TY 510D PTE ESTIMATED INCOME TAX FORM 2020

What is the TY 510D PTE ESTIMATED INCOME TAX FORM

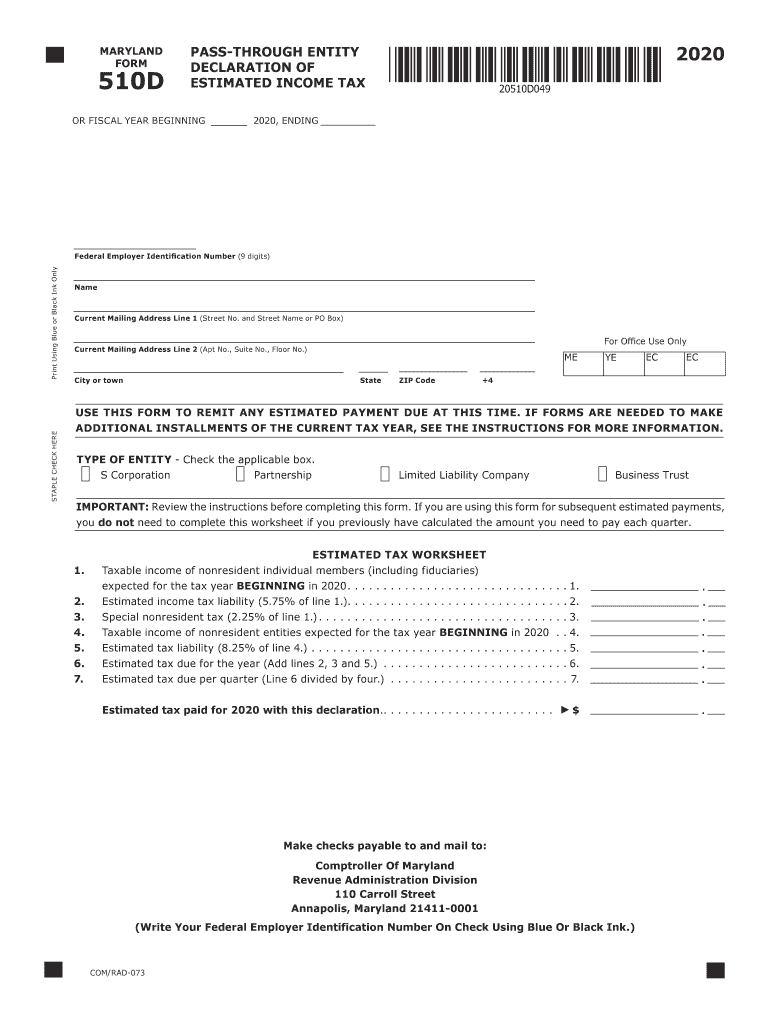

The TY 510D PTE Estimated Income Tax Form is a document used by individuals and businesses in the United States to report estimated income tax obligations for the current tax year. This form is particularly relevant for pass-through entities, such as partnerships and S corporations, that need to estimate their tax liabilities based on projected earnings. The form helps taxpayers calculate their expected tax payments to avoid penalties for underpayment when filing their annual tax returns.

Steps to complete the TY 510D PTE ESTIMATED INCOME TAX FORM

Completing the TY 510D PTE Estimated Income Tax Form involves several key steps:

- Gather necessary financial information, including income projections and deductible expenses.

- Calculate the estimated income tax based on current tax rates and your projected income.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy and completeness to prevent errors.

- Submit the form according to the specified submission methods, either online or via mail.

How to obtain the TY 510D PTE ESTIMATED INCOME TAX FORM

The TY 510D PTE Estimated Income Tax Form can be obtained through various channels. Taxpayers can access the form directly from the official state revenue department's website or request a physical copy by contacting their local tax office. Additionally, many tax preparation software programs include the form, allowing users to fill it out digitally as part of their overall tax preparation process.

Legal use of the TY 510D PTE ESTIMATED INCOME TAX FORM

The legal use of the TY 510D PTE Estimated Income Tax Form is crucial for compliance with tax regulations. This form must be filled out accurately and submitted on time to avoid penalties. The form serves as a formal declaration of estimated tax liabilities, and using it properly ensures that taxpayers fulfill their obligations under the law. Adhering to deadlines and providing accurate information is essential to maintain compliance with IRS guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the TY 510D PTE Estimated Income Tax Form are typically aligned with the federal tax calendar. Taxpayers should be aware of the following important dates:

- Estimated tax payments are generally due on April 15, June 15, September 15, and January 15 of the following year.

- Any changes in tax laws or regulations may affect these deadlines, so it is important to stay informed.

Form Submission Methods (Online / Mail / In-Person)

The TY 510D PTE Estimated Income Tax Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the state revenue department's e-filing system.

- Mailing a physical copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices or events, if available.

Quick guide on how to complete ty 2020 510d pte estimated income tax form

Access TY 510D PTE ESTIMATED INCOME TAX FORM effortlessly on any device

Digital document management has become more prevalent among organizations and individuals alike. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage TY 510D PTE ESTIMATED INCOME TAX FORM on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign TY 510D PTE ESTIMATED INCOME TAX FORM without hassle

- Find TY 510D PTE ESTIMATED INCOME TAX FORM and then click Obtain Form to begin.

- Utilize the features we provide to complete your form.

- Mark important sections of your documents or conceal confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Finish button to preserve your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow manages your document management needs in just a few clicks from a device of your choice. Modify and eSign TY 510D PTE ESTIMATED INCOME TAX FORM and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ty 2020 510d pte estimated income tax form

Create this form in 5 minutes!

How to create an eSignature for the ty 2020 510d pte estimated income tax form

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the TY 510D PTE ESTIMATED INCOME TAX FORM?

The TY 510D PTE ESTIMATED INCOME TAX FORM is a tax form used by entities to report estimated income tax payments for a specific tax year. This form is essential for businesses and individuals looking to align their tax obligations with state regulations. Understanding this form helps ensure timely and accurate tax filings.

-

How can airSlate SignNow assist with the TY 510D PTE ESTIMATED INCOME TAX FORM?

airSlate SignNow provides a streamlined platform to fill out, send, and eSign the TY 510D PTE ESTIMATED INCOME TAX FORM. With its user-friendly interface, you can conveniently manage your documents while ensuring they are legally binding and secure. Our solution simplifies the tax filing process.

-

What features does airSlate SignNow offer for the TY 510D PTE ESTIMATED INCOME TAX FORM?

airSlate SignNow offers features like customizable templates, real-time collaboration, and secure eSignature capabilities for the TY 510D PTE ESTIMATED INCOME TAX FORM. These features enhance the efficiency of completing and submitting your tax documents. Furthermore, you can easily track the status of your forms.

-

Is airSlate SignNow affordable for managing tax forms like the TY 510D PTE ESTIMATED INCOME TAX FORM?

Yes, airSlate SignNow is a cost-effective solution for managing your tax forms, including the TY 510D PTE ESTIMATED INCOME TAX FORM. We offer various pricing plans to suit businesses of all sizes, ensuring you get the right tools to manage your documents without breaking the bank.

-

Can I integrate airSlate SignNow with my existing accounting software for the TY 510D PTE ESTIMATED INCOME TAX FORM?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, allowing you to manage the TY 510D PTE ESTIMATED INCOME TAX FORM alongside your financial data. This integration helps streamline your workflows, saving you time and reducing the potential for errors.

-

What are the benefits of eSigning the TY 510D PTE ESTIMATED INCOME TAX FORM with airSlate SignNow?

ESigning the TY 510D PTE ESTIMATED INCOME TAX FORM with airSlate SignNow ensures quick turnaround times and legally binding agreements. Our platform enhances security, allowing you to track signatures and document changes in real time. These benefits simplify your tax filing process and provide peace of mind.

-

Is customer support available for assistance with the TY 510D PTE ESTIMATED INCOME TAX FORM?

Yes, airSlate SignNow offers dedicated customer support to assist with any inquiries related to the TY 510D PTE ESTIMATED INCOME TAX FORM. Our support team is knowledgeable and ready to help you navigate the features available on our platform, ensuring you can efficiently complete your tax documents.

Get more for TY 510D PTE ESTIMATED INCOME TAX FORM

Find out other TY 510D PTE ESTIMATED INCOME TAX FORM

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free