Form 8283 Rev December Noncash Charitable Contributions 2020

What is the Form 8283 for Noncash Charitable Contributions

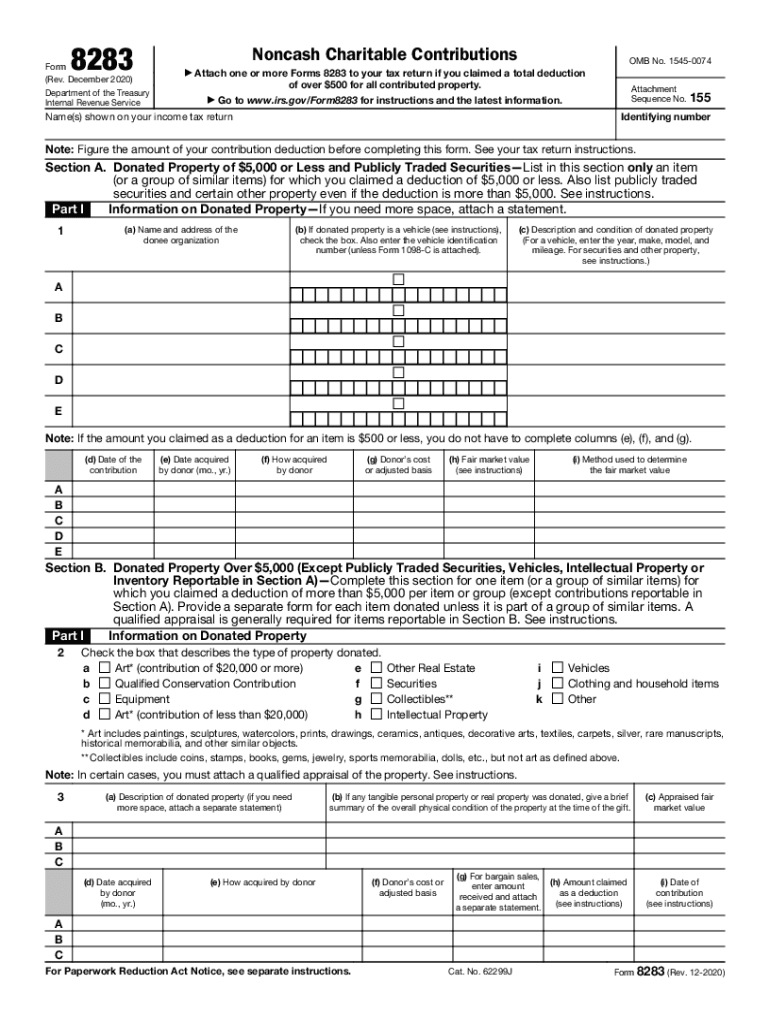

The Form 8283 is a federal tax form used in the United States for reporting noncash charitable contributions. This form is particularly important for taxpayers who donate property, such as clothing, vehicles, or other items, to qualified charitable organizations. The IRS requires this form to ensure that taxpayers accurately report the value of their donations and comply with tax regulations. The form includes sections for detailing the donated items, their fair market value, and information about the charitable organization receiving the donation.

Steps to Complete the Form 8283

Completing the Form 8283 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the donated items, including receipts and appraisals if required. Next, fill out the identification section, providing your name, Social Security number, and the tax year. Then, in Part A, list the items donated, their descriptions, and the fair market value. If the total value exceeds five thousand dollars, you will need to complete Part B, which requires additional details and possibly a qualified appraisal. Finally, sign and date the form before submitting it with your tax return.

IRS Guidelines for Form 8283

The IRS provides specific guidelines for using Form 8283, which are crucial for compliance. Taxpayers must ensure that their noncash contributions are made to qualified organizations recognized by the IRS. Additionally, the IRS requires that the fair market value of donated items be determined accurately, and any donations exceeding five thousand dollars must be substantiated with a qualified appraisal. It is also important to retain copies of the form and any supporting documents for your records, as the IRS may request them during an audit.

Filing Deadlines for Form 8283

The Form 8283 must be filed with your federal tax return by the annual tax deadline, which is typically April fifteenth. If you file for an extension, you can submit the form along with your extended return. However, it is essential to ensure that all contributions are reported accurately and on time to avoid penalties. Keeping track of these deadlines helps maintain compliance with IRS regulations and ensures that you receive the appropriate tax deductions for your charitable contributions.

Legal Use of the Form 8283

The legal use of Form 8283 is governed by IRS regulations, which stipulate that the form must be used to report noncash charitable contributions accurately. To be legally valid, the form must be completed in accordance with IRS guidelines, including the requirement for proper documentation and appraisals for high-value donations. Failure to comply with these regulations can lead to penalties, including the disallowance of the deduction and potential fines. Therefore, understanding the legal implications of using Form 8283 is crucial for taxpayers wishing to claim deductions for their charitable contributions.

Examples of Using the Form 8283

Examples of using Form 8283 include various scenarios where taxpayers donate noncash items to charities. For instance, if an individual donates a vehicle valued at eight thousand dollars to a nonprofit organization, they must complete Form 8283 to report this contribution. Another example is donating household items, such as furniture or electronics, with a total fair market value of three thousand dollars. In both cases, the taxpayers would need to provide detailed descriptions and values for the donated items on the form, ensuring compliance with IRS requirements.

Quick guide on how to complete form 8283 rev december 2020 noncash charitable contributions

Effortlessly Prepare Form 8283 Rev December Noncash Charitable Contributions on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools for quick creation, editing, and electronic signing of your documents with no delays. Manage Form 8283 Rev December Noncash Charitable Contributions on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign Form 8283 Rev December Noncash Charitable Contributions with Ease

- Find Form 8283 Rev December Noncash Charitable Contributions and click on Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method of sending your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from your chosen device. Edit and electronically sign Form 8283 Rev December Noncash Charitable Contributions, ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8283 rev december 2020 noncash charitable contributions

Create this form in 5 minutes!

How to create an eSignature for the form 8283 rev december 2020 noncash charitable contributions

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is a tax form 8283?

The tax form 8283 is an IRS document used for reporting non-cash charitable contributions. It provides details about the donated property and its fair market value. Understanding the tax form 8283 is essential for ensuring compliance and maximizing your tax deductions.

-

How can airSlate SignNow help with completing a tax form 8283?

airSlate SignNow simplifies the process of completing a tax form 8283 by allowing you to eSign and send documents securely. Our platform provides templates that help you fill out necessary details quickly, ensuring that your contributions are documented correctly. This feature saves time, reduces errors, and streamlines your document management.

-

Is there a cost associated with using airSlate SignNow for tax form 8283?

Yes, airSlate SignNow offers various pricing plans, allowing you to choose one that fits your business needs for processing tax form 8283. We provide a cost-effective solution that ensures you have access to all essential features for managing and signing documents electronically. Enjoy free trials to evaluate our service before committing.

-

What are the key features of airSlate SignNow for managing tax form 8283?

Key features of airSlate SignNow include user-friendly eSignature capabilities, document templates, and secure cloud storage. These functionalities make it easier to manage your tax form 8283 and other important documents. Additionally, you can track the status of your forms and ensure timely submissions.

-

Can I integrate airSlate SignNow with other applications for tax form 8283 management?

Absolutely! airSlate SignNow offers seamless integrations with popular platforms such as Google Drive, Dropbox, and CRM systems. This allows you to manage your tax form 8283 and related documents efficiently from one centralized location, enhancing your overall productivity.

-

What are the benefits of using airSlate SignNow for tax form 8283 submissions?

Using airSlate SignNow for your tax form 8283 offers numerous benefits, including enhanced document security, reduced processing time, and improved accuracy. Our solution streamlines the signing and submission process, making it easier for you to meet tax filing deadlines while minimizing errors. This leads to a more organized approach to your charitable contributions.

-

How does airSlate SignNow ensure the security of my tax form 8283?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and comply with industry standards to protect your tax form 8283 and other sensitive documents. Our platform ensures that your data remains confidential and secure throughout the entire signing process.

Get more for Form 8283 Rev December Noncash Charitable Contributions

Find out other Form 8283 Rev December Noncash Charitable Contributions

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe