Refund, Credit Forward and No Tax Due Returns Battle Creek City Income Tax, PO Box 1657, Battle Creek, MI 49016 1657 2017

What is the Refund, Credit Forward And No Tax Due Returns Battle Creek City Income Tax

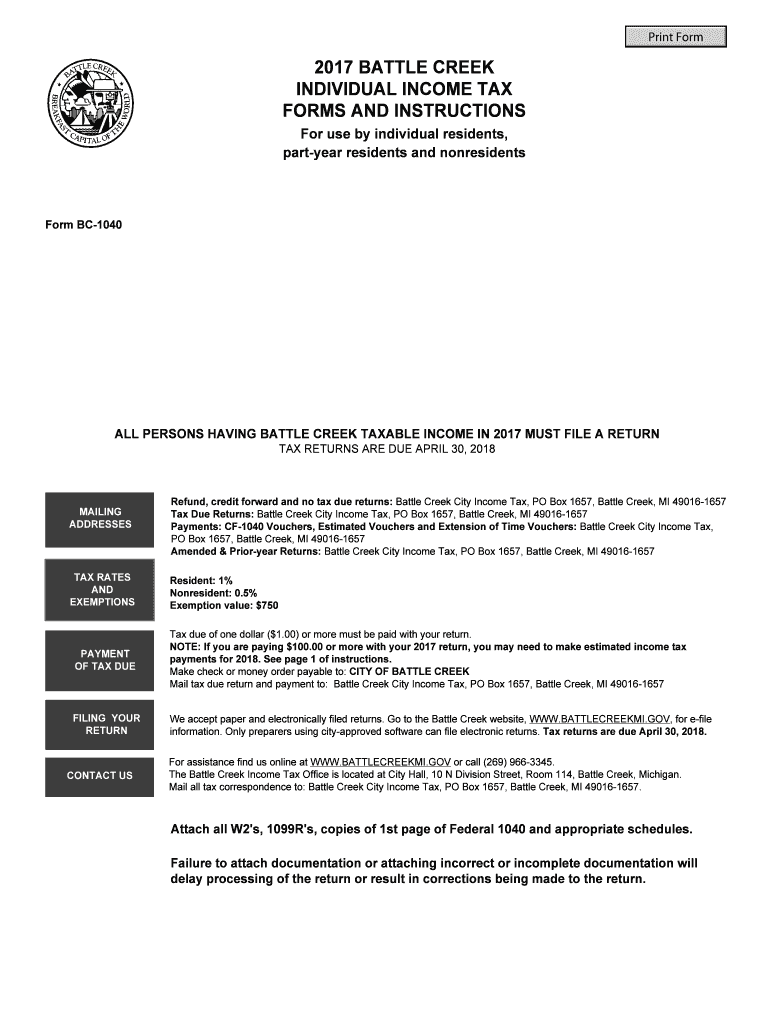

The Refund, Credit Forward And No Tax Due Returns Battle Creek City Income Tax form is a specific document used by residents of Battle Creek, Michigan, to report their income tax status. This form allows taxpayers to claim any refunds, apply credits forward to future tax years, or indicate that no tax is due for the current year. It is essential for ensuring compliance with local tax regulations and for managing any potential refunds or credits effectively.

Steps to complete the Refund, Credit Forward And No Tax Due Returns Battle Creek City Income Tax

Completing the Refund, Credit Forward And No Tax Due Returns Battle Creek City Income Tax form involves several key steps:

- Gather all necessary financial documents, including W-2s and 1099s.

- Access the form online or obtain a physical copy from the appropriate local tax office.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income and any applicable deductions or credits.

- Indicate whether you are claiming a refund, applying credits forward, or reporting no tax due.

- Review the completed form for accuracy before submission.

- Sign and date the form, then submit it via the designated method.

How to use the Refund, Credit Forward And No Tax Due Returns Battle Creek City Income Tax

This form can be used by Battle Creek residents to manage their income tax obligations effectively. It serves multiple purposes, including:

- Claiming any refunds owed to you by the city.

- Applying unused credits to future tax years.

- Indicating that no tax is due, which may simplify your filing process.

Using this form correctly ensures that you remain compliant with local tax laws and can help you avoid potential penalties.

Legal use of the Refund, Credit Forward And No Tax Due Returns Battle Creek City Income Tax

The Refund, Credit Forward And No Tax Due Returns Battle Creek City Income Tax form is legally binding when completed accurately and submitted in accordance with local regulations. It is crucial to adhere to the guidelines set forth by the city of Battle Creek and the state of Michigan to ensure that your submission is valid. This includes providing accurate information and meeting filing deadlines.

Filing Deadlines / Important Dates

Filing deadlines for the Refund, Credit Forward And No Tax Due Returns Battle Creek City Income Tax form are typically aligned with the federal tax deadlines. It is important to be aware of specific dates, such as:

- April 15 for individual income tax returns.

- Any extensions that may apply for filing or payment.

Staying informed about these dates helps ensure timely submissions and avoids penalties.

Required Documents

To complete the Refund, Credit Forward And No Tax Due Returns Battle Creek City Income Tax form, you will need several documents, including:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any deductions or credits you plan to claim.

Having these documents ready will streamline the process of filling out the form and ensure accuracy.

Quick guide on how to complete refund credit forward and no tax due returns battle creek city income tax po box 1657 battle creek mi 49016 1657

Your assistance manual on how to prepare your Refund, Credit Forward And No Tax Due Returns Battle Creek City Income Tax, PO Box 1657, Battle Creek, MI 49016 1657

If you are curious about how to fill out and submit your Refund, Credit Forward And No Tax Due Returns Battle Creek City Income Tax, PO Box 1657, Battle Creek, MI 49016 1657, here are some straightforward instructions to simplify tax filing.

To begin, all you need to do is create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to alter, generate, and complete your tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures and return to modify details as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Refund, Credit Forward And No Tax Due Returns Battle Creek City Income Tax, PO Box 1657, Battle Creek, MI 49016 1657 in just a few minutes:

- Set up your account and start working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Refund, Credit Forward And No Tax Due Returns Battle Creek City Income Tax, PO Box 1657, Battle Creek, MI 49016 1657 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to append your legally-binding eSignature (if needed).

- Examine your document and correct any errors.

- Save alterations, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that filing on paper may lead to increased return errors and slower reimbursements. Furthermore, prior to e-filing your taxes, consult the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct refund credit forward and no tax due returns battle creek city income tax po box 1657 battle creek mi 49016 1657

Create this form in 5 minutes!

How to create an eSignature for the refund credit forward and no tax due returns battle creek city income tax po box 1657 battle creek mi 49016 1657

How to make an electronic signature for the Refund Credit Forward And No Tax Due Returns Battle Creek City Income Tax Po Box 1657 Battle Creek Mi 49016 1657 online

How to generate an electronic signature for the Refund Credit Forward And No Tax Due Returns Battle Creek City Income Tax Po Box 1657 Battle Creek Mi 49016 1657 in Google Chrome

How to make an electronic signature for signing the Refund Credit Forward And No Tax Due Returns Battle Creek City Income Tax Po Box 1657 Battle Creek Mi 49016 1657 in Gmail

How to generate an eSignature for the Refund Credit Forward And No Tax Due Returns Battle Creek City Income Tax Po Box 1657 Battle Creek Mi 49016 1657 straight from your smart phone

How to generate an eSignature for the Refund Credit Forward And No Tax Due Returns Battle Creek City Income Tax Po Box 1657 Battle Creek Mi 49016 1657 on iOS devices

How to make an electronic signature for the Refund Credit Forward And No Tax Due Returns Battle Creek City Income Tax Po Box 1657 Battle Creek Mi 49016 1657 on Android OS

People also ask

-

What is the process for filing Refund, Credit Forward And No Tax Due Returns for Battle Creek City Income Tax?

To file Refund, Credit Forward And No Tax Due Returns for Battle Creek City Income Tax, simply gather your required documents and complete the necessary forms. You can submit your returns by mail to PO Box 1657, Battle Creek, MI 49016 1657. Make sure to adhere to the deadlines to avoid penalties.

-

What documents are needed for Refund, Credit Forward And No Tax Due Returns Battle Creek City Income Tax?

For Refund, Credit Forward And No Tax Due Returns, you'll typically need your W-2 forms, 1099 forms, and any supporting documentation for deductions or credits. These documents help ensure accurate reporting of your income and any applicable refunds. Always keep copies of everything you submit.

-

Are there fees associated with filing Refund, Credit Forward And No Tax Due Returns for Battle Creek City Income Tax?

Generally, there are no fees for filing a Refund, Credit Forward And No Tax Due Returns with Battle Creek City Income Tax if you are filing on your own. However, if you choose to use a tax professional or software, those services may charge a fee. It’s advisable to review their pricing before proceeding.

-

How can airSlate SignNow assist in filing my Refund, Credit Forward And No Tax Due Returns?

airSlate SignNow offers a streamlined platform for preparing and signing your tax documents securely. You can easily get your Refund, Credit Forward And No Tax Due Returns ready and electronically signed, speeding up the entire process. Our solution is user-friendly and ensures compliance with document requirements.

-

What are the benefits of using airSlate SignNow for my tax filing needs?

Using airSlate SignNow for your tax filing provides you with a secure and efficient way to manage documents. You'll benefit from features like easy eSigning, document tracking, and cloud storage, making it ideal for handling Refund, Credit Forward And No Tax Due Returns Battle Creek City Income Tax. This technology can save you time and streamline your filing process.

-

Is airSlate SignNow integrated with other tax preparation software?

Yes, airSlate SignNow can integrate with various tax preparation software, enabling a seamless workflow for your Refund, Credit Forward And No Tax Due Returns Battle Creek City Income Tax. This integration helps you manage your documents and submissions more effectively. Ensure to check compatibility with your chosen software.

-

What should I do if I encounter issues with my Refund, Credit Forward And No Tax Due Returns?

If you face any issues with your Refund, Credit Forward And No Tax Due Returns for Battle Creek City Income Tax, it's essential to first check your submitted documents for accuracy. You can also contact the tax office directly at their specified contact number for assistance. airSlate SignNow's support team can help you with document-related inquiries as well.

Get more for Refund, Credit Forward And No Tax Due Returns Battle Creek City Income Tax, PO Box 1657, Battle Creek, MI 49016 1657

- Certificado de cbtis form

- Has successfully completed civil rights training squaremeals form

- Syep timesheet 86852909 form

- Ap housing application form pdf

- Form 34a income tax

- Colortronic c150 manual form

- Its a long way to neptune amazon s3 form

- Rabies antibody test biochemistry amp toxicology certificate riasbt or form

Find out other Refund, Credit Forward And No Tax Due Returns Battle Creek City Income Tax, PO Box 1657, Battle Creek, MI 49016 1657

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple