MICHIGAN Adjustments of Capital Gains and Losses MI 1041D 2021

What is the Michigan Adjustments of Capital Gains and Losses MI 1041D

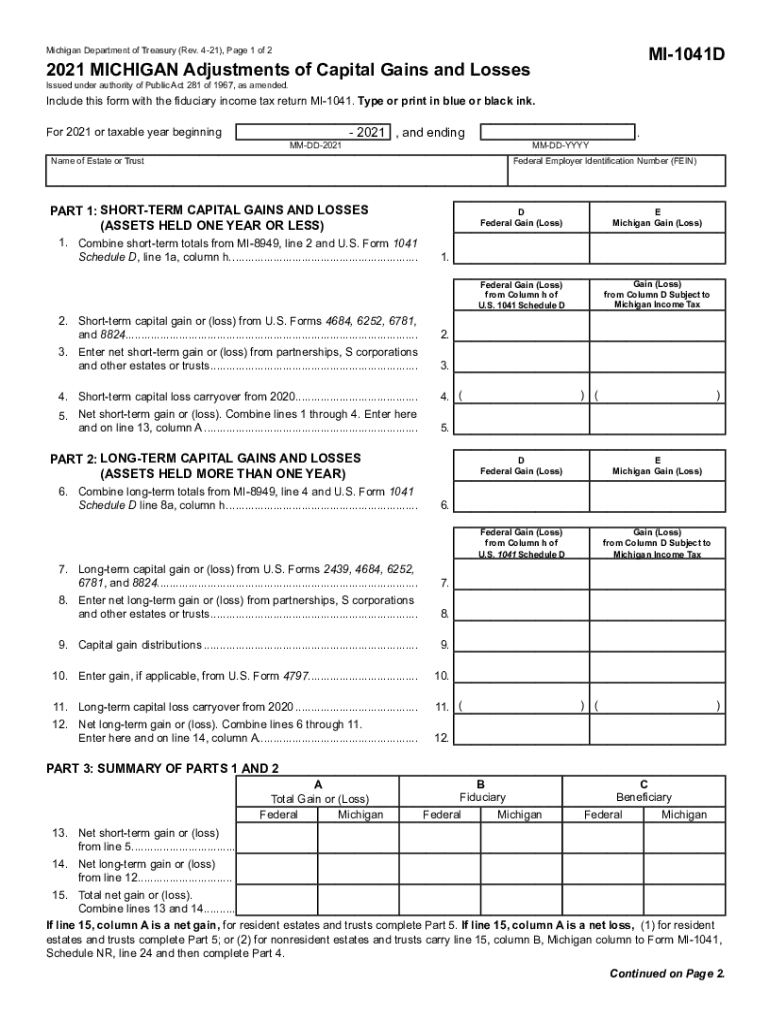

The Michigan Adjustments of Capital Gains and Losses MI 1041D is a tax form used to report adjustments to capital gains and losses for estates and trusts in Michigan. This form is essential for ensuring that any capital gains or losses are accurately reflected in the state tax filings. It serves to modify the federal amounts reported on the IRS Form 1041 to align with Michigan tax regulations. Understanding this form is crucial for fiduciaries managing estates or trusts, as it helps in determining the correct state tax liability.

Steps to Complete the Michigan Adjustments of Capital Gains and Losses MI 1041D

Completing the MI 1041D involves several key steps:

- Gather all necessary financial documents, including federal tax returns and any supporting documentation for capital gains and losses.

- Fill out the form by entering the required information, including the estate or trust's name, identification number, and the specific capital gains and losses that need adjustment.

- Calculate the adjustments by applying Michigan-specific rules to the federal amounts reported.

- Review the completed form for accuracy, ensuring all calculations are correct and all required fields are filled.

- Submit the form along with any other required tax documents to the Michigan Department of Treasury.

Legal Use of the Michigan Adjustments of Capital Gains and Losses MI 1041D

The MI 1041D is legally recognized as a valid document for reporting capital gains and losses in Michigan. To ensure its legal standing, the form must be completed accurately and submitted within the stipulated deadlines. It is important to comply with Michigan tax laws and regulations, as failure to do so may result in penalties or additional tax liabilities. Utilizing a reliable eSignature platform can also enhance the legal validity of the document by ensuring proper authentication and compliance with electronic signature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan Adjustments of Capital Gains and Losses MI 1041D typically coincide with the federal tax deadlines. Generally, the form must be filed by the fifteenth day of the fourth month following the close of the tax year for the estate or trust. For most taxpayers, this means the deadline is April 15. It is crucial to stay informed about any changes to these dates, as they can affect the timely submission of the form and potential penalties for late filing.

Examples of Using the Michigan Adjustments of Capital Gains and Losses MI 1041D

There are various scenarios where the MI 1041D may be utilized:

- When an estate sells property that has appreciated in value, the fiduciary must report the capital gain and adjust it according to Michigan tax laws.

- If a trust incurs capital losses from the sale of investments, these losses can be reported on the MI 1041D to offset any gains.

- Fiduciaries managing estates that have both federal and state tax obligations can use this form to ensure compliance with Michigan’s specific tax requirements.

Who Issues the Form

The Michigan Adjustments of Capital Gains and Losses MI 1041D is issued by the Michigan Department of Treasury. This department is responsible for overseeing tax collection and ensuring compliance with state tax laws. It is important for filers to access the most current version of the form from official state resources to ensure they are using the correct format and guidelines.

Quick guide on how to complete 2021 michigan adjustments of capital gains and losses mi 1041d

Effortlessly prepare MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the resources needed to craft, modify, and electronically sign your documents quickly without hold-ups. Manage MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to modify and electronically sign MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D with ease

- Find MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D and click on Get Form to begin.

- Use the tools provided to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 michigan adjustments of capital gains and losses mi 1041d

Create this form in 5 minutes!

People also ask

-

What is the mi 1041d 2018 form used for?

The mi 1041d 2018 form is primarily used for reporting income and expenses related to Michigan partnerships or limited liability companies. Completing this form accurately helps businesses ensure compliance with state tax regulations and provides clear financial information.

-

How can airSlate SignNow help with filling out the mi 1041d 2018?

airSlate SignNow offers various integrations that allow users to fill out the mi 1041d 2018 form quickly and efficiently. Our easy-to-use interface streamlines the document preparation process, enabling you to focus on the details without the hassle.

-

Is airSlate SignNow cost-effective for businesses filing the mi 1041d 2018?

Yes, airSlate SignNow is a cost-effective solution for businesses needing to file the mi 1041d 2018. Our pricing plans cater to various business sizes, ensuring you only pay for what you need while gaining access to robust eSigning features.

-

What features does airSlate SignNow offer for managing the mi 1041d 2018?

With airSlate SignNow, users can take advantage of advanced features such as document templates, customizable workflows, and secure storage for managing the mi 1041d 2018. These tools enhance efficiency and ensure your forms are always at your fingertips.

-

Can I integrate airSlate SignNow with other software for mi 1041d 2018 processing?

Absolutely! airSlate SignNow offers integrations with various accounting and financial software, making it easier to manage the mi 1041d 2018. This allows users to streamline workflows and reduce manual data entry, saving both time and resources.

-

What are the benefits of using airSlate SignNow for the mi 1041d 2018 filed electronically?

Using airSlate SignNow to eFile the mi 1041d 2018 provides benefits such as faster processing times, enhanced security, and reduced paperwork. Additionally, our platform ensures compliance with state regulations, giving businesses peace of mind in their filing process.

-

How secure is airSlate SignNow for handling the mi 1041d 2018 information?

airSlate SignNow employs industry-standard security measures to protect your sensitive information related to the mi 1041d 2018. With encryption and secure cloud storage, you can trust that your data remains confidential and safe from unauthorized access.

Get more for MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D

- Warranty deed from two individuals to llc north dakota form

- Title standards form

- Renunciation and disclaimer of real property interest north dakota form

- United states v south carolina recycling and disposal form

- Quitclaim deed by two individuals to corporation north dakota form

- North dakota corporation form

- Nd tod form

- Self inspection form

Find out other MICHIGAN Adjustments Of Capital Gains And Losses MI 1041D

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form