Download Forms Pennsylvania Department of Revenue 2022

Understanding the PA 1000 Schedule

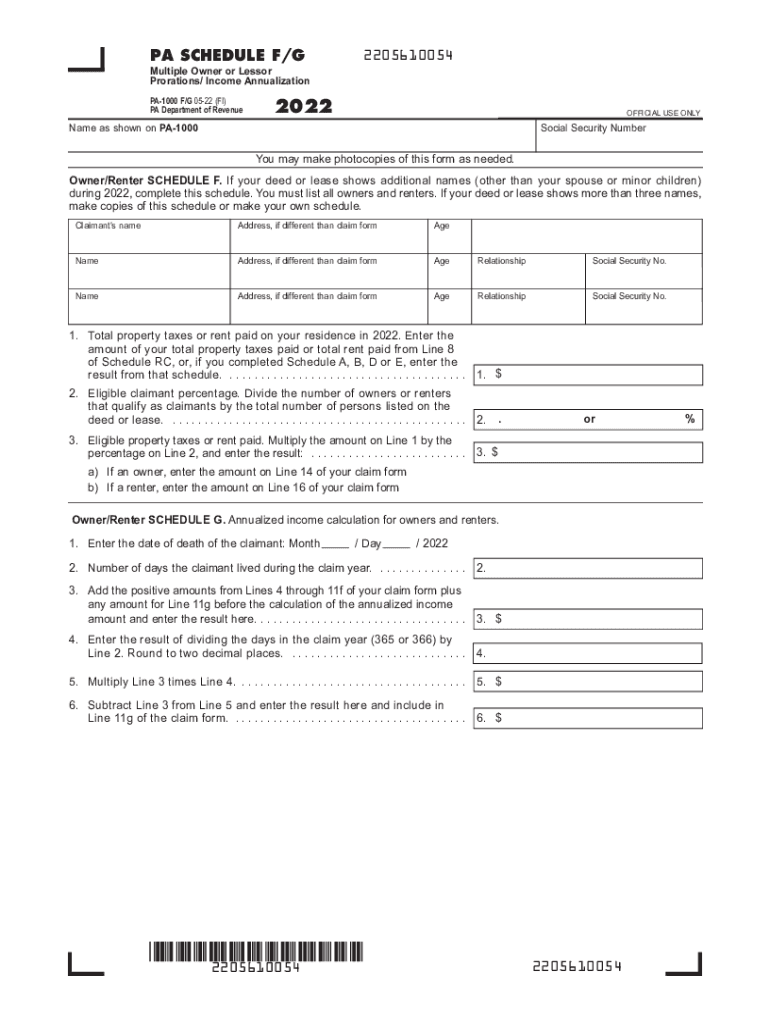

The PA 1000 schedule is a tax form used by residents of Pennsylvania to report income and calculate state tax liabilities. It is crucial for individuals and businesses to accurately complete this form to ensure compliance with state tax regulations. The PA Department of Revenue provides this form to facilitate the reporting of various income sources, including wages, business income, and investment earnings. Understanding the specific requirements and sections of the PA 1000 schedule helps taxpayers avoid errors that could lead to penalties or delays in processing.

Steps to Complete the PA 1000 Schedule

Completing the PA 1000 schedule involves several key steps. First, gather all necessary documentation, including W-2 forms, 1099s, and any records of additional income. Next, carefully follow the instructions provided with the form, ensuring that you fill out each section accurately. It is essential to report all sources of income and claim any applicable deductions or credits. After completing the form, review it for accuracy before submitting it to the Pennsylvania Department of Revenue. Filing electronically can streamline the process and reduce the risk of errors.

Legal Use of the PA 1000 Schedule

The PA 1000 schedule is legally recognized for tax reporting in Pennsylvania. To ensure its validity, taxpayers must adhere to the guidelines set forth by the Pennsylvania Department of Revenue. This includes signing the form electronically if submitted online, which requires compliance with eSignature laws. Proper completion and submission of the PA 1000 schedule are essential to avoid legal issues, such as audits or penalties for non-compliance.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the PA 1000 schedule. Typically, the deadline for submitting this form aligns with the federal tax filing deadline, which is usually April fifteenth. However, it is advisable to check for any specific extensions or changes announced by the Pennsylvania Department of Revenue. Timely filing ensures that taxpayers avoid late fees and potential interest charges on unpaid taxes.

Form Submission Methods

The PA 1000 schedule can be submitted through various methods, including online filing, mail, or in-person submission. Filing electronically is often the most efficient method, as it allows for quicker processing and confirmation of receipt. For those who prefer traditional methods, mailing the completed form to the appropriate address provided by the Pennsylvania Department of Revenue is an option. In-person submissions may be made at designated tax offices, but it is advisable to check for any specific requirements or appointments needed.

Penalties for Non-Compliance

Failure to comply with the requirements of the PA 1000 schedule can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for taxpayers to understand the importance of accurate reporting and timely submission. Being proactive in addressing any discrepancies or issues can help mitigate the risk of penalties and ensure compliance with state tax laws.

Eligibility Criteria for the PA 1000 Schedule

Eligibility to file the PA 1000 schedule typically includes individuals and businesses that earn income within Pennsylvania. This includes residents, part-year residents, and non-residents who have income sourced from Pennsylvania. Specific criteria may apply based on income levels, types of income, and residency status. Understanding these eligibility requirements is essential for ensuring that the correct form is filed and that all applicable income is reported accurately.

Quick guide on how to complete download forms pennsylvania department of revenue

Easily Prepare Download Forms Pennsylvania Department Of Revenue on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Download Forms Pennsylvania Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Simplest Way to Edit and eSign Download Forms Pennsylvania Department Of Revenue Effortlessly

- Obtain Download Forms Pennsylvania Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information thoroughly and click the Done button to save your changes.

- Select your preferred method to share your form via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Download Forms Pennsylvania Department Of Revenue and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct download forms pennsylvania department of revenue

Create this form in 5 minutes!

How to create an eSignature for the download forms pennsylvania department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA 1000 schedule and how does it work with airSlate SignNow?

The PA 1000 schedule is a comprehensive timetable that helps businesses manage and sign documents efficiently. With airSlate SignNow, you can easily integrate this schedule into your workflows, allowing for seamless tracking and execution of document signing. This ensures that all parties are on the same page and deadlines are met.

-

What are the pricing options for using airSlate SignNow with the PA 1000 schedule?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including integration with the PA 1000 schedule. These plans typically include options for individuals, small teams, and larger organizations. Each plan provides cost-effective solutions for eSigning and document management.

-

What features does airSlate SignNow offer for managing the PA 1000 schedule?

airSlate SignNow includes features such as customizable templates, automated reminders, and real-time tracking, all of which help in managing the PA 1000 schedule effectively. The user-friendly interface ensures that you can easily create, send, and manage documents without hassle. These features enhance productivity and streamline your document management process.

-

How can airSlate SignNow improve my business's efficiency with the PA 1000 schedule?

By using airSlate SignNow with the PA 1000 schedule, businesses can signNowly improve their efficiency. The solution automates many manual processes related to document management, reducing the time it takes to complete tasks. This leads to faster turnaround times and allows employees to focus on more critical business activities.

-

Can I integrate airSlate SignNow with other tools while using the PA 1000 schedule?

Yes, airSlate SignNow offers integration capabilities with various business applications that enhance the utility of the PA 1000 schedule. This means you can connect it with CRM systems, project management tools, and other software you use daily. These integrations allow for a fluid workflow and improved data management.

-

Is there customer support available for airSlate SignNow users working with the PA 1000 schedule?

Absolutely! airSlate SignNow provides dedicated customer support for all users, including those managing the PA 1000 schedule. Whether you have questions about features, troubleshooting, or best practices, the support team is available to assist you through multiple channels, ensuring you get the help you need promptly.

-

What benefits can I expect from using airSlate SignNow with the PA 1000 schedule?

Using airSlate SignNow with the PA 1000 schedule enhances your document signing process by providing efficiency and accuracy. You’ll experience quicker sign-offs, reduced paper use, and improved record keeping. Additionally, the secure nature of airSlate SignNow ensures that your documents are protected throughout the signing process.

Get more for Download Forms Pennsylvania Department Of Revenue

- Housing pathways medical assessment form

- Grade 11 sepedi paper 2 pdf form

- Pet relinquishment letter form

- Home insurance application form pdf

- Blumberg extension of lease form

- 1295 council audit report form

- Office of the tax assessor collector form

- International student financial aid application pdf ebooks 162 220 form

Find out other Download Forms Pennsylvania Department Of Revenue

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed