Fillable Online 510D PASS through ENTITY FORM MARYLAND 2022

What is the Fillable Online 510D Pass Through Entity Form Maryland

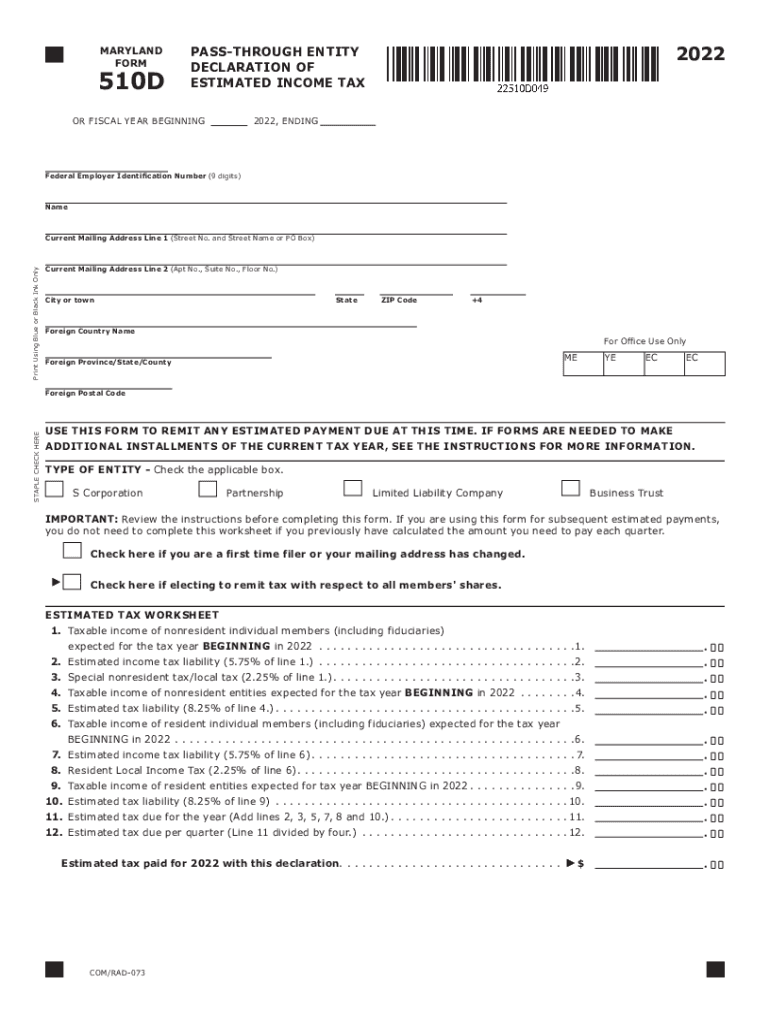

The Maryland Form 510D is a tax form specifically designed for pass-through entities in the state of Maryland. This form is used to report income, deductions, and other relevant tax information for entities such as partnerships, S corporations, and limited liability companies (LLCs) that do not pay income tax at the entity level. Instead, the income is passed through to the individual members or shareholders, who then report it on their personal tax returns. The form ensures that the state can accurately assess the tax obligations of these entities and their owners.

Steps to Complete the Fillable Online 510D Pass Through Entity Form Maryland

Completing the Maryland Form 510D online involves several straightforward steps:

- Access the fillable online form through the official Maryland tax website.

- Enter the entity's name, address, and federal employer identification number (FEIN).

- Report the total income of the entity, including all sources of revenue.

- Input any allowable deductions, such as business expenses and losses.

- Calculate the net income by subtracting total deductions from total income.

- Complete any additional sections required for specific tax credits or adjustments.

- Review the form for accuracy, then electronically sign and submit it.

Legal Use of the Fillable Online 510D Pass Through Entity Form Maryland

The Maryland Form 510D holds legal significance as it serves as an official document for reporting tax information to the state. When completed correctly, it fulfills the legal requirement for pass-through entities to disclose their income and deductions. The form must be signed by an authorized representative of the entity, ensuring that the information provided is accurate and complete. Compliance with the submission of this form is crucial, as it helps avoid penalties and ensures that the entity meets its tax obligations under Maryland law.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Form 510D are crucial for compliance. Generally, the form must be submitted by the 15th day of the fourth month following the end of the entity's tax year. For entities operating on a calendar year, this means the deadline is typically April 15. It is important to keep track of any changes to these dates, as extensions may be available under specific circumstances, but they must be requested in advance.

Required Documents

To complete the Maryland Form 510D, several documents may be required:

- Federal tax return for the entity, including supporting schedules.

- Records of income received from all sources.

- Documentation of allowable deductions, such as receipts and invoices.

- Any prior year tax returns, if applicable.

Having these documents ready will streamline the process of completing the form and ensure accurate reporting.

Form Submission Methods (Online / Mail / In-Person)

The Maryland Form 510D can be submitted through various methods to accommodate different preferences:

- Online: The form can be filled out and submitted electronically through the Maryland tax website, providing a quick and efficient option.

- Mail: Completed forms can be printed and mailed to the appropriate state tax office. Ensure that the form is postmarked by the filing deadline.

- In-Person: Entities may also choose to deliver the form directly to a local tax office, allowing for immediate confirmation of receipt.

Quick guide on how to complete fillable online 510d pass through entity form maryland

Easily Prepare Fillable Online 510D PASS THROUGH ENTITY FORM MARYLAND on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents promptly without any delays. Handle Fillable Online 510D PASS THROUGH ENTITY FORM MARYLAND on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Fillable Online 510D PASS THROUGH ENTITY FORM MARYLAND Effortlessly

- Obtain Fillable Online 510D PASS THROUGH ENTITY FORM MARYLAND and then click Get Form to initiate.

- Make use of the tools provided to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with features that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes only moments and carries the same legal validity as a conventional wet ink signature.

- Review all information and then click on the Done button to save your alterations.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Fillable Online 510D PASS THROUGH ENTITY FORM MARYLAND and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online 510d pass through entity form maryland

Create this form in 5 minutes!

How to create an eSignature for the fillable online 510d pass through entity form maryland

The best way to create an e-signature for your PDF online

The best way to create an e-signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to make an e-signature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The best way to make an e-signature for a PDF on Android

People also ask

-

What is the Maryland Form 510D and how does it work with airSlate SignNow?

The Maryland Form 510D is a form used for the state of Maryland's tax filings. With airSlate SignNow, you can easily fill out, send, and eSign this form electronically, streamlining your tax submission process. Our platform ensures that you have secure access to your documents and can manage them efficiently online.

-

How can I access the Maryland Form 510D using airSlate SignNow?

You can access the Maryland Form 510D through our user-friendly interface on airSlate SignNow. Simply navigate to the document library, search for the form, and begin the process of signing and submitting it. This quick access allows for efficient document management and timely submission.

-

Is there a cost associated with using airSlate SignNow for the Maryland Form 510D?

Yes, airSlate SignNow offers various pricing plans, including options for individuals and businesses. With our plans, you can access features ideal for managing the Maryland Form 510D and other documents without breaking your budget. We aim to provide a cost-effective solution for all your eSigning needs.

-

What are the key features of airSlate SignNow that benefit users of the Maryland Form 510D?

airSlate SignNow provides features like eSignatures, document tracking, and customizable templates to help you efficiently handle the Maryland Form 510D. These tools simplify the signing process and allow you to monitor document status in real-time. Our platform ensures ease of use while maintaining security and compliance.

-

Can I integrate airSlate SignNow with other applications to manage the Maryland Form 510D?

Absolutely! airSlate SignNow offers integration with a wide range of applications, enhancing your workflow when managing the Maryland Form 510D. You can connect with tools like Google Drive, Salesforce, and more, allowing you to streamline document processes and maintain consistency across platforms.

-

How does airSlate SignNow ensure the security of my Maryland Form 510D documents?

Your security is our priority at airSlate SignNow. We employ industry-standard encryption and secure servers to protect your Maryland Form 510D and other documents. Additionally, our platform supports compliance with various regulations, giving you peace of mind while handling sensitive information.

-

What support options are available if I need help with the Maryland Form 510D on airSlate SignNow?

airSlate SignNow offers multiple support options for users needing assistance with the Maryland Form 510D. You can access our comprehensive help center, engage with our knowledgeable customer service team through live chat, or explore tutorial videos that walk you through the process. We're here to ensure you have all the support you need.

Get more for Fillable Online 510D PASS THROUGH ENTITY FORM MARYLAND

- Maryland lease residential form

- Maryland lease residential 497310284 form

- 90 day notice lease form

- Assignment of deed of trust by individual mortgage holder maryland form

- Maryland deed 497310287 form

- 60 day notice to terminate month to month lease montgomery county only residential from landlord to tenant maryland form

- Lease landlord violation form

- Notice cure default form

Find out other Fillable Online 510D PASS THROUGH ENTITY FORM MARYLAND

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form