8283 Rev Form 2006

What is the 8283 Rev Form

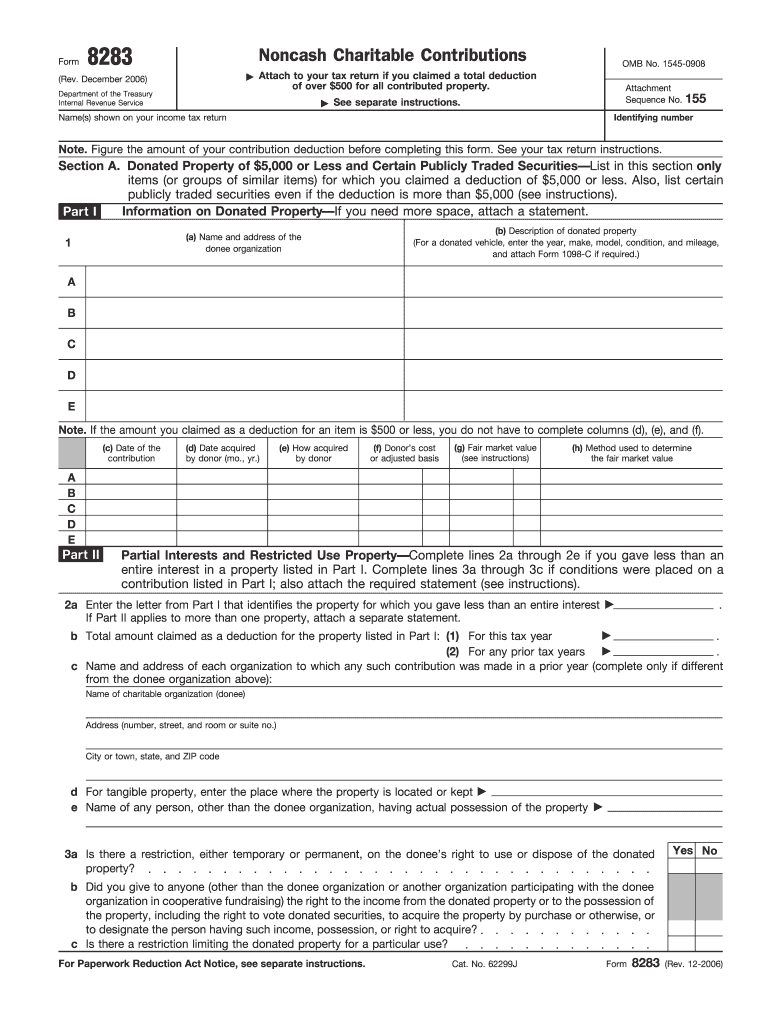

The 8283 Rev Form, also known as the "Noncash Charitable Contributions" form, is utilized by taxpayers in the United States to report noncash donations made to qualified charitable organizations. This form is essential for individuals who wish to claim a tax deduction for contributions of property, such as clothing, vehicles, or real estate. It provides the IRS with detailed information about the donated items, including their fair market value, and ensures compliance with tax regulations.

How to use the 8283 Rev Form

Using the 8283 Rev Form involves several steps to ensure accurate reporting of noncash charitable contributions. Taxpayers must first gather necessary information about the donated items, including descriptions, dates of contribution, and fair market values. Once this information is compiled, the taxpayer can fill out the form, detailing each item donated. It is crucial to retain any supporting documentation, such as receipts or appraisals, as the IRS may request these during an audit.

Steps to complete the 8283 Rev Form

Completing the 8283 Rev Form requires careful attention to detail. Follow these steps:

- Gather information about each noncash contribution, including descriptions and fair market values.

- Fill out Part A of the form for items valued at $500 or less, providing necessary details.

- For items valued over $500, complete Part B, which requires additional information and possibly an appraisal.

- Ensure all sections of the form are complete and accurate before submission.

- Attach the completed form to your tax return when filing.

Legal use of the 8283 Rev Form

The 8283 Rev Form is legally required for taxpayers who wish to claim deductions for noncash charitable contributions exceeding $500. To ensure compliance with IRS regulations, it is essential to accurately report all donated items and their values. Failure to complete the form correctly can result in penalties or disallowance of the claimed deductions. Adhering to the guidelines set forth by the IRS is crucial for maintaining the legal validity of the form.

IRS Guidelines

The IRS provides specific guidelines for completing the 8283 Rev Form. Taxpayers should refer to the IRS instructions for the form, which outline necessary details such as how to determine fair market value and the required documentation for different types of donations. Following these guidelines helps ensure that the form is filled out correctly and that all contributions are appropriately documented, minimizing the risk of issues during tax filing.

Filing Deadlines / Important Dates

Filing deadlines for the 8283 Rev Form align with the standard tax return deadlines. Taxpayers must submit the form along with their annual tax return, typically due on April fifteenth. If an extension is filed, the form must be submitted by the extended deadline. It is essential to keep track of these dates to avoid penalties and ensure that all contributions are reported in a timely manner.

Required Documents

To complete the 8283 Rev Form accurately, certain documents are required. These include:

- Receipts or written acknowledgments from the charitable organization.

- Appraisals for items valued over $5,000.

- Documentation of the fair market value of the donated items.

Having these documents on hand not only facilitates the completion of the form but also supports the taxpayer's claims in case of an audit.

Quick guide on how to complete 8283 rev 2006 form

Effortlessly Prepare 8283 Rev Form on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle 8283 Rev Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign 8283 Rev Form with ease

- Find 8283 Rev Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Verify all the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that require reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Alter and electronically sign 8283 Rev Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8283 rev 2006 form

Create this form in 5 minutes!

How to create an eSignature for the 8283 rev 2006 form

How to create an eSignature for a PDF file online

How to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the 8283 Rev Form and how is it used?

The 8283 Rev Form is a tax form used for reporting noncash charitable contributions. Businesses and individuals utilize this form to report the fair market value of donated property. Using the 8283 Rev Form correctly ensures compliance with IRS regulations and helps maximize tax deductions.

-

How can airSlate SignNow help with the 8283 Rev Form?

airSlate SignNow provides an easy-to-use platform for filling out and eSigning the 8283 Rev Form. Our solution simplifies document management, allowing you to distribute, sign, and store your forms securely. This streamlines the process, ensuring you can focus on your contribution rather than paperwork.

-

Are there any costs associated with using airSlate SignNow for the 8283 Rev Form?

Yes, airSlate SignNow offers various pricing plans based on your needs, ranging from free trials to subscription models. The cost-effective solution ensures that you only pay for features relevant to handling forms like the 8283 Rev Form. Evaluate our pricing plans to find one that fits your budget.

-

What features does airSlate SignNow offer for the 8283 Rev Form?

airSlate SignNow includes features such as customizable templates, in-app user authentication, and real-time tracking for the 8283 Rev Form. You can eSign documents securely and receive notifications when recipients view or sign the form. This enhances efficiency and ensures seamless collaboration.

-

Can I integrate airSlate SignNow with other software for handling the 8283 Rev Form?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions, including CRMs and accounting software, to enhance your ability to manage the 8283 Rev Form. Integration allows for automatic data population and improves workflow, making tax reporting easier and more efficient.

-

What are the benefits of eSigning the 8283 Rev Form through airSlate SignNow?

eSigning the 8283 Rev Form through airSlate SignNow provides several benefits such as security, convenience, and compliance. Your signed documents are stored securely and are easily accessible from anywhere. This saves you time and reduces the risk of lost paperwork.

-

Is airSlate SignNow compliant with regulations for the 8283 Rev Form?

Yes, airSlate SignNow complies with industry regulations, ensuring that your submissions, including the 8283 Rev Form, meet legal standards. Our platform guarantees encryption and secure storage of your sensitive information. You can trust that your document management adheres to compliance requirements.

Get more for 8283 Rev Form

- Llc notices resolutions and other operations forms package idaho

- Idaho disclosure form

- Idaho notice form

- Idaho certificate of trust by individual idaho form

- Id trust form

- Mutual wills containing last will and testaments for unmarried persons living together with no children idaho form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children idaho form

- Mutual wills or last will and testaments for unmarried persons living together with minor children idaho form

Find out other 8283 Rev Form

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free