Md Code Regs 03 04 07 04 Statements to Members 2023

What is the Maryland Form 510D?

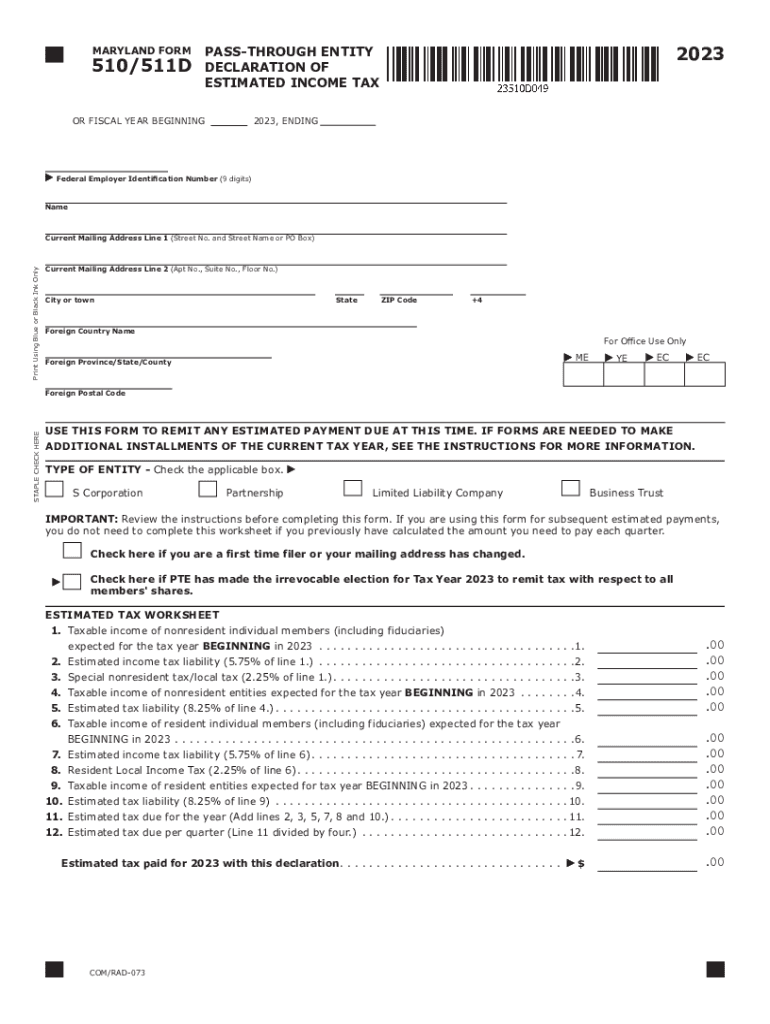

The Maryland Form 510D, also known as the Pass-Through Entity Estimated Tax Payment Voucher, is a crucial document for businesses operating as pass-through entities in Maryland. This form is used to report and pay estimated taxes on behalf of the entity's members or partners. It is specifically designed for entities such as partnerships, S corporations, and limited liability companies that pass income directly to their owners for tax purposes. By submitting this form, the entity ensures that its members comply with Maryland state tax requirements.

Filing Deadlines for Maryland Form 510D

It is essential to be aware of the filing deadlines associated with the Maryland Form 510D to avoid penalties. Typically, the estimated tax payments are due on the 15th day of the fourth, sixth, ninth, and twelfth months of the tax year. For example, if the tax year aligns with the calendar year, the due dates would be April 15, June 15, September 15, and December 15. Timely submission of the Form 510D ensures that the entity remains in good standing with the Maryland Comptroller's office.

Steps to Complete the Maryland Form 510D

Completing the Maryland Form 510D involves several key steps:

- Gather Required Information: Collect details about the entity, including its name, address, and federal employer identification number (EIN).

- Calculate Estimated Tax: Determine the estimated tax liability based on the entity's projected income for the year.

- Complete the Form: Fill out the Form 510D with the gathered information and calculated tax amount.

- Submit the Form: Choose a submission method—online, by mail, or in-person—based on your preference.

Legal Use of the Maryland Form 510D

The Maryland Form 510D serves a legal purpose by ensuring that pass-through entities comply with state tax laws. By submitting this form, entities fulfill their obligation to report estimated taxes on behalf of their members or partners. Failure to file or pay estimated taxes can result in penalties and interest charges, making it crucial for entities to adhere to the legal requirements associated with the Form 510D.

Required Documents for Maryland Form 510D

When preparing to file the Maryland Form 510D, certain documents are necessary to ensure accurate completion:

- Previous Year’s Tax Returns: Review prior tax returns to estimate the current year’s tax liability.

- Income Projections: Prepare projections of income for the current tax year to calculate estimated taxes accurately.

- Entity Information: Have the entity’s legal name, address, and EIN readily available.

Form Submission Methods for Maryland Form 510D

There are multiple ways to submit the Maryland Form 510D:

- Online Submission: Entities can file electronically through the Maryland Comptroller's website, which may offer a more streamlined process.

- Mail Submission: The completed form can be printed and mailed to the appropriate address provided by the Maryland Comptroller.

- In-Person Submission: Entities may also choose to deliver the form in person at a local Comptroller's office for immediate processing.

Quick guide on how to complete md code regs 03 04 07 04 statements to members

Complete Md Code Regs 03 04 07 04 Statements To Members effortlessly on any device

Managing documents online has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without delay. Handle Md Code Regs 03 04 07 04 Statements To Members on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Md Code Regs 03 04 07 04 Statements To Members with ease

- Locate Md Code Regs 03 04 07 04 Statements To Members and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information carefully and click on the Done button to save your changes.

- Select your preferred method for sharing your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns of lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Md Code Regs 03 04 07 04 Statements To Members to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct md code regs 03 04 07 04 statements to members

Create this form in 5 minutes!

How to create an eSignature for the md code regs 03 04 07 04 statements to members

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland Form 510D?

The Maryland Form 510D is a tax return form used by businesses to report income tax withholding for non-residents. Understanding this form is critical for compliance with Maryland tax laws, and airSlate SignNow can streamline the eSigning process for this documentation.

-

How can airSlate SignNow help with Maryland Form 510D?

airSlate SignNow simplifies the process of preparing and signing the Maryland Form 510D by allowing users to fill out the form electronically and send it for eSignature. This ensures that the form is completed efficiently and securely, reducing the chances of errors or delays.

-

Is there a fee for using airSlate SignNow to complete the Maryland Form 510D?

Yes, airSlate SignNow offers various pricing plans based on the features you need for handling documents, including the Maryland Form 510D. However, the cost is competitive and can save you time and effort, making it a cost-effective solution for businesses.

-

Are there any integrations available for ease of use with Maryland Form 510D?

airSlate SignNow integrates seamlessly with various applications, allowing users to access and manage the Maryland Form 510D within their existing workflows. This means you can connect it with your accounting software or document management systems for better efficiency.

-

What are the benefits of using airSlate SignNow for the Maryland Form 510D?

Using airSlate SignNow for the Maryland Form 510D saves time and simplifies the signing process. The platform provides users with secure eSigning capabilities, reducing the need for physical paperwork while enhancing compliance and tracking.

-

Can I use airSlate SignNow on mobile devices for the Maryland Form 510D?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to fill out and sign the Maryland Form 510D directly from your smartphone or tablet. This flexibility ensures you can manage your documents on-the-go without any hassle.

-

How secure is my information when using airSlate SignNow for Maryland Form 510D?

Security is a top priority for airSlate SignNow. When working with the Maryland Form 510D, your information is protected with advanced encryption and security protocols, ensuring that your documents remain confidential and secure throughout the signing process.

Get more for Md Code Regs 03 04 07 04 Statements To Members

- Agency information collection activity under omb review

- Va form 10 10hs request for hardship determination

- To the regional loan center form

- 2021 form 763s virginia special nonresident claim for individual income tax withheld

- Wwwtaxformfinderorgvirginiaform 760pyvirginia form 760py part year resident individual income tax

- Wwwtaxvirginiagov sites default2020 form 760py instructions virginia tax

- 2021 schedule 500fed corporation schedule of federal line items virginia schedule 500fed 2021 corporation schedule of federal form

- Wwwvagovvaformsmedicalinstructions for completing health benefits update form

Find out other Md Code Regs 03 04 07 04 Statements To Members

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors