Pa 1000 Form 2017

What is the PA 1000 Form

The PA 1000 form is a state-specific tax document used by residents of Pennsylvania to claim a tax rebate on property taxes or rent paid during the previous year. This form is particularly relevant for individuals who meet certain eligibility criteria, such as age, income level, and residency status. The PA 1000 form is essential for accessing financial relief through the Pennsylvania Property Tax/Rent Rebate Program, which aims to assist low-income residents, including seniors and people with disabilities.

How to use the PA 1000 Form

To use the PA 1000 form effectively, individuals must first determine their eligibility based on the program's criteria. Once eligibility is confirmed, the next step involves gathering necessary documentation, such as proof of income and records of property taxes or rent payments. After collecting this information, users can fill out the form accurately, ensuring all details are complete and correct. Finally, the completed form must be submitted according to the specified filing methods, which can include online submission or mailing the form to the appropriate state office.

Steps to complete the PA 1000 Form

Completing the PA 1000 form involves several key steps:

- Gather required documents, including income statements and proof of property taxes or rent payments.

- Download or obtain the PA 1000 form from the Pennsylvania Department of Revenue website or local offices.

- Fill out the form, ensuring all personal information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the form via the chosen method, either online or by mail, ensuring it is sent to the correct address.

Legal use of the PA 1000 Form

The PA 1000 form must be used in accordance with Pennsylvania state law to ensure compliance and validity. This includes accurately reporting income and expenses related to property taxes or rent. Misrepresentation or fraudulent claims can lead to penalties, including fines and disqualification from future rebates. It is important for users to familiarize themselves with the legal requirements and guidelines set forth by the Pennsylvania Department of Revenue to avoid any issues during the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the PA 1000 form are crucial for ensuring timely processing of tax rebates. Typically, the form must be filed by June 30 of the year following the tax year for which the rebate is claimed. For example, to claim a rebate for the 2022 tax year, the form must be submitted by June 30, 2023. It is advisable for individuals to keep track of any changes to deadlines announced by the Pennsylvania Department of Revenue, especially in response to special circumstances or legislative changes.

Required Documents

When completing the PA 1000 form, certain documents are required to substantiate the claim. These typically include:

- Proof of income, such as W-2 forms or tax returns.

- Documentation of property taxes paid or rent receipts.

- Identification documents to verify residency and eligibility, such as a driver's license or state ID.

Having these documents prepared in advance can streamline the completion and submission process.

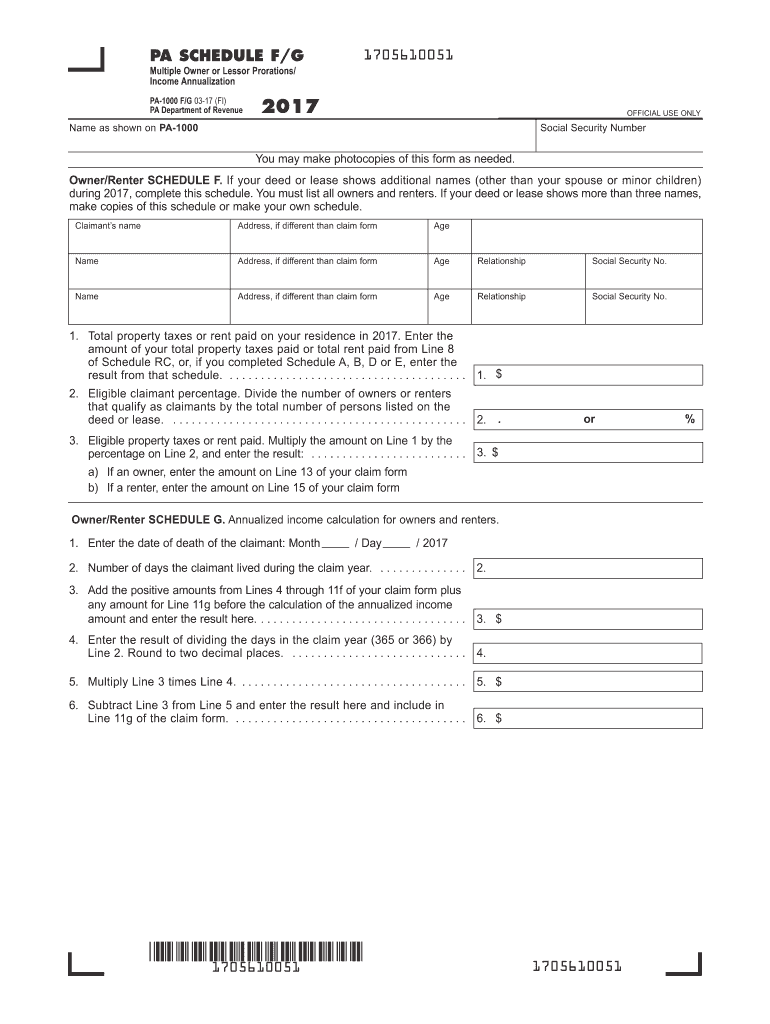

Quick guide on how to complete pa 1000 f schedule 2017 2019 form

Your assistance manual on how to prepare your Pa 1000 Form

If you’re wondering how to finalize and submit your Pa 1000 Form, here are a few straightforward guidelines on how to make tax submission less complicated.

To begin, you merely need to create your airSlate SignNow account to change how you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that allows you to modify, generate, and complete your tax documents effortlessly. With its editor, you can switch between text, checkboxes, and eSignatures and return to revise information as necessary. Streamline your tax management with enhanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Pa 1000 Form within a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Click Get form to access your Pa 1000 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper can increase return errors and postpone refunds. Certainly, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct pa 1000 f schedule 2017 2019 form

FAQs

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

A Data Entry Operator has been asked to fill 1000 forms. He fills 50 forms by the end of half-an hour, when he is joined by another steno who fills forms at the rate of 90 an hour. The entire work will be carried out in how many hours?

Work done by 1st person = 100 forms per hourWork done by 2nd person = 90 forms per hourSo, total work in 1 hour would be = 190 forms per hourWork done in 5hours = 190* 5 = 950Now, remaining work is only 50 formsIn 1 hour or 60minutes, 190 forms are filled and 50 forms will be filled in = 60/190 * 50 = 15.7minutes or 16minutes (approximaty)Total time = 5hours 16minutes

Create this form in 5 minutes!

How to create an eSignature for the pa 1000 f schedule 2017 2019 form

How to make an electronic signature for the Pa 1000 F Schedule 2017 2019 Form in the online mode

How to make an eSignature for the Pa 1000 F Schedule 2017 2019 Form in Chrome

How to create an eSignature for signing the Pa 1000 F Schedule 2017 2019 Form in Gmail

How to generate an electronic signature for the Pa 1000 F Schedule 2017 2019 Form from your smartphone

How to generate an electronic signature for the Pa 1000 F Schedule 2017 2019 Form on iOS devices

How to generate an electronic signature for the Pa 1000 F Schedule 2017 2019 Form on Android devices

People also ask

-

What is the Pa 1000 Form and why is it important?

The Pa 1000 Form is a crucial document used for individual income tax returns in Pennsylvania. It allows taxpayers to report their income, deductions, and tax credits accurately. Completing the Pa 1000 Form correctly ensures compliance with state tax regulations and helps avoid penalties.

-

How can airSlate SignNow help with the Pa 1000 Form?

airSlate SignNow streamlines the process of completing and eSigning the Pa 1000 Form. With its user-friendly interface, you can easily fill out the form electronically, gather signatures, and securely send it all from one platform. This saves time and enhances accuracy in your tax filing process.

-

What features does airSlate SignNow offer for managing the Pa 1000 Form?

airSlate SignNow offers features such as document templates, customizable workflows, and real-time collaboration, specifically designed to assist with the Pa 1000 Form. You can also track the signing status and receive notifications, ensuring you stay informed throughout the process.

-

Is airSlate SignNow cost-effective for handling the Pa 1000 Form?

Yes, airSlate SignNow provides a cost-effective solution for handling the Pa 1000 Form. With various pricing plans tailored for businesses of all sizes, you can choose a package that fits your budget while accessing all the essential features needed for efficient document management.

-

Can I integrate airSlate SignNow with other software for the Pa 1000 Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, making it easy to manage the Pa 1000 Form alongside your existing software tools. Popular integrations include CRM systems, accounting software, and cloud storage services, enhancing your overall workflow.

-

What are the benefits of using airSlate SignNow for the Pa 1000 Form?

Using airSlate SignNow for the Pa 1000 Form offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. The platform ensures your sensitive information is protected while simplifying the eSigning process, enabling quicker tax submissions.

-

Is it easy to eSign the Pa 1000 Form with airSlate SignNow?

Yes, eSigning the Pa 1000 Form with airSlate SignNow is incredibly easy. Users can simply upload the form, add signers, and send it out for signature with just a few clicks, making the entire process smooth and hassle-free.

Get more for Pa 1000 Form

- Request to hirerecruitment approval form

- Algeria visa application form visacenter us

- Domestic protection order forms ujs home state of south dakota ujs sd

- Sierra industries citation form

- Form it 204 cp new york corporate partners schedule k 1 tax year 772089043

- American heart association course evaluation form

- Room and board for parents agreement template form

- Government government proposal contract template form

Find out other Pa 1000 Form

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit