Form 8283 PDF 8283 FormRev December Department of 2021

What is the Form 8283 PDF?

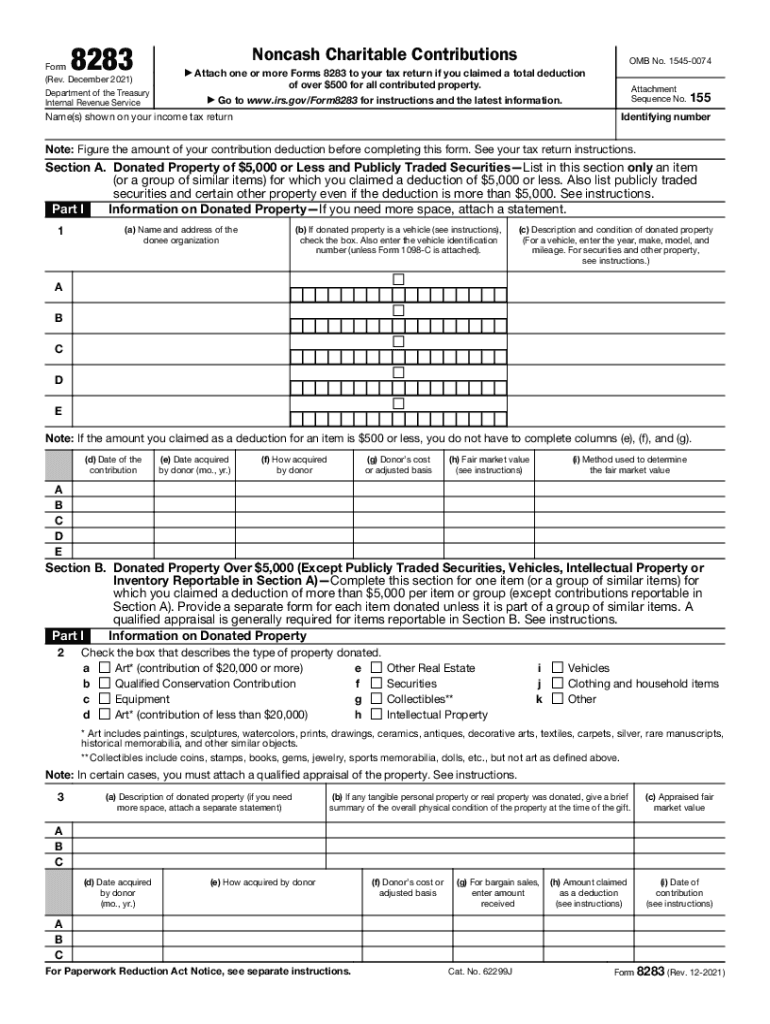

The Form 8283 is a document used by taxpayers in the United States to report noncash charitable contributions. This form is essential for individuals who donate property valued at more than $500 to qualified charities. The IRS requires this form to ensure that taxpayers accurately report the value of their donations for tax deduction purposes. The Form 8283 PDF can be downloaded from the IRS website, allowing users to fill it out electronically or print it for manual completion.

Steps to Complete the Form 8283 PDF

Completing the Form 8283 involves several key steps to ensure accuracy and compliance with IRS regulations. Here are the steps to follow:

- Gather Required Information: Collect details about the donated property, including its fair market value, the date of the donation, and the charity’s information.

- Fill Out the Form: Start by entering your name, Social Security number, and the details of the charity. Provide a description of the donated property and its value.

- Complete Section B: If the value of the donated property exceeds $5,000, you must complete Section B, which requires additional information and possibly a qualified appraisal.

- Sign and Date: After filling out the form, ensure you sign and date it. This step is crucial for the form to be considered valid by the IRS.

Legal Use of the Form 8283 PDF

The Form 8283 is legally binding when filled out correctly and submitted in accordance with IRS guidelines. It serves as proof of your charitable contributions, which can be essential during tax filing. To ensure legal compliance, taxpayers must adhere to specific regulations regarding the valuation of donated property. Accurate reporting and proper documentation are critical to avoid penalties or audits.

IRS Guidelines for Form 8283 PDF

The IRS provides detailed guidelines on how to complete the Form 8283, including instructions on determining the fair market value of donated items. Taxpayers must ensure that the value reported reflects what the property would sell for on the open market. Additionally, the IRS requires that donations of property valued over $5,000 be substantiated with a qualified appraisal, which must be attached to the form when filed.

Examples of Using the Form 8283 PDF

Several scenarios illustrate the use of the Form 8283. For instance, if a taxpayer donates a piece of artwork valued at $10,000 to a charity, they must complete the form to claim a tax deduction. Another example includes donating a vehicle; the taxpayer would report the vehicle’s fair market value and provide the necessary details about the charity. These examples highlight the importance of the form in documenting charitable contributions for tax purposes.

Required Documents for Form 8283 PDF

To successfully complete and submit the Form 8283, certain documents may be required. These include:

- A qualified appraisal for donations valued over $5,000.

- Receipts or acknowledgment letters from the charitable organization confirming the donation.

- Any additional documentation that supports the valuation of the donated property.

Quick guide on how to complete form 8283pdf 8283 formrev december 2020 department of

Complete Form 8283 pdf 8283 FormRev December Department Of effortlessly on any device

Online document management has gained popularity among organizations and individuals alike. It offers a perfect eco-friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Form 8283 pdf 8283 FormRev December Department Of on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

The easiest way to modify and eSign Form 8283 pdf 8283 FormRev December Department Of without hassle

- Locate Form 8283 pdf 8283 FormRev December Department Of and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal standing as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your adjustments.

- Select how you want to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8283 pdf 8283 FormRev December Department Of and ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8283pdf 8283 formrev december 2020 department of

Create this form in 5 minutes!

How to create an eSignature for the form 8283pdf 8283 formrev december 2020 department of

The way to make an e-signature for your PDF in the online mode

The way to make an e-signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is a form 8283 pdf and why do I need it?

A form 8283 pdf is used to report noncash charitable contributions valued over $500. This document is essential for both the donor and the IRS to ensure accurate record-keeping and compliance with tax regulations. Using airSlate SignNow allows you to easily fill out and eSign the form 8283 pdf online, streamlining the process.

-

How can airSlate SignNow help me fill out the form 8283 pdf?

airSlate SignNow provides a user-friendly platform to create, edit, and eSign the form 8283 pdf efficiently. With various templates and intuitive tools, you can fill in necessary details quickly and ensure that your document is ready for submission. Our platform also saves your progress, making it easy to complete your form 8283 pdf at your convenience.

-

Is there a cost associated with using airSlate SignNow for form 8283 pdf?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs, including features specifically for managing form 8283 pdf. While we provide a free trial, our subscription plans offer affordability and flexibility, enabling you to choose the best option for your document management needs.

-

Can I integrate airSlate SignNow with other applications when handling form 8283 pdf?

Absolutely! airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Dropbox, and Salesforce, allowing you to manage your form 8283 pdf alongside your existing workflows. This connectivity enhances collaboration and helps you keep all your document-related tasks in one place.

-

What benefits do I get from using airSlate SignNow for my form 8283 pdf?

Using airSlate SignNow for your form 8283 pdf offers numerous benefits, such as increased efficiency, reduced paperwork, and enhanced security. Our platform provides an easy-to-use interface for eSigning, ensuring that your contributions are documented correctly and securely stored, which is vital for tax purposes.

-

How do I eSign my form 8283 pdf using airSlate SignNow?

eSigning your form 8283 pdf with airSlate SignNow is simple. After preparing your document, you can add signature fields and invite signers via email. Once they review, sign, and submit, you will receive a fully executed form 8283 pdf, ensuring a smooth transaction process.

-

Is my data safe when I use airSlate SignNow for form 8283 pdf?

Yes, your data is secure when using airSlate SignNow for handling form 8283 pdf. We implement advanced encryption and follow industry-standard security protocols to protect your sensitive information. You can trust us to keep your data safe during document processing and storage.

Get more for Form 8283 pdf 8283 FormRev December Department Of

- Legal last will form for a widow or widower with no children georgia

- Legal last will and testament form for a widow or widower with adult and minor children georgia

- Legal last will and testament form for divorced and remarried person with mine yours and ours children georgia

- Legal last will and testament form with all property to trust called a pour over will georgia

- Written revocation of will georgia form

- Ga last 497304208 form

- Notice to beneficiaries of being named in will georgia form

- Estate planning questionnaire and worksheets georgia form

Find out other Form 8283 pdf 8283 FormRev December Department Of

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free