Mi 1041d 2017

What is the Mi 1041d?

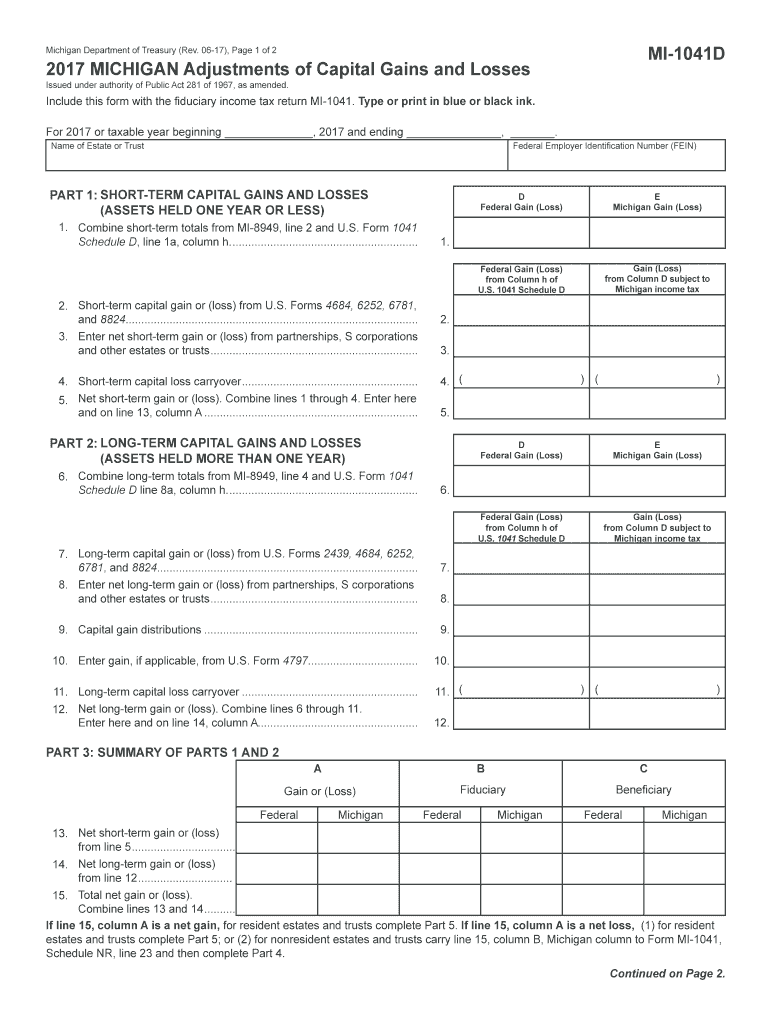

The Mi 1041d is a tax form used by businesses and individuals in Michigan to report income and calculate the state income tax owed. This form is specifically designed for fiduciaries, such as executors of estates or trustees, who are responsible for managing and distributing income on behalf of beneficiaries. It captures various income sources and deductions applicable to the estate or trust, ensuring compliance with Michigan tax laws.

How to use the Mi 1041d

Using the Mi 1041d involves several steps to ensure accurate reporting of income and tax obligations. First, gather all necessary financial documents related to the estate or trust, including income statements and records of deductions. Next, complete the form by entering the relevant financial information in the designated fields. It is important to review the form for accuracy before submission, as errors can lead to delays or penalties. Finally, submit the completed form to the Michigan Department of Treasury by the specified deadline.

Steps to complete the Mi 1041d

Completing the Mi 1041d requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, such as income statements and deduction records.

- Fill out the form, ensuring that all income sources are accurately reported.

- Include any applicable deductions to reduce the taxable income.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where required.

- Submit the form by mail or electronically, as per the instructions provided.

Legal use of the Mi 1041d

The Mi 1041d is legally binding when completed and submitted in accordance with Michigan tax regulations. To ensure its legal standing, it must be signed by the fiduciary responsible for the estate or trust. Additionally, compliance with relevant laws, such as the Michigan Income Tax Act, is essential. Failure to adhere to these regulations can result in penalties or legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Mi 1041d are crucial to avoid penalties. Generally, the form must be filed by the 15th day of the fourth month following the close of the tax year. For estates or trusts that operate on a calendar year, this means the form is due by April 15 of the following year. It is important to stay informed about any changes to deadlines or extensions that may apply.

Required Documents

To complete the Mi 1041d, several documents are typically required. These include:

- Income statements for the estate or trust.

- Records of all deductions claimed.

- Previous tax returns, if applicable.

- Any supporting documentation for income and deductions, such as receipts or bank statements.

Quick guide on how to complete michigan income tax withholding guide state of michigan

Effortlessly Prepare Mi 1041d on Any Device

The management of online documents has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any complications. Manage Mi 1041d on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Editing and eSigning Mi 1041d with Ease

- Locate Mi 1041d and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your updates.

- Select your preferred method to distribute your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that require the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Mi 1041d to guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct michigan income tax withholding guide state of michigan

Create this form in 5 minutes!

How to create an eSignature for the michigan income tax withholding guide state of michigan

How to generate an eSignature for your Michigan Income Tax Withholding Guide State Of Michigan in the online mode

How to generate an eSignature for the Michigan Income Tax Withholding Guide State Of Michigan in Google Chrome

How to create an eSignature for putting it on the Michigan Income Tax Withholding Guide State Of Michigan in Gmail

How to generate an electronic signature for the Michigan Income Tax Withholding Guide State Of Michigan right from your smartphone

How to generate an electronic signature for the Michigan Income Tax Withholding Guide State Of Michigan on iOS

How to create an eSignature for the Michigan Income Tax Withholding Guide State Of Michigan on Android

People also ask

-

What is MI 1041D 2018?

The MI 1041D 2018 form is a crucial document used for certain tax purposes in Michigan. It allows taxpayers to report and calculate their tax responsibilities, ensuring they remain compliant with state regulations. Understanding this form is essential for anyone looking to file their taxes accurately.

-

How can airSlate SignNow help me with MI 1041D 2018?

airSlate SignNow provides a seamless platform to eSign the MI 1041D 2018 form quickly and securely. You can upload the document, add your signatures, and send it to relevant parties without any hassle. This streamlines the filing process and ensures that your documents are handled efficiently.

-

Is there a cost associated with using airSlate SignNow for MI 1041D 2018?

Yes, while airSlate SignNow offers competitive pricing, the costs can vary based on your specific needs and the number of documents you send. However, the value you receive, especially for handling important forms like MI 1041D 2018, is signNow due to the time saved and the convenience provided.

-

What features does airSlate SignNow offer for MI 1041D 2018?

airSlate SignNow offers features such as secure eSigning, document templates, and automated reminders for MI 1041D 2018. These tools make the documentation process smoother and help ensure that you meet all necessary deadlines. Additionally, the platform is user-friendly, making it accessible for all businesses.

-

Can I integrate airSlate SignNow with other tools for MI 1041D 2018?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage the MI 1041D 2018 form alongside other business tools. Popular integrations include CRM systems and cloud storage services, allowing for an efficient workflow that keeps all your documents in sync.

-

What are the benefits of using airSlate SignNow for MI 1041D 2018?

Using airSlate SignNow for the MI 1041D 2018 form offers benefits such as increased efficiency and reduced paper usage. With eSigning capabilities, you can finalize your tax documents from anywhere, at any time, streamlining the process. This not only saves time but also helps reduce the risk of errors.

-

How secure is airSlate SignNow when dealing with MI 1041D 2018?

airSlate SignNow takes security seriously, utilizing advanced encryption and secure servers to protect your MI 1041D 2018 form and any sensitive information. This ensures that your data remains confidential and secure throughout the signing process. You can trust that your documents are in safe hands.

Get more for Mi 1041d

- Eia 861s form us energy information administration eia

- Iaff report form

- Travel insurance claim form pdf 28mb monash university monash edu

- Mauritius renewal passport form

- Adv lionel jacobs form

- Ifta license application saskatchewan finance finance gov sk form

- Devonhomechoice form

- Quarterlymonthly building inspection form ladelta

Find out other Mi 1041d

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself