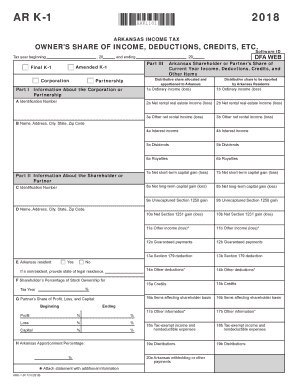

Ar K 1 2018

What is the Arkansas K-1?

The Arkansas K-1 form is a tax document used to report income, deductions, and credits from partnerships, S corporations, and certain trusts. It provides detailed information about each partner's or shareholder's share of the entity's income, which is essential for individual tax filings. This form is particularly important for taxpayers who are involved in pass-through entities, as it ensures that income is accurately reported to the state and federal tax authorities.

How to use the Arkansas K-1

To use the Arkansas K-1 effectively, individuals must first receive the form from the partnership or S corporation in which they are involved. Once received, taxpayers should review the information for accuracy, including their allocated share of income, deductions, and credits. This information must then be reported on the individual's Arkansas state tax return. It is crucial to ensure that the amounts reported on the K-1 align with the taxpayer's overall financial records for accurate reporting.

Steps to complete the Arkansas K-1

Completing the Arkansas K-1 involves several steps:

- Obtain the form from the partnership or S corporation.

- Review the income, deductions, and credits listed on the form.

- Ensure all information is accurate and corresponds with your financial records.

- Transfer the relevant information to your Arkansas state tax return.

- Keep a copy of the K-1 for your records and for future reference.

Legal use of the Arkansas K-1

The Arkansas K-1 is legally recognized as a valid document for reporting income from pass-through entities. To ensure its legal standing, it must be completed accurately and submitted in accordance with state tax regulations. Compliance with IRS guidelines is also necessary, as the K-1 information must match the federal tax return submissions. Failure to comply with these requirements may result in penalties or issues with tax filings.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines related to the Arkansas K-1. Typically, the form must be issued to partners and shareholders by March fifteenth of the tax year. Individual taxpayers must then report the K-1 information on their state tax returns by April fifteenth. Staying informed about these deadlines is crucial to avoid late filing penalties and ensure compliance with state tax laws.

Who Issues the Form

The Arkansas K-1 is issued by partnerships, S corporations, and certain trusts to their partners or shareholders. It is the responsibility of the entity to accurately prepare and distribute the K-1 forms to all involved parties. Entities must ensure that the information reported is correct and submitted on time to facilitate smooth tax reporting for their partners or shareholders.

Quick guide on how to complete ar k 1

Effortlessly manage Ar K 1 on any gadget

Digital document administration has gained traction among businesses and individuals. It offers an excellent environmentally-friendly substitute for traditional printed and signed documents, as you can access the right template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Ar K 1 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to edit and electronically sign Ar K 1 easily

- Locate Ar K 1 and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize signNow sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or a shareable link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunts, or mistakes that necessitate printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Ar K 1 and ensure exceptional communication throughout the document preparation phase with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ar k 1

Create this form in 5 minutes!

How to create an eSignature for the ar k 1

How to generate an electronic signature for your PDF document in the online mode

How to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is Arkansas K 1 and how does it relate to airSlate SignNow?

Arkansas K 1 refers to the tax form used for partnerships and S corporations in Arkansas. With airSlate SignNow, businesses can easily eSign and send Arkansas K 1 forms securely, streamlining the document management process while ensuring compliance with state requirements.

-

How can airSlate SignNow help with eSigning Arkansas K 1 forms?

AirSlate SignNow provides a user-friendly platform for eSigning Arkansas K 1 forms, allowing you to digitally sign documents quickly and easily. This eliminates the hassle of printing, scanning, and mailing physical copies, making the process more efficient for individuals and businesses alike.

-

What are the pricing options for using airSlate SignNow for Arkansas K 1 documents?

AirSlate SignNow offers several pricing plans tailored to different needs, including options for businesses frequently handling Arkansas K 1 forms. These pricing packages are designed to be cost-effective while providing all the necessary features to manage your document workflows efficiently.

-

What features of airSlate SignNow are beneficial for managing Arkansas K 1 forms?

AirSlate SignNow includes features like customizable templates, secure cloud storage, and automated reminders, which are particularly useful for managing Arkansas K 1 forms. These functionalities ensure that you can prepare, sign, and store your tax documents with ease and security.

-

Can airSlate SignNow integrate with other software for handling Arkansas K 1?

Yes, airSlate SignNow integrates seamlessly with various accounting and business software to facilitate the management of Arkansas K 1 forms. These integrations streamline your workflow by allowing you to access documents and data from one centralized platform.

-

Is airSlate SignNow compliant with Arkansas state regulations for K 1 documents?

Absolutely! AirSlate SignNow is designed to comply with Arkansas state regulations concerning K 1 documents. Our eSigning process adheres to legal standards, ensuring that your electronically signed Arkansas K 1 forms are valid and legally recognized.

-

What are the advantages of using airSlate SignNow for Arkansas K 1 eSignatures?

Using airSlate SignNow for Arkansas K 1 eSignatures offers numerous advantages, including time savings and reduced paperwork. The platform provides an easy-to-navigate interface that enhances collaboration and speeds up the entire signing process, making it ideal for busy professionals.

Get more for Ar K 1

Find out other Ar K 1

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will