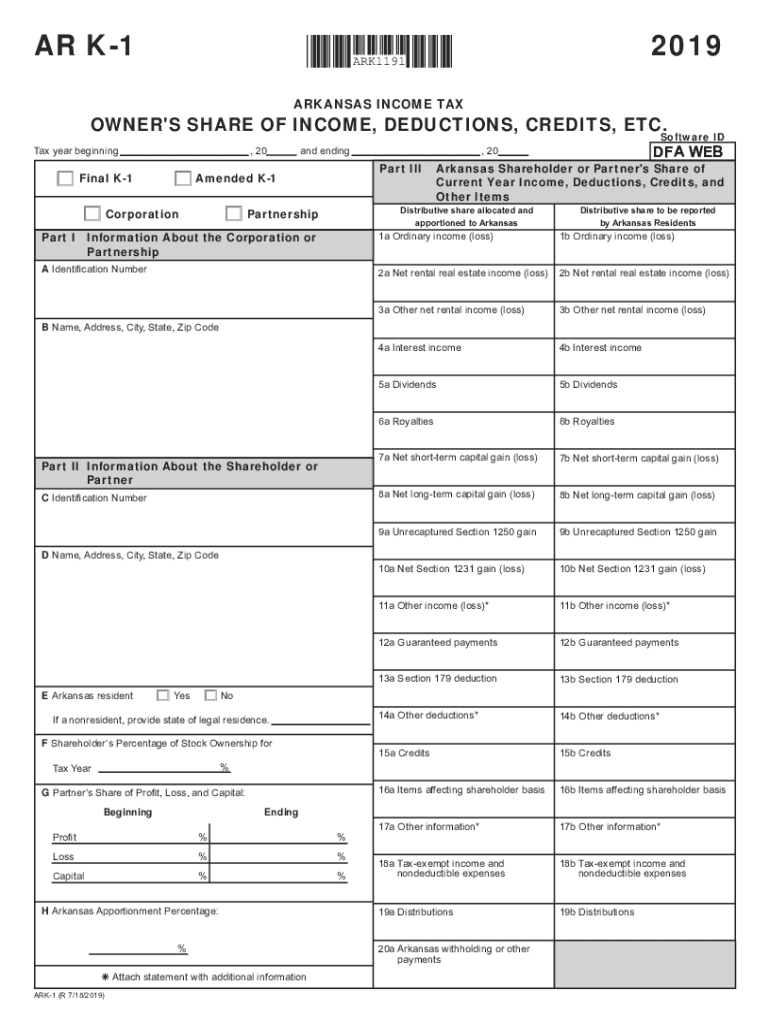

The Arkansas K-1 form is a tax document used to report income, deductions, and credits from partnerships, S corporations, and certain estates and trusts. It provides detailed information about each partner or shareholder's share of the entity's income, which is essential for individual tax filing. The form includes sections for identifying information, income distributions, and any applicable adjustments. Understanding the Arkansas K-1 is crucial for accurate tax reporting and compliance with state tax laws.

How to use the Arkansas K-1

To use the Arkansas K-1 effectively, individuals must first receive the form from the partnership or S corporation in which they hold an interest. Once in possession of the form, taxpayers should carefully review the information provided, ensuring all income and deductions are accurately reported. The details from the Arkansas K-1 must be transferred to the individual's Arkansas state tax return, specifically on the appropriate lines designated for K-1 income. Accurate completion ensures compliance and helps avoid potential penalties.

Steps to complete the Arkansas K-1

Completing the Arkansas K-1 involves several key steps. First, gather all necessary personal and financial information, including your Social Security number and details of the partnership or S corporation. Next, fill out the form by entering your share of income, deductions, and credits as reported by the entity. Make sure to review all entries for accuracy. Once completed, retain a copy for your records and submit the form along with your Arkansas state tax return by the designated deadline.

Legal use of the Arkansas K-1

The legal use of the Arkansas K-1 is governed by state tax regulations. This form is considered valid for reporting income and deductions as long as it is completed accurately and submitted on time. Taxpayers must ensure that the information aligns with their tax obligations and that they comply with all relevant laws. Using a reliable electronic signature tool can enhance the security and legality of submitting the Arkansas K-1 electronically, ensuring adherence to eSignature laws.

Key elements of the Arkansas K-1

Key elements of the Arkansas K-1 include the entity's name, the taxpayer's name and identification number, and the specific amounts of income, deductions, and credits allocated to the taxpayer. The form also includes sections for reporting any adjustments and the type of entity issuing the K-1. Understanding these elements is critical for correctly interpreting the information and ensuring accurate reporting on individual tax returns.

Filing Deadlines / Important Dates

Filing deadlines for the Arkansas K-1 typically align with the overall tax filing deadlines for individuals. Generally, individuals must file their state tax returns by April 15 of the following year. However, if the partnership or S corporation has a different fiscal year, the deadlines may vary. It is essential to stay informed about any changes in tax law that may affect these deadlines to ensure timely compliance.

Who Issues the Form

The Arkansas K-1 is issued by partnerships, S corporations, and certain estates or trusts that are required to report income to their partners or shareholders. Each entity is responsible for providing accurate K-1 forms to its stakeholders, detailing their respective shares of income, deductions, and credits. Taxpayers should ensure they receive this form in a timely manner to facilitate accurate tax reporting.

Quick guide on how to complete arkansas k 1

Effortlessly Prepare Arkansas K 1 on Any Device

The management of online documents has become increasingly favored by companies and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delay. Manage Arkansas K 1 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric процесс today.

The easiest method to modify and electronically sign Arkansas K 1 with ease

- Obtain Arkansas K 1 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you would like to submit your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors necessitating new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you prefer. Modify and electronically sign Arkansas K 1 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arkansas k 1

Create this form in 5 minutes!

How to create an eSignature for the arkansas k 1

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is the Arkansas K Form and why is it important?

The Arkansas K Form is a crucial document for businesses operating in Arkansas, as it helps in reporting income and other tax-related information. Properly completing the Arkansas K Form ensures compliance with state tax regulations and can prevent costly penalties.

-

How can airSlate SignNow help me with the Arkansas K Form?

airSlate SignNow simplifies the process of filling and eSigning the Arkansas K Form by providing a user-friendly platform for document management. With our solution, you can easily create, edit, and securely send the Arkansas K Form to your stakeholders, streamlining your workflow.

-

What features does airSlate SignNow offer for the Arkansas K Form?

Our platform includes features like customizable templates, easy signature capture, and automated reminders for the Arkansas K Form. These tools enhance efficiency and ensure that you never miss deadlines for submission.

-

Is there a cost associated with using airSlate SignNow for the Arkansas K Form?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs when managing the Arkansas K Form. We provide affordable options designed to fit within your budget while delivering essential functionalities.

-

Can I integrate airSlate SignNow with other software for the Arkansas K Form?

Absolutely! airSlate SignNow offers seamless integrations with several popular software solutions, allowing you to efficiently handle the Arkansas K Form alongside your existing tools. This ensures that your document processes are interconnected and streamlined.

-

What are the benefits of using airSlate SignNow for the Arkansas K Form?

Using airSlate SignNow for the Arkansas K Form brings several benefits, including enhanced security for sensitive information, quick turnaround times for document processing, and improved collaboration among team members. These advantages can signNowly aid your business in meeting compliance requirements.

-

How do I get started with airSlate SignNow for the Arkansas K Form?

Getting started with airSlate SignNow is easy! Simply sign up for an account, explore our templates, and begin customizing your Arkansas K Form. Our intuitive platform makes it simple to understand and utilize all features from day one.

Get more for Arkansas K 1

Find out other Arkansas K 1

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer