Form 8283 Rev December Noncash Charitable Contributions 2023-2026

What is the Form 8283 for Noncash Charitable Contributions

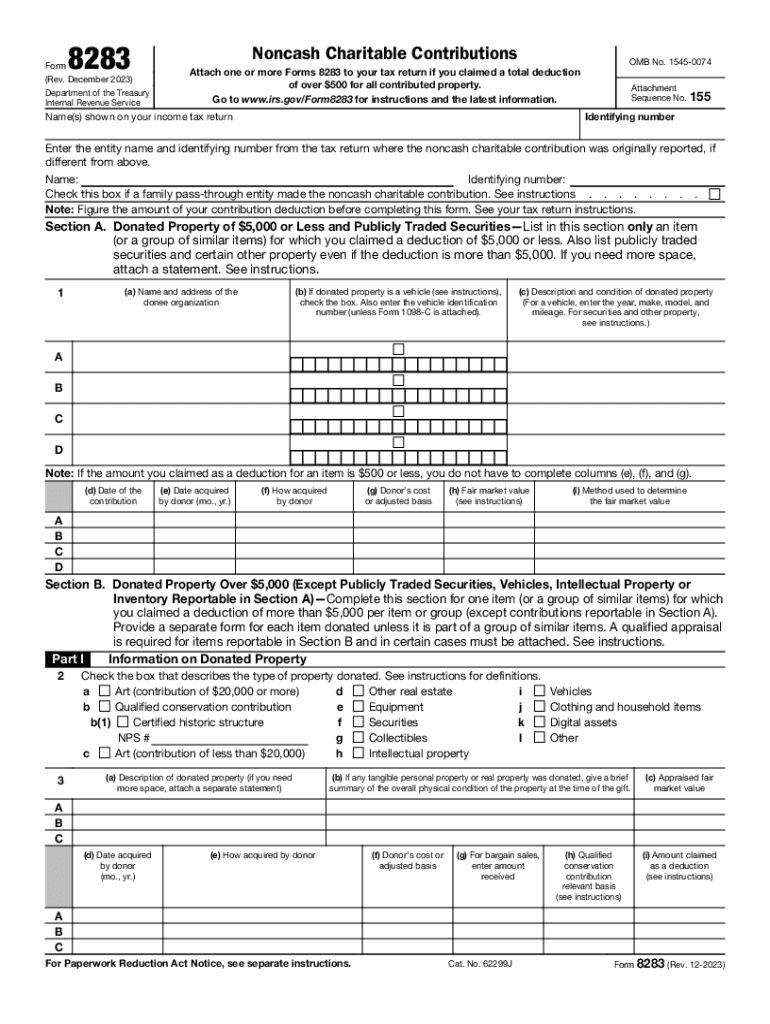

The Form 8283 is an official document used by taxpayers in the United States to report noncash charitable contributions made to qualified organizations. This form is essential for individuals who donate items such as clothing, furniture, or other tangible goods valued at over five hundred dollars. The IRS requires this form to ensure that taxpayers accurately report the value of their donations and comply with tax regulations. By using Form 8283, donors can claim a charitable deduction on their tax returns, which can significantly reduce their taxable income.

How to Complete the Form 8283

Completing Form 8283 involves several key steps. First, you will need to provide your personal information, including your name, address, and Social Security number. Next, you must list the noncash contributions you made, including a description of each item and its fair market value. If the total value of your contributions exceeds five thousand dollars, you will need to have an appraisal conducted by a qualified appraiser. Additionally, you must obtain the signature of an authorized official from the charitable organization to verify the donation. Finally, ensure that you retain copies of any documentation related to the contributions for your records.

IRS Guidelines for Using Form 8283

The IRS has established specific guidelines for the use of Form 8283. According to IRS rules, taxpayers must complete this form for any noncash charitable contributions valued over five hundred dollars. It is important to accurately report the fair market value of the donated items, as inflated values may lead to penalties. The IRS also requires that taxpayers maintain records of their donations, including receipts and appraisals, to substantiate their claims. Familiarizing yourself with these guidelines can help ensure compliance and maximize your potential deductions.

Examples of Using Form 8283

Form 8283 can be utilized in various scenarios involving noncash charitable contributions. For instance, if an individual donates a vehicle to a nonprofit organization, they must complete Form 8283 to report the vehicle's fair market value. Similarly, if someone donates furniture or electronics to a local charity, they would also need to fill out this form if the total value exceeds five hundred dollars. Each example highlights the importance of accurately documenting and reporting noncash contributions to benefit from potential tax deductions.

Required Documents for Form 8283

When preparing to submit Form 8283, certain documents are required to support your claims. These may include:

- Receipts from the charitable organization confirming the donation.

- An appraisal report if the total value of the donated items exceeds five thousand dollars.

- Photographs of the items donated, especially for unique or high-value contributions.

Having these documents ready will help ensure that your submission is complete and compliant with IRS requirements.

Filing Deadlines for Form 8283

It is crucial to be aware of the filing deadlines associated with Form 8283. Typically, this form should be submitted along with your annual tax return. For most taxpayers, the deadline for filing is April fifteenth of the following year. If you are unable to file by this date, you may request an extension, but it is important to ensure that Form 8283 is included with your return to avoid potential issues with the IRS.

Quick guide on how to complete form 8283 rev december noncash charitable contributions

Complete Form 8283 Rev December Noncash Charitable Contributions effortlessly on any device

Online document management has become popular with companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Form 8283 Rev December Noncash Charitable Contributions on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Form 8283 Rev December Noncash Charitable Contributions with ease

- Find Form 8283 Rev December Noncash Charitable Contributions and click on Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Mark essential parts of the documents or conceal sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 8283 Rev December Noncash Charitable Contributions and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8283 rev december noncash charitable contributions

Create this form in 5 minutes!

How to create an eSignature for the form 8283 rev december noncash charitable contributions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8283 and who needs it?

Form 8283 is used for the valuation of noncash charitable contributions. This form is essential for individuals or businesses who donate items valued over $500, ensuring they comply with IRS regulations while maximizing their tax deductions. Understanding how to properly fill out form 8283 can streamline your charitable giving process.

-

How can airSlate SignNow assist with form 8283?

AirSlate SignNow provides an easy-to-use platform for electronically signing and sending form 8283. By utilizing our service, you ensure that your documents are securely signed and processed, reducing the time spent on paperwork and increasing efficiency. Our application helps maintain compliance with IRS guidelines for submitting donations.

-

What are the pricing options for using airSlate SignNow for form 8283?

AirSlate SignNow offers competitive pricing plans that cater to various business needs when managing documents like form 8283. Whether you're an individual or part of a larger organization, there's a plan suitable for you. Our plans come with a full suite of features designed to streamline the signing and sending process.

-

Can I integrate airSlate SignNow with other applications for handling form 8283?

Yes, airSlate SignNow integrates seamlessly with a variety of applications, allowing for a smooth workflow when managing form 8283. You can connect it with CRM systems, cloud storage solutions, and more, ensuring all your document handling is efficient and centralized. Integration capabilities enhance your productivity and organizational tasks.

-

What features does airSlate SignNow offer for managing form 8283?

AirSlate SignNow offers numerous features tailored for managing form 8283, including customizable templates, real-time tracking, and secure electronic signatures. Our user-friendly interface makes it simple to create, send, and store your forms efficiently. These features help you maintain organization and compliance throughout your documentation process.

-

Is it safe to use airSlate SignNow for sensitive documents like form 8283?

Absolutely! AirSlate SignNow prioritizes your data security with advanced encryption protocols to protect sensitive documents like form 8283. We comply with various regulatory requirements to ensure your information is safe during transmission and storage. You can trust us to help you manage your documents securely.

-

How does airSlate SignNow improve the efficiency of filling out form 8283?

AirSlate SignNow enhances the efficiency of filling out form 8283 by allowing you to create templates that can be reused for future donations. This saves time and eliminates errors typically associated with paper forms. Furthermore, our platform streamlines the entire process, from preparation to signing, enhancing overall productivity.

Get more for Form 8283 Rev December Noncash Charitable Contributions

Find out other Form 8283 Rev December Noncash Charitable Contributions

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template