Mi Battle Creek 2018

What is the Mi Battle Creek?

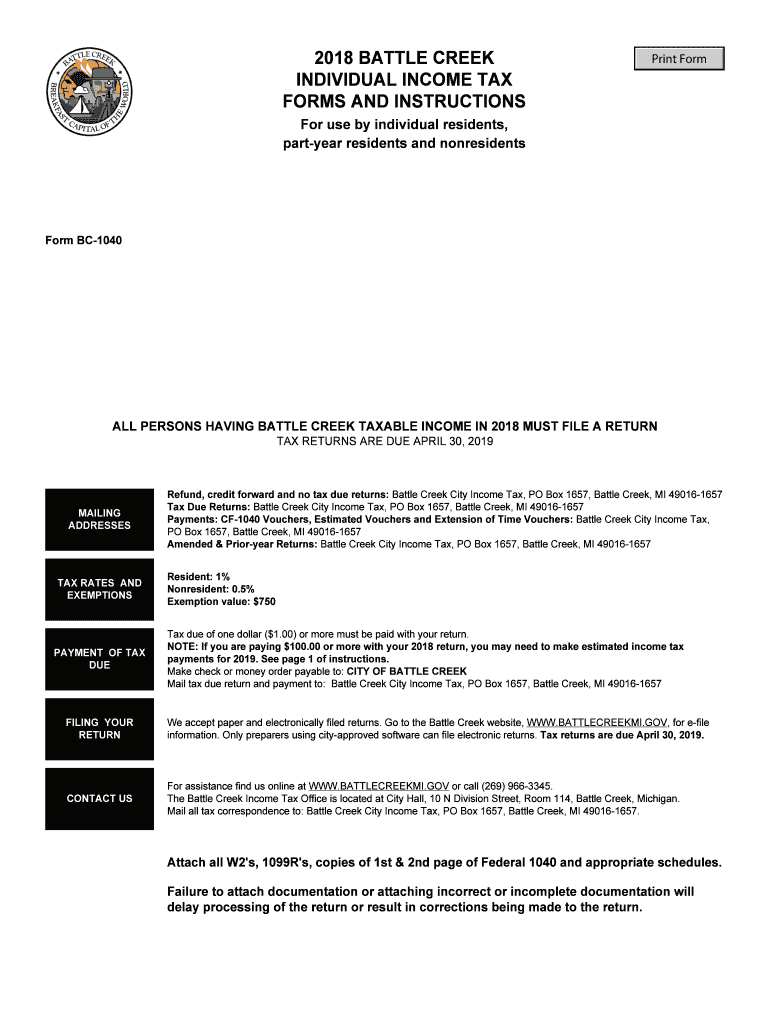

The Mi Battle Creek refers to the specific tax forms and guidelines used by residents of Battle Creek, Michigan, for filing their city taxes. This includes various forms such as the 2018 Michigan income booklet and other related documents necessary for accurate tax reporting. Understanding the Mi Battle Creek is essential for ensuring compliance with local tax regulations and making the filing process smoother for taxpayers.

Steps to complete the Mi Battle Creek

Completing the Mi Battle Creek involves several key steps to ensure accurate filing. First, gather all necessary documentation, including income statements and previous tax records. Next, access the appropriate forms, such as the 2018 Michigan instructions booklet, which provides detailed guidance on filling out each section. Carefully fill out the form, ensuring all information is accurate and complete. After completing the form, review it for any errors before signing. Finally, submit the form electronically or via mail, depending on your preference.

Legal use of the Mi Battle Creek

The Mi Battle Creek forms are legally recognized documents that must be completed and submitted according to state and local laws. Compliance with these regulations ensures that taxpayers fulfill their obligations and avoid penalties. Additionally, using an eSignature solution, such as airSlate SignNow, can enhance the legal validity of your submissions, as electronic signatures are accepted under the ESIGN Act, provided all requirements are met.

Filing Deadlines / Important Dates

Filing deadlines for the Mi Battle Creek are crucial for taxpayers to note. Typically, city taxes must be filed by April 15 each year, aligning with federal tax deadlines. However, it is important to check for any specific local extensions or changes that may apply. Marking these dates on your calendar can help ensure timely submissions and avoid late fees or penalties.

Required Documents

When preparing to file the Mi Battle Creek, certain documents are essential. These include your W-2 forms from employers, 1099 forms for any freelance or contract work, and any other income documentation. Additionally, you may need receipts for deductions, such as property taxes or charitable contributions. Having these documents organized will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in Battle Creek have several options for submitting their city tax forms. The preferred method is online submission, which allows for quick processing and confirmation of receipt. Alternatively, forms can be mailed to the appropriate tax office address, ensuring they are postmarked by the filing deadline. In-person submissions may also be accepted, providing an opportunity for direct assistance if needed. Each method has its advantages, so choose the one that best fits your needs.

Quick guide on how to complete form creek tax 2018 2019

Your assistance manual on how to prepare your Mi Battle Creek

If you’re wondering how to finalize and submit your Mi Battle Creek, here are a few straightforward instructions on how to simplify tax processing.

Firstly, you will need to establish your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document management solution that enables you to modify, generate, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to amend details as necessary. Optimize your tax administration with advanced PDF editing, eSigning, and simple sharing.

Follow the instructions below to finish your Mi Battle Creek in just minutes:

- Create your profile and begin working on PDFs in no time.

- Utilize our directory to obtain any IRS tax form; sift through versions and schedules.

- Click Get form to access your Mi Battle Creek in our editor.

- Complete the necessary fields with your particulars (text, numbers, checkmarks).

- Use the Sign Tool to affix your legally-binding eSignature (if necessary).

- Review your entries and correct any mistakes.

- Save modifications, print your version, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting on paper can lead to increased return errors and delay reimbursements. Naturally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form creek tax 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

Create this form in 5 minutes!

How to create an eSignature for the form creek tax 2018 2019

How to generate an electronic signature for your Form Creek Tax 2018 2019 online

How to create an electronic signature for the Form Creek Tax 2018 2019 in Chrome

How to make an electronic signature for signing the Form Creek Tax 2018 2019 in Gmail

How to generate an electronic signature for the Form Creek Tax 2018 2019 from your mobile device

How to make an electronic signature for the Form Creek Tax 2018 2019 on iOS

How to create an eSignature for the Form Creek Tax 2018 2019 on Android

People also ask

-

What are the key features of airSlate SignNow for managing Battle Creek city taxes?

airSlate SignNow offers features like eSigning, document management, and secure sharing, which are essential for handling Battle Creek city taxes efficiently. Users can easily create, send, and sign tax documents, ensuring compliance with local regulations. Its user-friendly interface makes it simple for individuals and businesses to manage their tax documents.

-

How does airSlate SignNow help with the filing of Battle Creek city taxes?

By using airSlate SignNow, businesses can streamline the filing process for Battle Creek city taxes. The platform allows users to prepare all necessary documents digitally, making it easier to gather signatures and submit forms on time. Automation features minimize paperwork and help ensure that nothing is overlooked.

-

What is the pricing structure for airSlate SignNow in relation to Battle Creek city taxes?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes managing Battle Creek city taxes. Each plan includes essential features such as unlimited eSigning, custom templates, and intuitive workflow management. By opting for an appropriate plan, users can find a cost-effective solution tailored to their needs.

-

Can I integrate airSlate SignNow with other tools for Battle Creek city taxes?

Yes, airSlate SignNow provides seamless integration with popular applications such as Google Workspace, Salesforce, and more. These integrations allow for efficient document handling and streamline workflows related to Battle Creek city taxes. Users can easily connect their existing software to enhance their tax management processes.

-

How secure is airSlate SignNow for handling documents related to Battle Creek city taxes?

airSlate SignNow prioritizes the security and confidentiality of your documents. The platform employs advanced encryption and complies with industry standards to protect sensitive information related to Battle Creek city taxes. Users can have peace of mind knowing their tax documents are safeguarded against unauthorized access.

-

Is there a mobile app for managing Battle Creek city taxes with airSlate SignNow?

Absolutely! airSlate SignNow offers a mobile app that enables users to manage their Battle Creek city taxes on-the-go. You can easily sign documents, track submissions, and ensure all tax-related paperwork is handled swiftly from your mobile device. This flexibility helps busy professionals stay organized and compliant.

-

What benefits does airSlate SignNow provide for businesses managing Battle Creek city taxes?

airSlate SignNow simplifies the entire process of managing Battle Creek city taxes, leading to improved accuracy and reduced administrative burden. The platform not only saves time but also enhances collaboration among team members when handling tax documents. This allows businesses to focus on what they do best while ensuring tax compliance.

Get more for Mi Battle Creek

- Aspira drainage system dischargeprescription formurgent physician order

- Casa form 452

- How to apply for guardianship in seneca county ohio form

- Flexible spending account claim form

- Domiciliary care home care application form personal

- Illinois warranty deed from individual to corporation form

- Fillable online the renfro trust grant application form

- Kwarapoly oath form

Find out other Mi Battle Creek

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile