Do I Need to Submit a Maryland Form 510 If My Pass through 2021

Understanding the Maryland 510D Estimated Tax Form

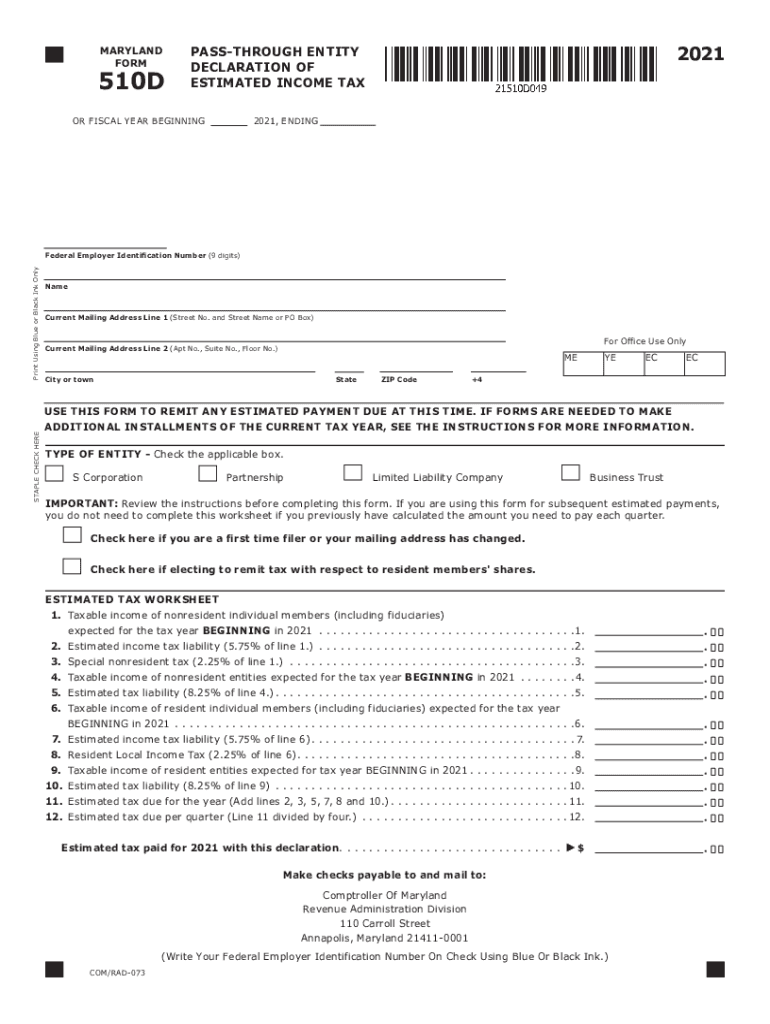

The Maryland 510D estimated tax form is crucial for individuals and businesses that expect to owe tax of $500 or more when filing their annual return. This form is specifically designed for those who receive income from sources such as self-employment, rental properties, or investments. Understanding the purpose and requirements of this form can help ensure compliance with state tax laws.

Steps to Complete the Maryland 510D Estimated Tax Form

Completing the Maryland 510D estimated tax form involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your expected income for the year to determine your estimated tax liability.

- Fill out the form accurately, ensuring all income sources are reported.

- Submit the form by the appropriate deadlines to avoid penalties.

Filing Deadlines for the Maryland 510D Estimated Tax Form

It is essential to be aware of the filing deadlines for the Maryland 510D estimated tax form. Typically, the estimated tax payments are due quarterly, with specific dates set by the Maryland Comptroller's office. Missing these deadlines can result in penalties and interest on unpaid taxes.

Required Documents for Filing the Maryland 510D Estimated Tax Form

When preparing to file the Maryland 510D estimated tax form, you will need several documents:

- Income statements from all sources, including W-2s and 1099s.

- Previous year’s tax return for reference.

- Any relevant deductions or credits that may apply to your situation.

Penalties for Non-Compliance with the Maryland 510D Estimated Tax Form

Failing to file the Maryland 510D estimated tax form or making late payments can lead to significant penalties. The state may impose fines based on the amount owed and the duration of the delay. Understanding these penalties can motivate timely and accurate filing.

Digital vs. Paper Version of the Maryland 510D Estimated Tax Form

Taxpayers have the option to file the Maryland 510D estimated tax form either digitally or via paper submission. The digital version offers advantages such as ease of use, faster processing times, and reduced risk of errors. However, some individuals may prefer the traditional paper method for its familiarity.

Quick guide on how to complete do i need to submit a maryland form 510 if my pass through

Effortlessly Prepare Do I Need To Submit A Maryland Form 510 If My Pass Through on Any Device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed forms, allowing you to obtain the necessary document and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without any delays. Manage Do I Need To Submit A Maryland Form 510 If My Pass Through on any device with the airSlate SignNow applications for Android or iOS, and streamline your document-related tasks today.

How to Modify and Electronically Sign Do I Need To Submit A Maryland Form 510 If My Pass Through with Ease

- Obtain Do I Need To Submit A Maryland Form 510 If My Pass Through and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sharing the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and electronically sign Do I Need To Submit A Maryland Form 510 If My Pass Through to ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct do i need to submit a maryland form 510 if my pass through

Create this form in 5 minutes!

People also ask

-

What is the Maryland 510D estimated form?

The Maryland 510D estimated form is used by individuals and businesses in Maryland to estimate their state tax liabilities. It allows taxpayers to report their expected income and deductions, ensuring that they meet their tax obligations. Using an efficient eSigning solution like airSlate SignNow simplifies submitting your Maryland 510D estimated forms securely and effectively.

-

How can airSlate SignNow help with filing Maryland 510D estimated forms?

AirSlate SignNow enables users to easily prepare and send their Maryland 510D estimated forms for electronic signatures. Its user-friendly platform streamlines the document workflow, allowing you to collect signatures and send reminders efficiently. This helps ensure that your Maryland 510D estimated forms are submitted on time.

-

What features does airSlate SignNow offer for Maryland 510D estimated forms?

AirSlate SignNow provides several features for managing Maryland 510D estimated forms, including template creation, automated reminders, and integration with popular accounting software. These features help businesses efficiently prepare and process their tax forms. Additionally, the platform allows for secure document storage and tracking, providing peace of mind.

-

Is there a cost associated with using airSlate SignNow for Maryland 510D estimated?

AirSlate SignNow offers a range of pricing plans to accommodate different business needs when using it for Maryland 510D estimated forms. There is a free trial available, allowing you to explore the platform's features without commitment. Pricing is based on the number of users and specific functionalities required, making it cost-effective for organizations of all sizes.

-

Can I integrate airSlate SignNow with accounting software for Maryland 510D estimated forms?

Yes, airSlate SignNow seamlessly integrates with various accounting software, enhancing the process of managing Maryland 510D estimated forms. This integration allows for easy data transfer and reduces the likelihood of errors during form preparation. By using airSlate SignNow, users can keep their financial documentation organized and up-to-date.

-

What are the benefits of using airSlate SignNow for my Maryland 510D estimated forms?

The benefits of using airSlate SignNow for your Maryland 510D estimated forms include increased efficiency, reduced paper usage, and enhanced security. The platform allows for quick signatures and easy sharing of your tax documents, ensuring compliance with state regulations. Furthermore, its user-friendly interface enables a smoother experience for both senders and recipients.

-

How do I get started with airSlate SignNow for Maryland 510D estimated?

Getting started with airSlate SignNow for Maryland 510D estimated forms is easy. Simply sign up for an account, choose a pricing plan that fits your needs, and begin creating or uploading your tax documents. From there, you can leverage the platform's features to enhance your document signing experience.

Get more for Do I Need To Submit A Maryland Form 510 If My Pass Through

Find out other Do I Need To Submit A Maryland Form 510 If My Pass Through

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed