Net Worth Tax for Corporations FAQ Department of Revenue 2019

Understanding the Net Worth Tax for Corporations

The net worth tax for corporations in Georgia is a tax imposed on the net worth of corporations operating within the state. This tax is calculated based on the total assets minus total liabilities, and it applies to corporations that meet specific criteria set by the Georgia Department of Revenue. Understanding this tax is crucial for compliance and financial planning.

Corporations must assess their net worth annually to determine their tax liability. The tax rate may vary, and it is essential for businesses to stay informed about any changes to the law that could affect their obligations.

Steps to Complete the Georgia Form 600

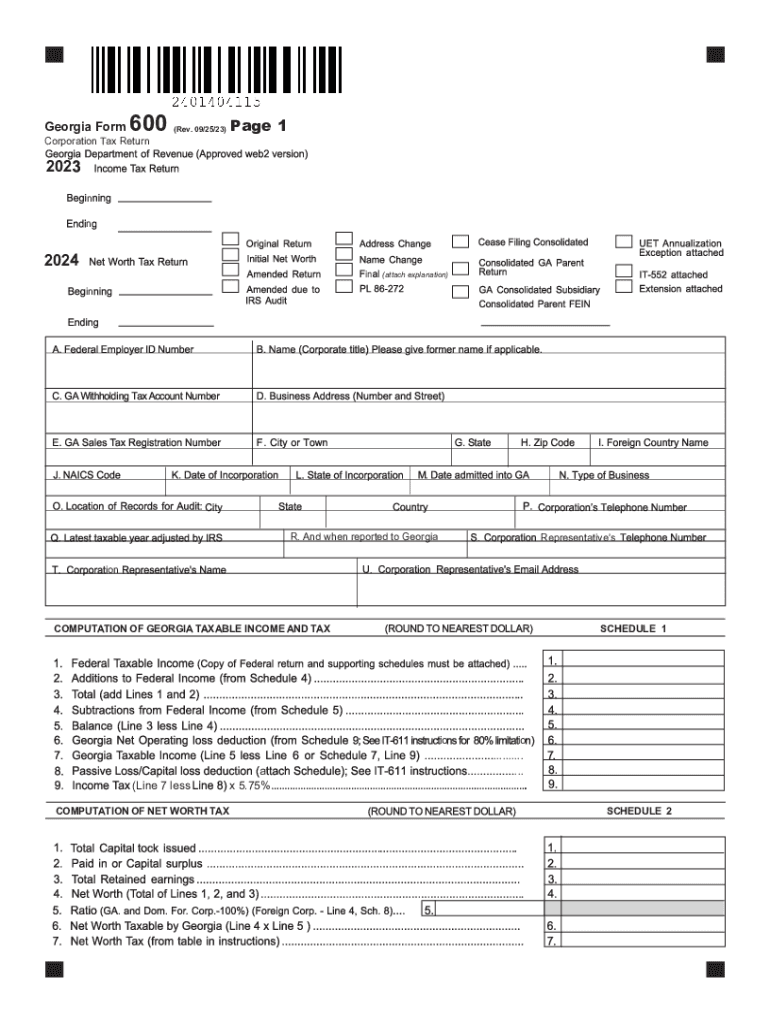

Completing the Georgia Form 600, also known as the corporation tax return, involves several steps to ensure accurate reporting of income and net worth. Here’s a streamlined process:

- Gather necessary financial documents, including balance sheets and income statements.

- Calculate your corporation's net worth by subtracting total liabilities from total assets.

- Fill out the Georgia Form 600, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form by the designated deadline, either electronically or via mail.

Following these steps helps ensure compliance with state regulations and minimizes the risk of penalties.

Required Documents for Filing

When filing the Georgia Form 600, several documents are essential to support your tax return. These include:

- Financial statements, including profit and loss statements and balance sheets.

- Documentation of all income sources and deductions.

- Records of any previous tax payments made.

- Any additional schedules or forms required by the Georgia Department of Revenue.

Having these documents ready can facilitate a smooth filing process and ensure that your return is complete and accurate.

Filing Deadlines for Georgia Form 600

Corporations must adhere to specific filing deadlines for the Georgia Form 600 to avoid penalties. The standard deadline for filing is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15.

It is important to check for any extensions or changes to deadlines, especially in light of recent tax law updates or state-specific announcements.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Georgia Form 600 can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, increasing the total amount due.

- Potential legal action for persistent non-compliance.

Understanding these penalties emphasizes the importance of timely and accurate filing to avoid unnecessary financial burdens.

Eligibility Criteria for Net Worth Tax

To be subject to the net worth tax in Georgia, corporations must meet certain eligibility criteria. Generally, these include:

- Being registered and operating as a corporation within Georgia.

- Having a net worth that exceeds the minimum threshold set by the state.

- Filing the appropriate tax returns as required by the Georgia Department of Revenue.

Meeting these criteria ensures that corporations are aware of their tax obligations and can plan accordingly.

Quick guide on how to complete net worth tax for corporations faq department of revenue

Complete Net Worth Tax For Corporations FAQ Department Of Revenue effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Net Worth Tax For Corporations FAQ Department Of Revenue on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to modify and eSign Net Worth Tax For Corporations FAQ Department Of Revenue with ease

- Find Net Worth Tax For Corporations FAQ Department Of Revenue and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Modify and eSign Net Worth Tax For Corporations FAQ Department Of Revenue and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct net worth tax for corporations faq department of revenue

Create this form in 5 minutes!

How to create an eSignature for the net worth tax for corporations faq department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the GA Form 600 return and why is it important?

The GA Form 600 return is a crucial document for business owners to report their income and expenses in Georgia. Completing this return accurately ensures compliance with state tax laws, helps avoid penalties, and can potentially maximize your tax refund. Utilizing tools like airSlate SignNow can streamline this process with electronic signatures.

-

How does airSlate SignNow help with the GA Form 600 return?

airSlate SignNow provides a user-friendly platform for businesses to complete their GA Form 600 return efficiently. With features like document templates and electronic signatures, users can manage their tax forms seamlessly, reducing the hassle of paper-based processes. This makes filing your GA Form 600 return easier and faster.

-

Is airSlate SignNow cost-effective for managing GA Form 600 returns?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing their GA Form 600 returns. With flexible pricing plans, you can choose the option that best fits your needs, allowing for savings compared to traditional methods. Investing in this solution can lead to greater efficiency and time savings during tax season.

-

Can I integrate airSlate SignNow with other accounting software for my GA Form 600 return?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software, making it easy to import and export data related to your GA Form 600 return. This integration helps streamline workflows and ensures that all relevant financial information is accurately reflected in your tax documents.

-

Are electronic signatures valid for the GA Form 600 return?

Yes, electronic signatures on your GA Form 600 return are legally valid and accepted by the state of Georgia. By using airSlate SignNow, you can electronically sign your tax documents securely and conveniently, ensuring compliance while also expediting the filing process. This modern approach simplifies submitting your GA Form 600 return.

-

What features does airSlate SignNow offer to assist with the GA Form 600 return?

airSlate SignNow provides several features designed to assist with the GA Form 600 return, including customizable document templates, in-app signing, and real-time collaboration. These tools help you assemble your return quickly and accurately, ensuring all necessary information is included. The platform's user-friendly interface makes navigation a breeze.

-

How secure is my information when I use airSlate SignNow for my GA Form 600 return?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption protocols to protect your sensitive information while preparing and signing your GA Form 600 return. You can trust that your data remains confidential and secure throughout the entire process.

Get more for Net Worth Tax For Corporations FAQ Department Of Revenue

- Services and forms rigov rhode island government

- State of rhode island and providence sosrigov form

- Sfn 17899 form

- Nd sfn 13401 form

- Sfn 19355 form

- Fllc 1app for coa for fllc fllc 1app for coa for fllc form

- Instructions for filing application for certificate of authority form

- Oac family membership form oac family membership form

Find out other Net Worth Tax For Corporations FAQ Department Of Revenue

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter