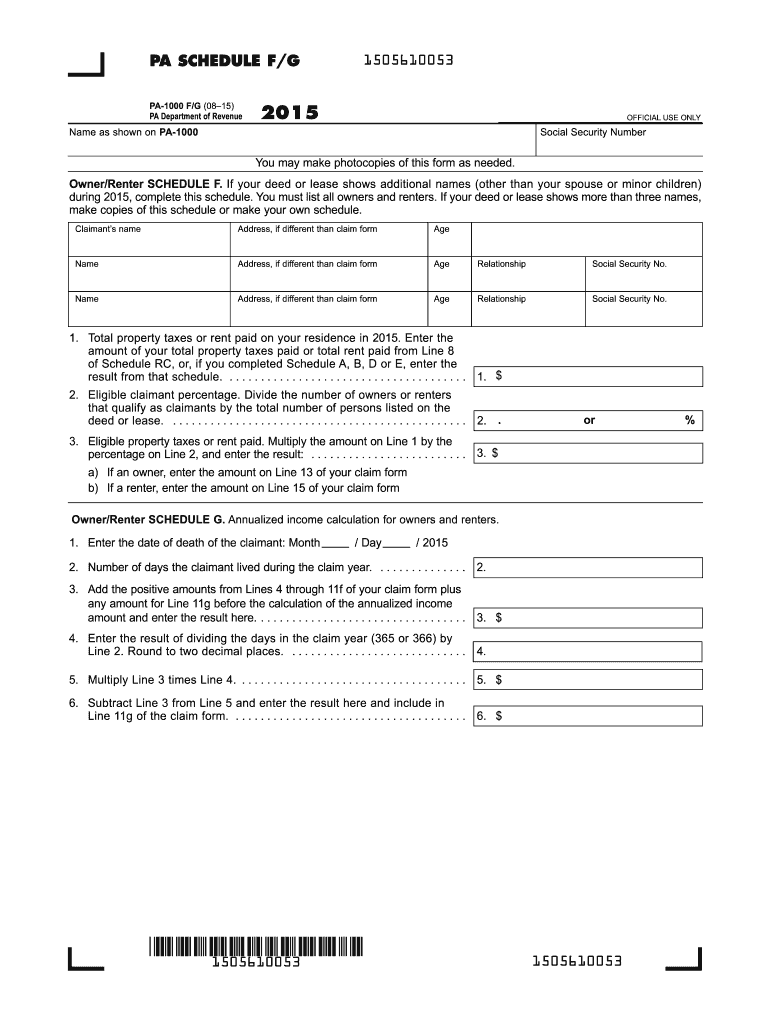

Pa 1000 F Schedule Form 2015

What is the Schedule F Tax Form?

The Schedule F tax form is used by farmers and ranchers in the United States to report income and expenses related to farming activities. This form is essential for individuals who operate a farm as a sole proprietorship or as a single-member LLC. By using Schedule F, taxpayers can calculate their net profit or loss from farming operations, which is then reported on their individual income tax return (Form 1040). It is important to note that this form is specifically designed for agricultural activities and helps ensure that farmers receive the appropriate deductions for their business expenses.

Steps to Complete the Schedule F Tax Form

Completing the Schedule F tax form involves several key steps:

- Gather Financial Records: Collect all relevant financial documents, including income statements, receipts for expenses, and any other records related to your farming activities.

- Report Income: Enter your total farming income in the designated section. This includes sales of livestock, produce, and other farm products.

- List Expenses: Itemize all allowable expenses related to your farming operations, such as feed, equipment, and maintenance costs. Be sure to keep accurate records to support your claims.

- Calculate Net Profit or Loss: Subtract total expenses from total income to determine your net profit or loss from farming activities.

- Complete Additional Sections: Fill out any additional sections of the form as required, such as information on self-employment tax if applicable.

- Review and Sign: Carefully review the completed form for accuracy before signing and submitting it with your tax return.

How to Obtain the Schedule F Tax Form

The Schedule F tax form can be obtained through several methods:

- IRS Website: Download the form directly from the official IRS website, where you can find the most current version available.

- Tax Preparation Software: Many tax preparation software programs include Schedule F and can guide you through the completion process.

- Local IRS Office: Visit a local IRS office to request a physical copy of the form if you prefer to fill it out by hand.

Filing Deadlines / Important Dates

For most taxpayers, the deadline for filing the Schedule F tax form coincides with the annual income tax return deadline, which is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, farmers may qualify for a special filing extension, allowing them to file their returns by September 15. It is crucial to stay informed about these dates to avoid penalties for late filing.

Legal Use of the Schedule F Tax Form

The Schedule F tax form is legally recognized by the IRS as the official document for reporting farming income and expenses. To ensure compliance, it is essential to follow IRS guidelines and accurately report all income and expenses. Misreporting can lead to audits or penalties. Additionally, eSigning the form is acceptable, as the IRS has expanded the use of electronic signatures for various forms, including Schedule F, to facilitate timely submissions.

Key Elements of the Schedule F Tax Form

Several key elements must be included when completing the Schedule F tax form:

- Identification Information: Include your name, address, and Social Security number or Employer Identification Number (EIN).

- Income Section: Report total income from farming activities, including sales and any subsidies received.

- Expenses Section: Itemize all farming-related expenses, categorized into sections such as operating expenses, depreciation, and other costs.

- Net Profit or Loss Calculation: Clearly show the calculation of your net profit or loss, as this figure is crucial for your overall tax return.

Quick guide on how to complete pa 1000 f schedule 2015 form

Your assistance manual on how to prepare your Pa 1000 F Schedule Form

If you’re curious about how to generate and send your Pa 1000 F Schedule Form, here are some quick tips to make tax filing easier.

To begin, you will need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, draft, and complete your tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and revisit to modify information as necessary. Streamline your tax handling with sophisticated PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Pa 1000 F Schedule Form in no time:

- Create your account and start editing PDFs rapidly.

- Utilize our directory to locate any IRS tax form; browse various versions and schedules.

- Click Obtain form to access your Pa 1000 F Schedule Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to add your legally-recognized eSignature (if required).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper can lead to increased return errors and delayed refunds. Before e-filing your taxes, make sure to verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct pa 1000 f schedule 2015 form

FAQs

-

How do I schedule a US visa interview of two people together after filling out a DS160 form?

Here is a link that might help answer your question >> DS-160: Frequently Asked QuestionsFor more information on this and similar matters, please call me direct: 650.424.1902Email: heller@hellerimmigration.comHeller Immigration Law Group | Silicon Valley Immigration Attorneys

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

I cannot fill up the ITR form on my own. If I go to any professional, they will charge me Rs. 1000, which I cannot pay. What can be my way out?

I can fill it for you…

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the pa 1000 f schedule 2015 form

How to generate an electronic signature for the Pa 1000 F Schedule 2015 Form in the online mode

How to make an eSignature for the Pa 1000 F Schedule 2015 Form in Chrome

How to create an electronic signature for signing the Pa 1000 F Schedule 2015 Form in Gmail

How to generate an eSignature for the Pa 1000 F Schedule 2015 Form straight from your smartphone

How to generate an eSignature for the Pa 1000 F Schedule 2015 Form on iOS

How to create an electronic signature for the Pa 1000 F Schedule 2015 Form on Android OS

People also ask

-

What is the schedule F tax form and who needs it?

The schedule F tax form is used by farmers and fishers to report income and expenses related to farming and fishing activities. If you earn income from these activities, you'll need to file this form as part of your annual tax return. Properly completing the schedule F can help you maximize your deductions and credits.

-

How can airSlate SignNow help with the schedule F tax form?

airSlate SignNow allows you to easily eSign and send your schedule F tax form and any related documents securely. With our user-friendly interface, you can reduce paperwork and streamline the filing process, ensuring timely submissions. This efficiency is particularly beneficial during tax season when time is of the essence.

-

What features does airSlate SignNow offer for managing tax forms?

AirSlate SignNow provides a variety of features tailored for tax form management, including customizable templates, secure e-signatures, and automated reminders. These tools make it easier to collect necessary signatures on your schedule F tax form, enhancing your workflow. Additionally, you can track the status of your documents in real-time.

-

Is airSlate SignNow cost-effective for small farmers using the schedule F tax form?

Yes, airSlate SignNow offers competitive pricing specifically designed to be budget-friendly for small farmers. Our plan provides all essential features needed to manage your schedule F tax form without breaking the bank. The efficiency gained often outweighs costs, allowing you to focus more on your business.

-

Can I integrate airSlate SignNow with other accounting software for my schedule F tax form?

Absolutely! AirSlate SignNow seamlessly integrates with various accounting software solutions compatible with the schedule F tax form. This integration allows for smooth data transfer and helps maintain accurate records. It's a great way to enhance productivity and ensure consistency in your tax filings.

-

What are the benefits of using airSlate SignNow for tax forms?

The benefits of using airSlate SignNow for your tax forms, including the schedule F tax form, include increased efficiency, enhanced security, and the ability to access documents anywhere, any time. Plus, our e-signature feature eliminates the hassle of physical paperwork, making the entire process quicker and more reliable. You can easily manage your documents from one centralized platform.

-

Is there customer support available for questions regarding the schedule F tax form?

Yes, airSlate SignNow offers robust customer support to assist you with any inquiries regarding the schedule F tax form. Our team is available via various channels, ensuring you receive timely help whenever you need it. This support makes navigating tax season much less stressful.

Get more for Pa 1000 F Schedule Form

Find out other Pa 1000 F Schedule Form

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy