MICHIGAN Adjustments of Capital Gains and Losses MI 1041D 2023-2026

What is the Michigan Adjustments of Capital Gains and Losses MI 1041D

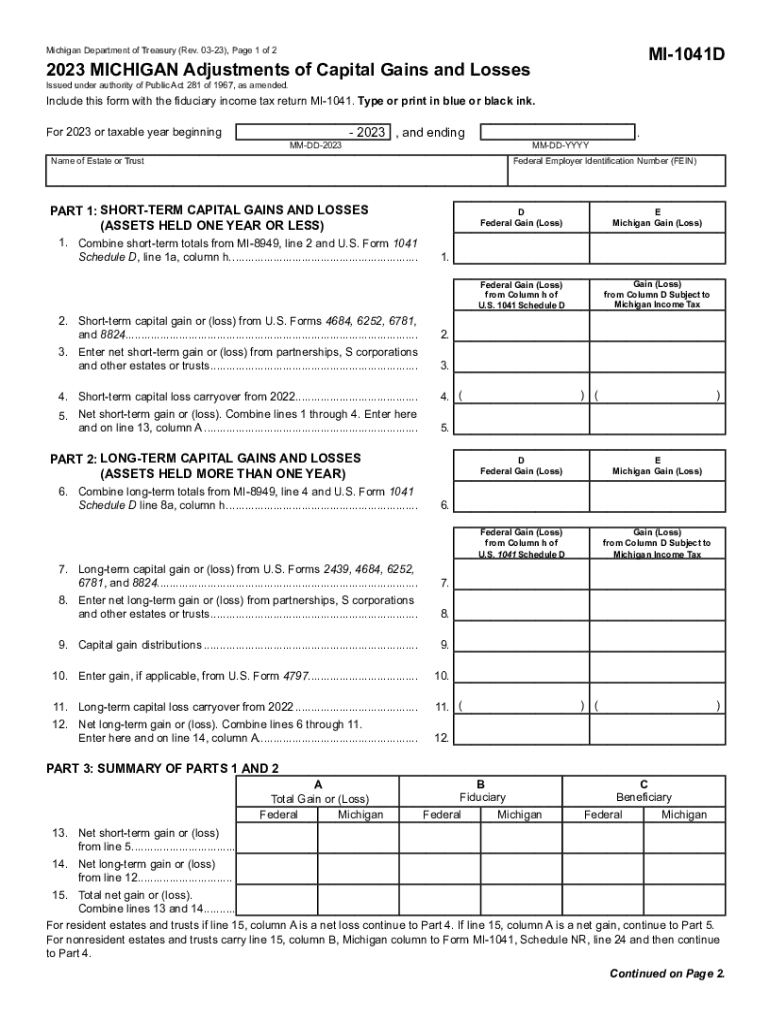

The Michigan Adjustments of Capital Gains and Losses MI 1041D is a tax form used by individuals and entities to report capital gains and losses on their Michigan state tax returns. This form is specifically designed for the adjustments that need to be made to federal capital gains and losses when calculating state tax obligations. Understanding this form is crucial for ensuring compliance with Michigan tax laws and accurately reporting income.

How to use the Michigan Adjustments of Capital Gains and Losses MI 1041D

To effectively use the Michigan Adjustments of Capital Gains and Losses MI 1041D, taxpayers must first gather all relevant financial information regarding their capital transactions. This includes details of any sales or exchanges of assets that resulted in gains or losses. The form allows taxpayers to adjust their federal capital gains and losses to align with Michigan tax regulations. It is important to follow the instructions carefully to ensure that all entries are accurate and complete.

Steps to complete the Michigan Adjustments of Capital Gains and Losses MI 1041D

Completing the Michigan Adjustments of Capital Gains and Losses MI 1041D involves several key steps:

- Gather all necessary documentation related to capital gains and losses.

- Fill out the form by entering the total capital gains and losses as reported on the federal return.

- Make the required adjustments specific to Michigan tax law, which may differ from federal regulations.

- Review the completed form for accuracy and completeness.

- Submit the form along with your Michigan tax return by the designated deadline.

Key elements of the Michigan Adjustments of Capital Gains and Losses MI 1041D

Several key elements are essential when working with the Michigan Adjustments of Capital Gains and Losses MI 1041D. These include:

- Capital Gains: Profits from the sale of assets that are subject to tax.

- Capital Losses: Losses incurred from the sale of assets, which can offset gains.

- Adjustments: Modifications required to align federal figures with Michigan tax laws.

- Filing Requirements: Specific guidelines on when and how to file the form.

Legal use of the Michigan Adjustments of Capital Gains and Losses MI 1041D

The Michigan Adjustments of Capital Gains and Losses MI 1041D is legally required for taxpayers who have capital gains or losses to report. Proper use of this form ensures compliance with state tax laws and helps avoid potential penalties. Taxpayers must ensure that all information reported is accurate and reflects their financial situation to meet legal obligations.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Michigan Adjustments of Capital Gains and Losses MI 1041D. Typically, this form must be submitted along with the Michigan tax return by April 15th of the following year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Staying informed about these dates is crucial for timely compliance.

Quick guide on how to complete michigan adjustments of capital gains and losses mi 1041d

Complete MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly option to conventional printed and signed papers, allowing you to obtain the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D without any hassle

- Locate MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D and then click Get Form to begin.

- Use the tools we offer to finalize your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D and ensure clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct michigan adjustments of capital gains and losses mi 1041d

Create this form in 5 minutes!

How to create an eSignature for the michigan adjustments of capital gains and losses mi 1041d

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Michigan capital?

airSlate SignNow is a powerful eSignature and document management solution that helps businesses streamline their signing processes. For companies in Michigan capital, it offers an easy-to-use platform that ensures secure and efficient document signing, enhancing productivity.

-

How does airSlate SignNow help businesses in Michigan capital save on costs?

By using airSlate SignNow, businesses in Michigan capital can signNowly reduce the costs associated with paper documents and traditional signatures. The platform's digital approach minimizes printing, mailing, and storage expenses, making it a cost-effective solution for any size business.

-

What features does airSlate SignNow offer to users in Michigan capital?

airSlate SignNow provides a range of features, including customizable templates, real-time tracking, and integration with popular applications. These features are particularly beneficial for businesses in Michigan capital looking to enhance their document management processes.

-

Can airSlate SignNow integrate with other software commonly used in Michigan capital?

Yes, airSlate SignNow seamlessly integrates with many software applications that businesses in Michigan capital already use. This includes CRM systems, project management tools, and cloud storage solutions, ensuring a smooth workflow for users.

-

What are the benefits of using airSlate SignNow for Michigan capital residents?

Residents and businesses in Michigan capital can enjoy several benefits from using airSlate SignNow, including improved efficiency and faster turnaround times for documents. The platform enhances collaboration and ensures that signing documents is a hassle-free experience.

-

Is airSlate SignNow a secure option for businesses in Michigan capital?

Absolutely! airSlate SignNow prioritizes security with advanced encryption technology, ensuring that all documents are protected. For businesses in Michigan capital, this means peace of mind knowing their sensitive information remains confidential.

-

What is the pricing structure for airSlate SignNow for users in Michigan capital?

airSlate SignNow offers flexible pricing plans tailored to different business needs, making it accessible for all companies in Michigan capital. The plans vary based on features and user counts, providing a cost-effective solution for every budget.

Get more for MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D

Find out other MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors