MICHIGAN Adjustments of Capital Gains and Losses MI 1041D MICHIGAN Adjustments of Capital Gains and Losses MI 1041D 2019

Understanding the MI 1041D 2018 Form

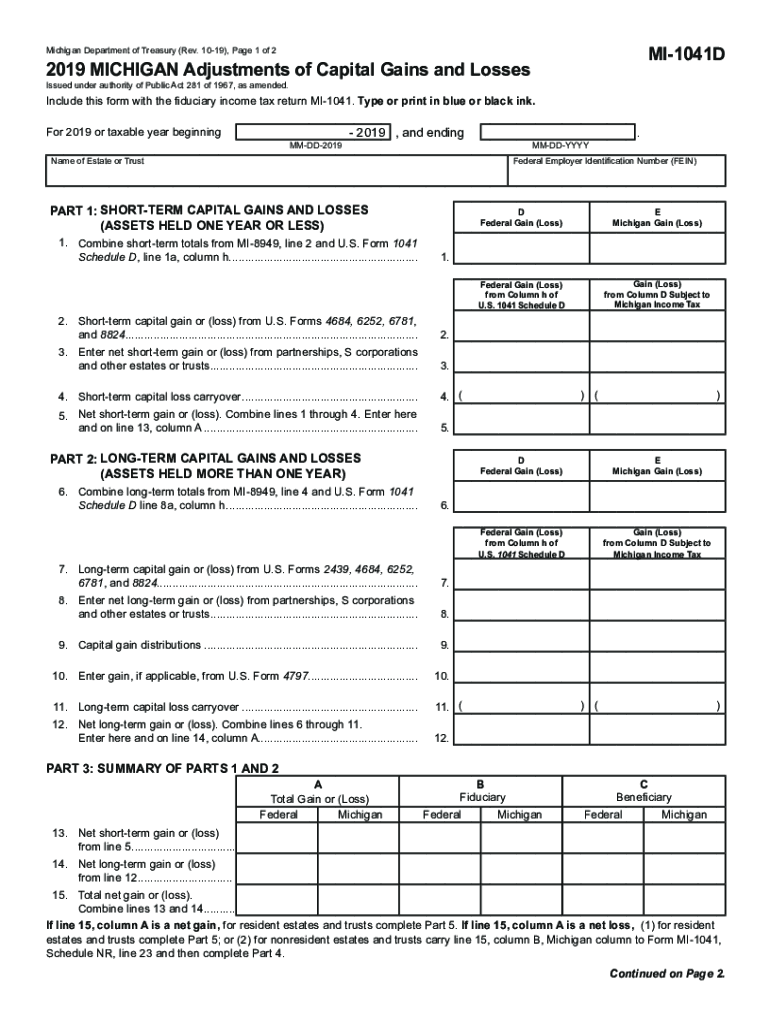

The MI 1041D 2018 form, known as the Michigan Adjustments of Capital Gains and Losses, is a crucial document for taxpayers in Michigan. This form is specifically designed for fiduciaries to report adjustments related to capital gains and losses that affect the taxable income of estates and trusts. Understanding its purpose is essential for accurate tax reporting and compliance with state regulations.

Steps to Complete the MI 1041D 2018 Form

Completing the MI 1041D 2018 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including records of capital gains and losses. Next, fill out the form by entering the required information in the designated fields. It is important to double-check calculations and ensure that all entries align with the supporting documentation. Finally, review the form for completeness before submission.

Legal Use of the MI 1041D 2018 Form

The MI 1041D 2018 form holds legal significance as it is used to report capital gains and losses for estates and trusts in Michigan. Properly completing and submitting this form ensures compliance with state tax laws. Electronic signatures can be used for submission, provided they meet the legal standards set forth by U.S. regulations, including the ESIGN Act and UETA. This ensures that the form is legally binding and recognized by the state.

Key Elements of the MI 1041D 2018 Form

Key elements of the MI 1041D 2018 form include sections for reporting various types of capital gains and losses. Taxpayers must provide detailed information about the transactions that led to these gains or losses. This includes the date of acquisition, sale price, and the adjusted basis of the assets involved. Accurately reporting these elements is crucial for determining the correct tax liability.

Filing Deadlines for the MI 1041D 2018 Form

Filing deadlines for the MI 1041D 2018 form are critical for compliance. Typically, the form must be submitted by April 15 of the year following the tax year being reported. However, if the fiduciary has applied for an extension, the deadline may be extended to October 15. It is essential to keep track of these dates to avoid penalties for late submission.

Obtaining the MI 1041D 2018 Form

Taxpayers can obtain the MI 1041D 2018 form through the Michigan Department of Treasury's website or by contacting their local tax office. The form is available in both digital and paper formats, allowing for flexibility in how it is completed and submitted. Ensuring you have the correct version of the form is important for accurate reporting.

Quick guide on how to complete 2019 michigan adjustments of capital gains and losses mi 1041d 2019 michigan adjustments of capital gains and losses mi 1041d

Complete MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely retain it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D seamlessly

- Find MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize crucial sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that use.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to preserve your changes.

- Select how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 michigan adjustments of capital gains and losses mi 1041d 2019 michigan adjustments of capital gains and losses mi 1041d

Create this form in 5 minutes!

How to create an eSignature for the 2019 michigan adjustments of capital gains and losses mi 1041d 2019 michigan adjustments of capital gains and losses mi 1041d

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is the MI 1041D 2018 form and who needs to complete it?

The MI 1041D 2018 is a tax form specifically used by the Michigan Department of Treasury for reporting income for estates and trusts. Individuals managing estates or trusts in Michigan are required to complete this form to ensure compliance with state tax regulations.

-

How can airSlate SignNow help me with the MI 1041D 2018 form?

airSlate SignNow offers a streamlined platform for electronically signing and sending the MI 1041D 2018 form. With our easy-to-use tools, you can quickly complete, sign, and share your tax documents securely, saving you valuable time and increasing accuracy.

-

What are the pricing options for using airSlate SignNow to manage the MI 1041D 2018 process?

airSlate SignNow provides flexible pricing plans to suit the needs of any business, whether you are a freelancer or part of a large organization. We also offer transparent pricing for eSigning services associated with the MI 1041D 2018 form, allowing you to choose the best option based on your document volume and required features.

-

Are there any integration options for using airSlate SignNow with accounting software for the MI 1041D 2018?

Yes, airSlate SignNow integrates seamlessly with various popular accounting and tax software solutions. This makes it easier to manage your MI 1041D 2018 form alongside your financial tools, helping to streamline your workflow and maintain accurate records.

-

What security measures does airSlate SignNow implement for the MI 1041D 2018 form?

Security is a top priority at airSlate SignNow. We employ robust encryption protocols and comply with industry standards to ensure that your MI 1041D 2018 form and other documents are protected against unauthorized access while in transit and at rest.

-

Can I track the status of my MI 1041D 2018 form with airSlate SignNow?

Absolutely! airSlate SignNow offers tracking features that allow you to monitor the status of your MI 1041D 2018 form throughout the signing process. You’ll receive notifications when documents are viewed, signed, or completed, ensuring you stay informed every step of the way.

-

Is there customer support available for issues related to the MI 1041D 2018 form?

Yes, airSlate SignNow provides comprehensive customer support to assist you with any issues related to the MI 1041D 2018 form. Our dedicated team is available via chat, email, or phone to ensure you have the help you need whenever it's required.

Get more for MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D

- Confidential sheet document form

- Addendum confidential form

- Sealed financial form

- Support worksheets form

- Washington child support 497430411 form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497430412 form

- Bill of sale of automobile and odometer statement wisconsin form

- Bill of sale for automobile or vehicle including odometer statement and promissory note wisconsin form

Find out other MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement