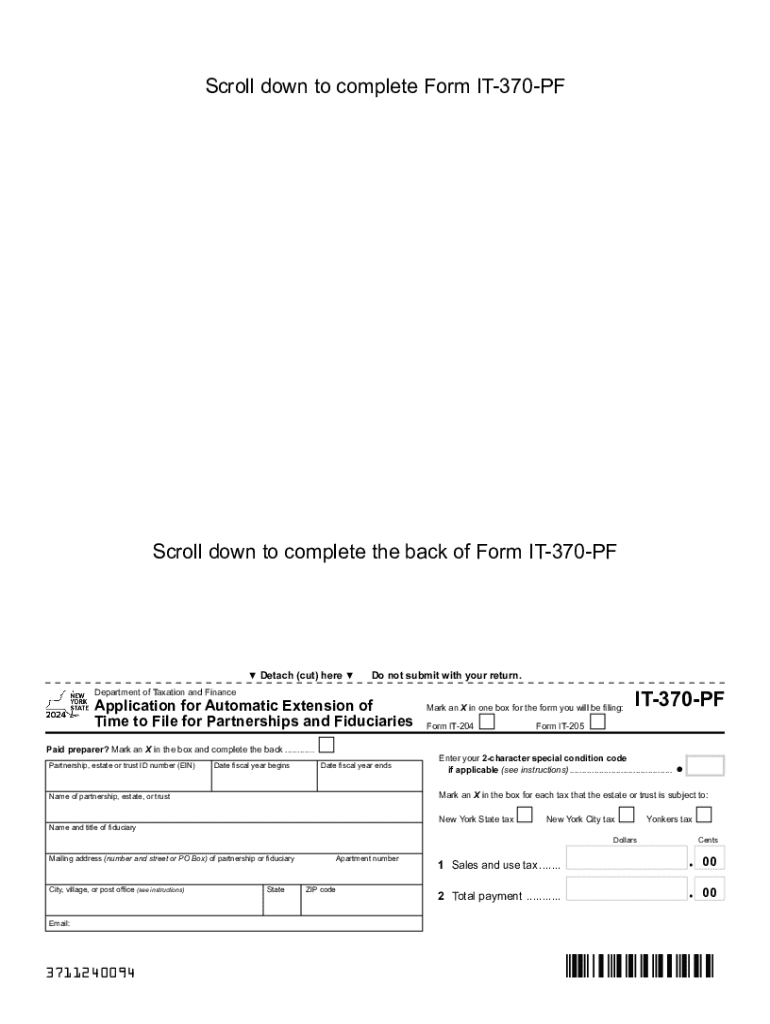

Form it 370 Application for Automatic Six Month 2024-2026

What is the Form IT 370 Application for Automatic Six Month

The Form IT 370 is an application used by taxpayers in New York to request an automatic six-month extension for filing their personal income tax returns. This form is particularly beneficial for individuals who may need additional time to gather their financial documents or complete their tax returns accurately. By submitting this form, taxpayers can avoid penalties associated with late filing, provided they pay any taxes owed by the original due date.

How to use the Form IT 370 Application for Automatic Six Month

To use the Form IT 370, taxpayers must fill out the required sections accurately. This includes providing personal information such as name, address, and social security number. After completing the form, it should be submitted to the New York State Department of Taxation and Finance. It is important to remember that this application does not extend the time to pay any taxes owed; therefore, taxpayers should ensure that they remit any due payments by the original filing deadline to avoid interest and penalties.

Steps to complete the Form IT 370 Application for Automatic Six Month

Completing the Form IT 370 involves several straightforward steps:

- Obtain the latest version of the form from the New York State Department of Taxation and Finance website.

- Fill in your personal information, including your name, address, and social security number.

- Indicate the type of return you are requesting an extension for, such as the IT-201 or IT-203.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form by mail or electronically, depending on your preference.

Filing Deadlines / Important Dates

The filing deadline for the Form IT 370 coincides with the original due date of the tax return, which is typically April fifteenth for most taxpayers. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to submit the form before this deadline to ensure that the extension is granted and to avoid any penalties for late filing.

Required Documents

When submitting the Form IT 370, taxpayers do not need to provide additional documentation at the time of application. However, it is advisable to keep records of income, deductions, and any other relevant financial documents on hand, as these will be necessary for completing the tax return once the extension period has concluded. This preparation can help facilitate a smoother filing process later.

Eligibility Criteria

Eligibility for using the Form IT 370 is generally open to all individual taxpayers in New York who need more time to file their personal income tax returns. This includes residents, part-year residents, and non-residents who have income sourced from New York. However, it is essential to note that the extension applies only to the filing of the return and does not extend the time to pay any taxes owed.

Create this form in 5 minutes or less

Find and fill out the correct form it 370 application for automatic six month

Create this form in 5 minutes!

How to create an eSignature for the form it 370 application for automatic six month

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 370 pf and how does it work?

The it 370 pf is a powerful feature within airSlate SignNow that allows users to streamline their document signing process. It enables businesses to send, sign, and manage documents electronically, ensuring a seamless workflow. With its user-friendly interface, the it 370 pf simplifies the eSigning experience for both senders and recipients.

-

How much does the it 370 pf cost?

Pricing for the it 370 pf varies based on the subscription plan you choose. airSlate SignNow offers flexible pricing options to accommodate businesses of all sizes. You can visit our pricing page to find the plan that best fits your needs and budget.

-

What are the key features of the it 370 pf?

The it 370 pf includes features such as customizable templates, real-time tracking, and secure cloud storage. These features enhance the efficiency of document management and ensure that your important files are always accessible. Additionally, the it 370 pf supports multiple file formats for added convenience.

-

What benefits does the it 370 pf provide for businesses?

The it 370 pf offers numerous benefits, including reduced turnaround times for document signing and improved compliance with legal standards. By using the it 370 pf, businesses can save time and resources, allowing them to focus on core operations. This ultimately leads to increased productivity and customer satisfaction.

-

Can the it 370 pf integrate with other software?

Yes, the it 370 pf seamlessly integrates with various third-party applications, enhancing its functionality. Whether you use CRM systems, project management tools, or cloud storage services, the it 370 pf can connect with them to streamline your workflow. This integration capability makes it a versatile solution for businesses.

-

Is the it 370 pf secure for sensitive documents?

Absolutely, the it 370 pf prioritizes security and compliance. It employs advanced encryption methods to protect your documents during transmission and storage. With features like audit trails and secure access controls, the it 370 pf ensures that your sensitive information remains confidential.

-

How can I get started with the it 370 pf?

Getting started with the it 370 pf is easy! Simply sign up for an account on the airSlate SignNow website and choose the plan that suits your needs. Once registered, you can explore the features of the it 370 pf and begin sending and signing documents in no time.

Get more for Form IT 370 Application For Automatic Six Month

- Help the card holder with the cost of public transport form

- R43manual claim to personal allowances and tax repayment by an individual not resident in the uk form

- Non residents relief under double taxation agreements form

- Assets publishing service gov uk governmentmyanmar assets publishing service gov uk form

- Fill in this form if the deceased died on or after 18 march 1986

- Request for child support services form

- Submitting a sample chemcentre form

- Copy certification pub form

Find out other Form IT 370 Application For Automatic Six Month

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online