ALL PERSONS HAVING BATTLE CREEK TAXABLE INCOME in MUST FILE a RETURN 2023-2026

Who Must File the Battle Creek City Income Tax Return

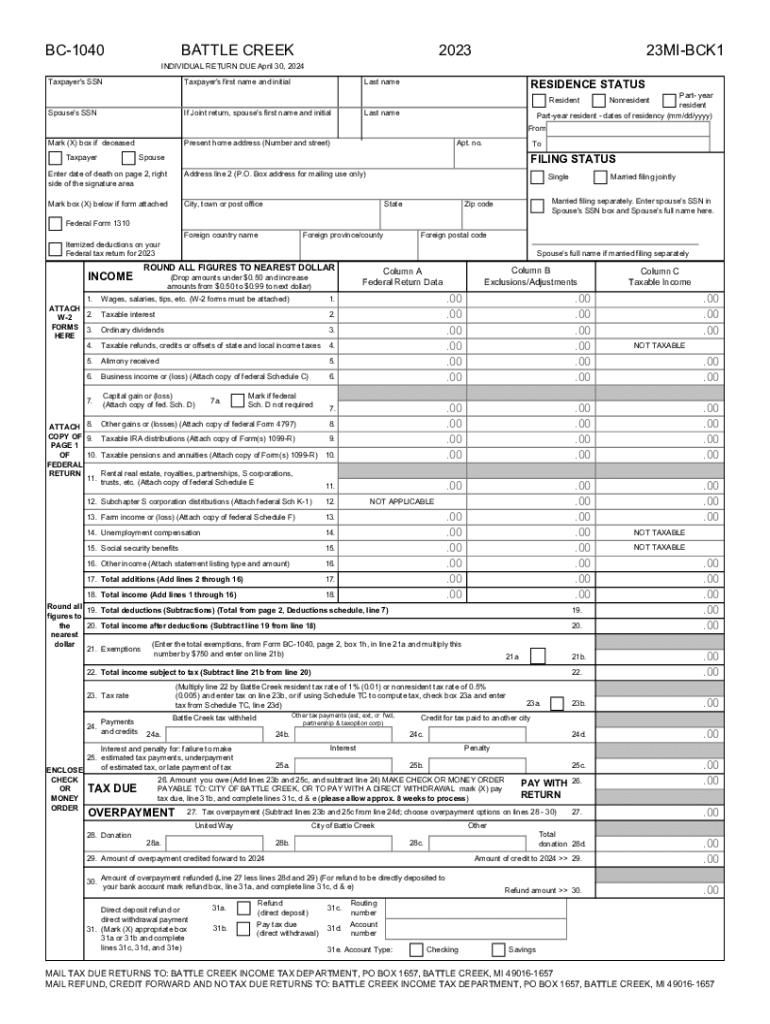

All individuals and businesses earning taxable income within the city of Battle Creek are required to file a city income tax return. This includes residents, non-residents who work in the city, and businesses operating within city limits. Taxable income generally encompasses wages, salaries, tips, and other forms of compensation. Understanding who qualifies as a taxpayer is crucial for compliance with local tax regulations.

Steps to Complete the Battle Creek City Income Tax Return

Completing the Battle Creek city income tax return involves several key steps:

- Gather all necessary documents, including W-2 forms, 1099s, and any other income statements.

- Determine your total taxable income for the year, including all sources of income.

- Access the appropriate Battle Creek city tax forms, ensuring you have the correct version for the current tax year.

- Fill out the forms accurately, ensuring all income and deductions are reported correctly.

- Review your completed return for any errors or omissions.

- Submit your return by the designated deadline, either online, by mail, or in person.

Required Documents for Filing Battle Creek City Income Tax

To file the Battle Creek city income tax return, taxpayers must prepare several documents:

- W-2 forms from employers, detailing annual wages and withheld taxes.

- 1099 forms for any freelance or contract work performed.

- Records of any other income sources, such as rental income or dividends.

- Documentation for deductions, including receipts and statements related to business expenses or eligible deductions.

Filing Deadlines for Battle Creek City Income Tax

The deadline for filing the Battle Creek city income tax return typically aligns with the federal tax filing deadline, which is usually April fifteenth. It is essential to stay informed about any changes to deadlines, as local regulations may vary. Taxpayers should also be aware of any extensions that may apply.

Form Submission Methods for Battle Creek City Income Tax

Taxpayers have multiple options for submitting their Battle Creek city income tax return:

- Online: Many taxpayers prefer to file electronically through approved platforms that facilitate online submissions.

- Mail: Completed forms can be mailed to the designated city tax office address. Ensure that you send your return with sufficient time for it to arrive by the deadline.

- In-Person: Taxpayers may also choose to submit their returns in person at the local tax office during business hours.

Penalties for Non-Compliance with Battle Creek City Income Tax

Failure to file the Battle Creek city income tax return by the deadline can result in penalties. These may include fines, interest on unpaid taxes, and additional charges for late filing. It is crucial for taxpayers to understand these potential consequences and to file their returns on time to avoid unnecessary financial burdens.

Quick guide on how to complete all persons having battle creek taxable income in must file a return

Accomplish ALL PERSONS HAVING BATTLE CREEK TAXABLE INCOME IN MUST FILE A RETURN effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage ALL PERSONS HAVING BATTLE CREEK TAXABLE INCOME IN MUST FILE A RETURN across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign ALL PERSONS HAVING BATTLE CREEK TAXABLE INCOME IN MUST FILE A RETURN with ease

- Obtain ALL PERSONS HAVING BATTLE CREEK TAXABLE INCOME IN MUST FILE A RETURN and click on Get Form to initiate.

- Utilize the tools provided to finalize your document.

- Emphasize key sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign function, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Modify and eSign ALL PERSONS HAVING BATTLE CREEK TAXABLE INCOME IN MUST FILE A RETURN and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct all persons having battle creek taxable income in must file a return

Create this form in 5 minutes!

How to create an eSignature for the all persons having battle creek taxable income in must file a return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are battle creek city tax forms?

Battle Creek city tax forms are official documents required for filing local taxes in Battle Creek. These forms must be completed accurately to ensure compliance with the city's tax regulations. Using airSlate SignNow simplifies the process of filling out and submitting these forms electronically.

-

How can airSlate SignNow help me with battle creek city tax forms?

AirSlate SignNow provides an easy-to-use platform for filling out and eSigning battle creek city tax forms. The software allows you to complete your forms online, ensuring a smooth experience from start to finish. Additionally, eSigning your tax forms saves time and eliminates the need for physical paperwork.

-

Are there any fees associated with using airSlate SignNow for battle creek city tax forms?

AirSlate SignNow offers multiple pricing plans that cater to different needs, including options specifically for handling battle creek city tax forms. While there is a subscription fee, the platform enhances productivity and could save money in the long run by reducing printing and mailing costs. Free trials are often available so you can explore the features before committing.

-

What features does airSlate SignNow offer for managing battle creek city tax forms?

AirSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking for managing battle creek city tax forms. These features streamline the filing process and help ensure that you never miss an important deadline. Additionally, the interface is intuitive, making it accessible even for those who are not tech-savvy.

-

Is it safe to use airSlate SignNow for battle creek city tax forms?

Yes, airSlate SignNow prioritizes the security and confidentiality of your information. The platform implements advanced encryption protocols to protect your battle creek city tax forms and personal data. This ensures that your sensitive information remains secure during the eSigning and submission process.

-

Can I integrate airSlate SignNow with other tools for battle creek city tax forms?

Absolutely! AirSlate SignNow integrates seamlessly with various productivity tools and software, enhancing your ability to manage battle creek city tax forms. This includes integration with cloud storage services and project management applications, making it easier to organize your documents in one central location.

-

What are the advantages of using an electronic approach for battle creek city tax forms?

Using an electronic approach for battle creek city tax forms greatly enhances efficiency and accuracy. It reduces the risk of errors associated with handwritten forms and accelerates the submission process through eSigning. Moreover, going digital saves on paper and postage costs, aligning with eco-friendly practices.

Get more for ALL PERSONS HAVING BATTLE CREEK TAXABLE INCOME IN MUST FILE A RETURN

- Gu 1338 mass form

- Itd 0020 form

- Small estate affidavit idaho transportation department itdidaho form

- Free idaho small estate affidavitform cao pb 01 pdf

- Itd 3227 form

- Internet application for replacement idaho drivers license or identification card form

- Vehicle color chart form

- Full form dartfirststatecom

Find out other ALL PERSONS HAVING BATTLE CREEK TAXABLE INCOME IN MUST FILE A RETURN

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter