Individual Income Tax Forms 2022Maine Revenue Services 2022

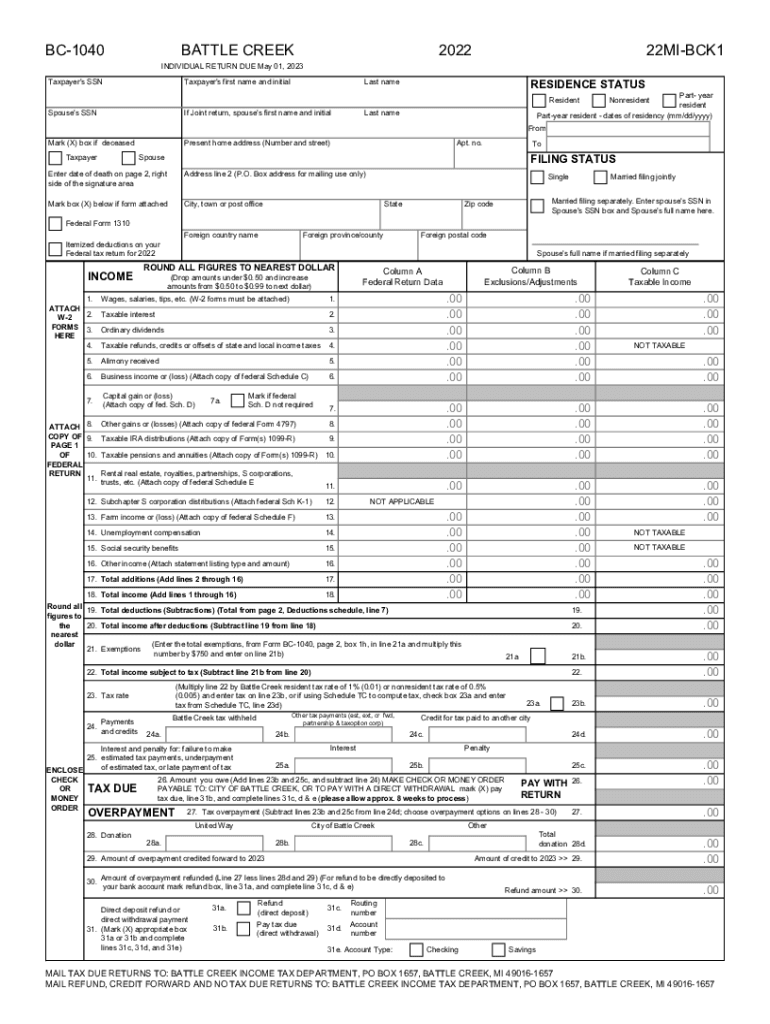

Understanding the City of Battle Creek Tax Forms

The city of Battle Creek tax forms are essential documents for residents and businesses to report and pay their local income taxes. These forms include various types, such as the BC-1040, which is the primary individual income tax return for residents. Understanding the purpose of each form is crucial for accurate filing and compliance with local tax laws.

Battle Creek city tax forms are designed to capture income earned within the city limits and ensure that residents contribute their fair share to local services. It is important to familiarize yourself with the specific forms required for your situation, whether you are an individual taxpayer or a business entity.

Steps to Complete the City of Battle Creek Tax Forms

Completing the city of Battle Creek tax forms involves several key steps to ensure accuracy and compliance. Here is a simplified process to guide you:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Obtain the correct city tax forms, such as the BC-1040, from the official city website or local tax office.

- Fill out the forms carefully, ensuring all personal information and income details are accurate.

- Calculate your total income tax liability based on the instructions provided with the forms.

- Review your completed forms for any errors or omissions.

- Submit the forms either electronically through a secure platform or by mailing them to the appropriate city tax office.

Filing Deadlines for City of Battle Creek Taxes

Filing deadlines are critical for ensuring compliance with the city of Battle Creek tax regulations. Typically, individual income tax returns are due by April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day.

It is advisable to check for any specific deadlines related to extensions or special circumstances that may apply. Staying informed about these deadlines helps avoid penalties and ensures timely processing of your tax forms.

Form Submission Methods for City of Battle Creek Taxes

Residents have several options for submitting their city of Battle Creek tax forms. The available methods include:

- Online Submission: Many taxpayers prefer to file electronically through secure e-filing platforms, which streamline the process and provide immediate confirmation of submission.

- Mail: Taxpayers can print their completed forms and send them via postal service to the designated city tax office. It is recommended to use certified mail for tracking purposes.

- In-Person: Some residents may choose to deliver their forms directly to the city tax office during business hours.

Required Documents for Filing City of Battle Creek Taxes

To successfully complete your city of Battle Creek tax forms, you will need to gather several key documents, including:

- W-2 Forms: These forms report wages and tax withholding from your employer.

- 1099 Forms: If you are self-employed or received other income, these forms will detail your earnings.

- Previous Year’s Tax Return: This can help ensure consistency and accuracy in reporting your income.

- Proof of Deductions: Collect any documentation for deductions you plan to claim, such as receipts for business expenses or charitable contributions.

Legal Use of City of Battle Creek Tax Forms

The city of Battle Creek tax forms must be filled out and submitted in accordance with local tax laws to be considered legally binding. Electronic signatures are accepted if they comply with the ESIGN Act and other relevant regulations. Using a secure platform for electronic submission can enhance the legal standing of your documents.

It is important to ensure that all information provided is truthful and accurate to avoid potential legal issues, including penalties for fraud or misrepresentation. Keeping copies of submitted forms and supporting documents is also advisable for your records.

Quick guide on how to complete individual income tax forms 2022maine revenue services

Effortlessly Prepare Individual Income Tax Forms 2022Maine Revenue Services on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage Individual Income Tax Forms 2022Maine Revenue Services on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Modify and eSign Individual Income Tax Forms 2022Maine Revenue Services with Ease

- Obtain Individual Income Tax Forms 2022Maine Revenue Services and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tiring form searches, or errors that require new copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Individual Income Tax Forms 2022Maine Revenue Services and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual income tax forms 2022maine revenue services

Create this form in 5 minutes!

How to create an eSignature for the individual income tax forms 2022maine revenue services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the city of Battle Creek tax forms available through airSlate SignNow?

airSlate SignNow provides users with easy access to all essential city of Battle Creek tax forms. This includes forms required for tax filing and other related documents. Users can complete and eSign these forms online, streamlining the entire process signNowly.

-

How does airSlate SignNow ensure the security of my city of Battle Creek tax forms?

Security is a top priority at airSlate SignNow. All city of Battle Creek tax forms are encrypted both in transit and at rest, ensuring that sensitive information remains protected. Additionally, we implement multi-factor authentication to further safeguard your documents.

-

Can airSlate SignNow integrate with other software for managing city of Battle Creek tax forms?

Yes, airSlate SignNow seamlessly integrates with various software solutions to manage city of Battle Creek tax forms efficiently. Whether you’re using accounting software or document management systems, our platform works well with popular applications, facilitating a smooth workflow.

-

What is the pricing structure for using airSlate SignNow for city of Battle Creek tax forms?

airSlate SignNow offers a range of pricing plans to suit different needs for managing city of Battle Creek tax forms. Our plans are designed to be cost-effective while providing robust features. You can choose from monthly or annual subscriptions depending on your usage and requirements.

-

How does eSigning city of Battle Creek tax forms work with airSlate SignNow?

eSigning city of Battle Creek tax forms with airSlate SignNow is straightforward. Users can upload their forms, add signature fields, and send them out for eSignatures. Recipients can review and sign the documents electronically, making the whole process quick and efficient.

-

What benefits can I expect from using airSlate SignNow for city of Battle Creek tax forms?

Using airSlate SignNow to manage city of Battle Creek tax forms offers numerous benefits, including increased efficiency and reduced paperwork. Our platform enhances collaboration by allowing multiple parties to access and sign documents easily. Additionally, it saves time and minimizes the likelihood of errors.

-

Is it easy to track the status of city of Battle Creek tax forms sent with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for the status of city of Battle Creek tax forms. Users can see when documents have been sent, viewed, and signed, ensuring that you always stay informed throughout the signing process.

Get more for Individual Income Tax Forms 2022Maine Revenue Services

- Warranty deed for parents to child with reservation of life estate south dakota form

- Warranty deed for separate or joint property to joint tenancy south dakota form

- Warranty deed to separate property of one spouse to both spouses as joint tenants south dakota form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries south dakota form

- Warranty deed from limited partnership or llc is the grantor or grantee south dakota form

- South dakota ucc1 financing statement south dakota form

- South dakota ucc1 financing statement addendum south dakota form

- Ucc3 financing statement 497326512 form

Find out other Individual Income Tax Forms 2022Maine Revenue Services

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form