MICHIGAN Adjustments of Capital Gains and Losses MI 1041D MICHIGAN Adjustments of Capital Gains and Losses MI 1041D 2020

Understanding the MI 1041D 2018 Form

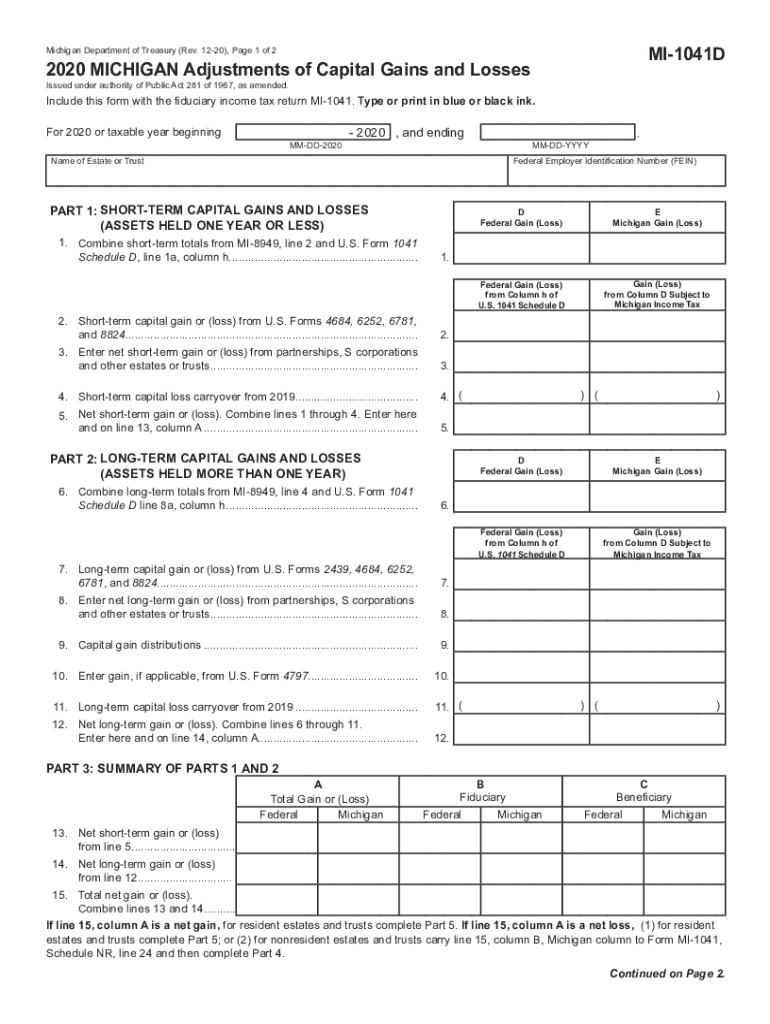

The MI 1041D 2018 form, known as the Michigan Adjustments of Capital Gains and Losses, is essential for reporting adjustments related to capital gains and losses for entities that are subject to Michigan income tax. This form is specifically designed for fiduciaries of estates and trusts to accurately report these adjustments to the Michigan Department of Treasury. Understanding the nuances of this form is crucial for compliance and accurate tax reporting.

Steps to Complete the MI 1041D 2018 Form

Completing the MI 1041D 2018 form involves several key steps:

- Gather Necessary Information: Collect all relevant financial documents, including income statements and records of capital gains and losses.

- Fill Out the Form: Input the required information accurately, ensuring that all figures are correct and correspond to your financial records.

- Review for Accuracy: Double-check all entries for accuracy to avoid potential penalties.

- Sign and Date: Ensure that the form is signed and dated by the fiduciary responsible for the estate or trust.

Legal Use of the MI 1041D 2018 Form

The MI 1041D 2018 form is legally binding when completed and submitted in accordance with Michigan tax laws. To ensure its legal validity, it must be filled out accurately, signed by the appropriate party, and submitted by the designated deadlines. Compliance with state regulations is essential to avoid penalties and ensure that the adjustments are recognized by the Michigan Department of Treasury.

Key Elements of the MI 1041D 2018 Form

The MI 1041D 2018 form includes several key elements that are critical for accurate reporting:

- Identification Information: This includes the name, address, and tax identification number of the estate or trust.

- Capital Gains and Losses: Detailed reporting of capital gains and losses that occurred during the tax year.

- Adjustments: Specific adjustments that need to be made based on Michigan tax laws.

Filing Deadlines for the MI 1041D 2018 Form

Timely filing of the MI 1041D 2018 form is crucial to avoid penalties. The form is typically due on the same date as the federal income tax return for the estate or trust. It is important to check for any specific deadlines set by the Michigan Department of Treasury to ensure compliance.

Examples of Using the MI 1041D 2018 Form

There are various scenarios where the MI 1041D 2018 form is applicable. For instance, if an estate sells a property and realizes a capital gain, the fiduciary must report this gain using the MI 1041D form. Similarly, if there are losses from the sale of stocks, these must also be reported to adjust the overall tax liability. Each situation requires careful consideration of the form's instructions to ensure accurate reporting.

Quick guide on how to complete 2020 michigan adjustments of capital gains and losses mi 1041d 2020 michigan adjustments of capital gains and losses mi 1041d

Effortlessly prepare MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D on any device

Digital document management has gained signNow traction among organizations and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-driven task today.

The easiest way to edit and electronically sign MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D effortlessly

- Locate MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Select your preferred method to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 michigan adjustments of capital gains and losses mi 1041d 2020 michigan adjustments of capital gains and losses mi 1041d

Create this form in 5 minutes!

How to create an eSignature for the 2020 michigan adjustments of capital gains and losses mi 1041d 2020 michigan adjustments of capital gains and losses mi 1041d

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is the MI 1041D 2018 form and why is it important?

The MI 1041D 2018 form is a crucial document for fiscal year reporting in Michigan, specifically for fiduciary tax returns. Businesses and estates must complete this form to ensure compliance with state tax regulations. Understanding its requirements helps avoid penalties and ensures accurate filings.

-

How can airSlate SignNow help me with the MI 1041D 2018 form?

airSlate SignNow streamlines the process of preparing and eSigning the MI 1041D 2018 form. With user-friendly templates and cloud storage, you can easily fill out and manage your documents securely. This efficiency saves time and minimizes the hassle of traditional paper processes.

-

What are the pricing options for airSlate SignNow for handling the MI 1041D 2018?

airSlate SignNow offers flexible pricing plans designed for businesses of all sizes managing forms like the MI 1041D 2018. Plans vary based on the number of users and features you need, allowing you to choose an option that best fits your budget. Explore our website for detailed pricing information.

-

What features does airSlate SignNow provide for the MI 1041D 2018 form?

AirSlate SignNow includes essential features such as document templates, real-time collaboration, and automated reminders specifically for the MI 1041D 2018. These features enhance the efficiency of document management and ensure timely submissions. Additionally, users can access audit trails for compliance tracking.

-

Can I integrate airSlate SignNow with other tools for the MI 1041D 2018?

Yes, airSlate SignNow integrates seamlessly with various applications that are useful for managing the MI 1041D 2018 form. This includes CRM systems, cloud storage solutions, and productivity tools. Leveraging these integrations can enhance your workflow and document handling processes.

-

What are the benefits of eSigning the MI 1041D 2018 through airSlate SignNow?

eSigning the MI 1041D 2018 with airSlate SignNow offers signNow benefits, including speed and security. The process eliminates the need for printing and scanning, allowing for quicker submission of documents. Moreover, advanced encryption and authentication ensure that your sensitive information remains protected.

-

Is airSlate SignNow compliant with state regulations for the MI 1041D 2018?

Absolutely, airSlate SignNow complies with all necessary state regulations relevant to the MI 1041D 2018 form. Our solutions are designed to meet compliance standards, ensuring that your signed documents are legally binding. You can trust airSlate SignNow to safeguard your compliance needs.

Get more for MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D

Find out other MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template