NY DTF it 370 PF Fill Out Tax Template Online 2022

What is the NY DTF IT 370 PF?

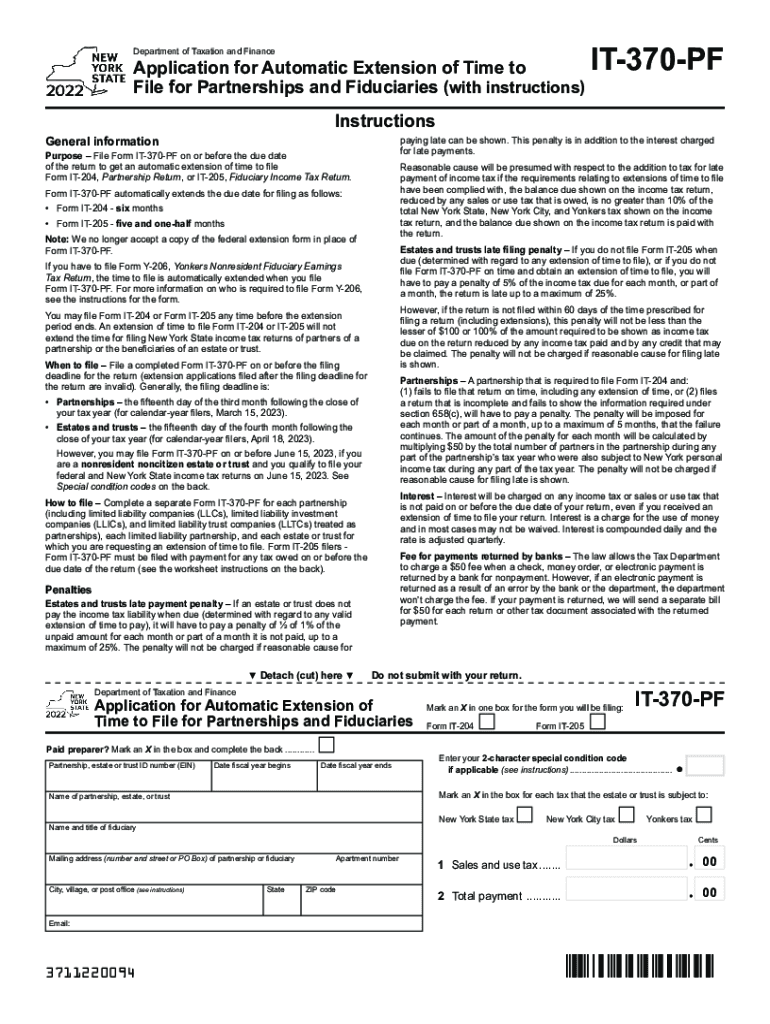

The NY DTF IT 370 PF is a tax form used by New York State residents to request a refund of overpaid personal income taxes. This form is essential for individuals who have made estimated tax payments or had excess withholding during the tax year. By filling out the IT 370 PF, taxpayers can ensure they receive the appropriate refund amount based on their financial situation.

Steps to complete the NY DTF IT 370 PF

Completing the NY DTF IT 370 PF involves several key steps:

- Gather Required Information: Collect your personal identification details, including your Social Security number, and any relevant tax documents.

- Access the Form: Visit the official New York State Department of Taxation and Finance website to download the IT 370 PF form.

- Fill Out the Form: Carefully enter your information in the designated fields, ensuring accuracy to avoid delays.

- Review Your Entries: Double-check all entries for correctness, including amounts and personal details.

- Submit the Form: Choose your submission method, either electronically or by mail, and ensure it is sent before the deadline.

Legal use of the NY DTF IT 370 PF

The NY DTF IT 370 PF is legally recognized as a valid document for tax refund requests in New York State. To ensure its legal standing, it must be completed accurately and submitted in accordance with state regulations. Utilizing an electronic signature through a trusted platform can enhance the legitimacy of your submission, providing a secure method for signing and sending your form.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the NY DTF IT 370 PF to avoid penalties or delays in receiving your refund. Generally, the form must be submitted by the due date of your tax return. For the 2022 tax year, the deadline typically aligns with the federal tax filing deadline, which is usually April 15. Always verify specific dates on the New York State Department of Taxation and Finance website for any updates or changes.

Required Documents

When filling out the NY DTF IT 370 PF, certain documents are necessary to support your refund request. These may include:

- Your previous year’s tax return

- W-2 forms or 1099s showing income and withholding

- Records of estimated tax payments made throughout the year

- Any other relevant documentation that substantiates your claim for a refund

Form Submission Methods

The NY DTF IT 370 PF can be submitted through various methods. Taxpayers have the option to file electronically using approved e-filing services, which can expedite processing times. Alternatively, the form can be printed and mailed to the appropriate address provided by the New York State Department of Taxation and Finance. Ensure that you select the method that best suits your needs and follow any specific instructions for each submission type.

Quick guide on how to complete ny dtf it 370 pf 2020 2023 fill out tax template online

Effortlessly Prepare NY DTF IT 370 PF Fill Out Tax Template Online on Any Device

Managing documents online has become increasingly favored by companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary format and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Handle NY DTF IT 370 PF Fill Out Tax Template Online on any device using airSlate SignNow's Android or iOS applications and simplify any document-based task today.

Edit and eSign NY DTF IT 370 PF Fill Out Tax Template Online with Ease

- Locate NY DTF IT 370 PF Fill Out Tax Template Online and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from your selected device. Modify and eSign NY DTF IT 370 PF Fill Out Tax Template Online while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ny dtf it 370 pf 2020 2023 fill out tax template online

Create this form in 5 minutes!

How to create an eSignature for the ny dtf it 370 pf 2020 2023 fill out tax template online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 370 PF 2022 form used for?

The IT 370 PF 2022 form is a key document for businesses to report income and expenses related to eSigning solutions. It's essential for compliance and ensures that all necessary information is submitted accurately for tax purposes.

-

How can airSlate SignNow help with filing the IT 370 PF 2022?

airSlate SignNow streamlines the eSigning process, making it easier to collect signatures on documents needed for the IT 370 PF 2022. Our solution helps you maintain organized records, simplifying your reporting process and ensuring compliance.

-

What features does airSlate SignNow offer for managing IT 370 PF 2022 documentation?

airSlate SignNow provides features such as customizable templates, secure storage, and automated workflows specifically designed to manage important documents like the IT 370 PF 2022. These features enhance efficiency and accuracy in document management.

-

Is airSlate SignNow cost-effective for preparing the IT 370 PF 2022?

Yes, airSlate SignNow is an affordable solution that can signNowly reduce administrative costs associated with preparing the IT 370 PF 2022. Our pricing plans are designed to meet the budgets of businesses of all sizes, ensuring accessibility and value.

-

Can airSlate SignNow integrate with other software for IT 370 PF 2022 processes?

Definitely! airSlate SignNow offers seamless integrations with popular accounting and document management software. This connectivity simplifies the data flow needed for preparing and submitting the IT 370 PF 2022 efficiently.

-

What benefits does eSigning offer for IT 370 PF 2022 submissions?

ESigning with airSlate SignNow speeds up the approval process for documents required for the IT 370 PF 2022, reducing turnaround time. This means documents can be submitted quickly and efficiently, ensuring compliance without unnecessary delays.

-

Is the IT 370 PF 2022 submission process secure with airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption and secure access protocols to protect all documentation, including those related to the IT 370 PF 2022, ensuring that your sensitive information remains confidential.

Get more for NY DTF IT 370 PF Fill Out Tax Template Online

Find out other NY DTF IT 370 PF Fill Out Tax Template Online

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free