Maryland Form 510DFill Out and Use This PDF 2024-2026

Understanding the Maryland Form 510D

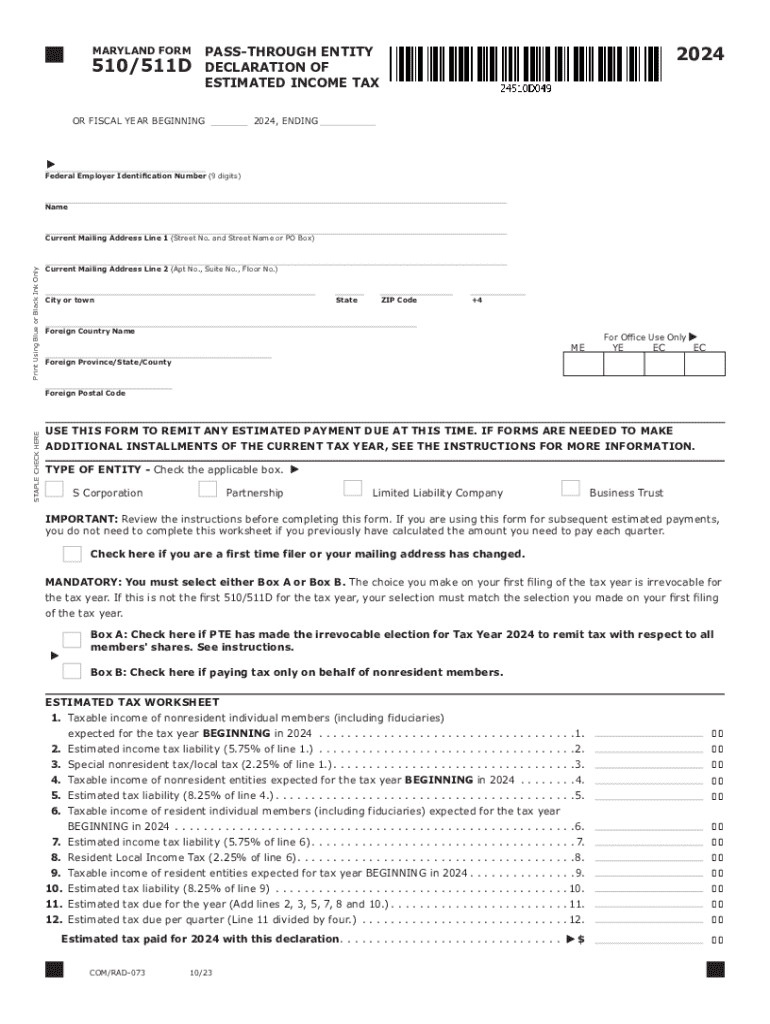

The Maryland Form 510D is a crucial document used by businesses and individuals for reporting and paying state income tax for non-residents. This form is specifically designed for those who earn income in Maryland but do not reside in the state. It ensures that non-residents comply with Maryland tax laws while providing a streamlined process for tax reporting.

By utilizing Form 510D, taxpayers can accurately report their income, claim any applicable deductions, and determine their tax liability. This form is essential for maintaining compliance with Maryland's tax regulations, thereby avoiding potential penalties or legal issues.

Steps to Complete the Maryland Form 510D

Completing the Maryland Form 510D involves several key steps to ensure accuracy and compliance. Here is a straightforward guide to help you through the process:

- Gather necessary documentation, including income statements and any relevant tax documents.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income earned in Maryland, ensuring you include all sources of income.

- Claim any deductions you may qualify for, which can reduce your taxable income.

- Calculate your total tax liability based on the income reported and applicable deductions.

- Review the completed form for accuracy before submission.

Following these steps will help ensure that you complete the Maryland Form 510D correctly and efficiently.

Obtaining the Maryland Form 510D

To obtain the Maryland Form 510D, you can access it through the official Maryland state tax website. The form is available in PDF format, allowing for easy downloading and printing. Additionally, you may find physical copies at local tax offices or libraries throughout Maryland. Ensure you have the most current version of the form to avoid any compliance issues.

Legal Use of the Maryland Form 510D

The Maryland Form 510D is legally required for non-residents earning income in Maryland. It serves as a formal declaration of income and tax liability to the state. Proper use of this form is essential to avoid penalties associated with underreporting income or failing to file. Taxpayers should ensure that they adhere to all state regulations when using this form, as it is subject to audits and reviews by the Maryland Comptroller's office.

Filing Deadlines for the Maryland Form 510D

Timely filing of the Maryland Form 510D is critical to avoid penalties. The typical deadline for submitting this form aligns with the federal tax filing deadline, which is usually April fifteenth of each year. However, if you are unable to meet this deadline, it is advisable to file for an extension to avoid late fees. Always check for any changes in deadlines or specific circumstances that may affect your filing requirements.

Required Documents for Filing the Maryland Form 510D

When preparing to file the Maryland Form 510D, it is important to gather all necessary documents to support your income claims and deductions. Key documents include:

- W-2 forms from employers for income earned in Maryland.

- 1099 forms for any freelance or contract work.

- Records of any deductions you plan to claim, such as business expenses or contributions.

- Proof of residency in your home state for tax purposes.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in your tax reporting.

Quick guide on how to complete maryland form 510dfill out and use this pdf

Prepare Maryland Form 510DFill Out And Use This PDF effortlessly on any device

Online document administration has become increasingly favored among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents rapidly without delays. Manage Maryland Form 510DFill Out And Use This PDF on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to edit and electronically sign Maryland Form 510DFill Out And Use This PDF with ease

- Locate Maryland Form 510DFill Out And Use This PDF and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important portions of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Select how you wish to distribute your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Maryland Form 510DFill Out And Use This PDF and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maryland form 510dfill out and use this pdf

Create this form in 5 minutes!

How to create an eSignature for the maryland form 510dfill out and use this pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the md form 510d and how can airSlate SignNow help?

The md form 510d is a crucial document used for various administrative purposes. airSlate SignNow simplifies the process of filling out and signing this form electronically, ensuring that you can complete it quickly and efficiently. With our platform, you can easily manage and store your md form 510d, enhancing your workflow.

-

How much does it cost to use airSlate SignNow for md form 510d?

airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose a plan that fits your budget while ensuring you have access to features that streamline the signing process for documents like the md form 510d. Check our pricing page for detailed information on subscription options.

-

What features does airSlate SignNow provide for managing md form 510d?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for forms like the md form 510d. These tools help you manage your documents efficiently, ensuring compliance and reducing turnaround time. Our user-friendly interface makes it easy to navigate these features.

-

Can I integrate airSlate SignNow with other applications for md form 510d?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your ability to manage the md form 510d. Whether you use CRM systems, cloud storage, or project management tools, our platform can connect with them to streamline your document workflow. Explore our integrations to find the best fit for your needs.

-

What are the benefits of using airSlate SignNow for md form 510d?

Using airSlate SignNow for the md form 510d provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform allows you to sign documents from anywhere, at any time, which is particularly useful for busy professionals. Additionally, you can track the status of your documents in real-time.

-

Is airSlate SignNow secure for handling md form 510d?

Absolutely! airSlate SignNow prioritizes security, ensuring that your md form 510d and other documents are protected with advanced encryption and compliance with industry standards. We implement robust security measures to safeguard your data, giving you peace of mind while using our eSigning solution.

-

How can I get started with airSlate SignNow for md form 510d?

Getting started with airSlate SignNow for the md form 510d is simple. You can sign up for a free trial on our website, allowing you to explore our features and see how they can benefit your document management process. Once registered, you can easily upload your md form 510d and start eSigning right away.

Get more for Maryland Form 510DFill Out And Use This PDF

- Gift deed 497327439 form

- Texas general deed 497327440 form

- Assumption warranty deed form

- Gift deed from five grantors to one grantee texas form

- General warranty deed individual to individual with reserved life estate in grantor texas form

- General warranty deed two individuals to an individual and a llc texas form

- General warranty deed 497327445 form

- Texas correction deed form

Find out other Maryland Form 510DFill Out And Use This PDF

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe