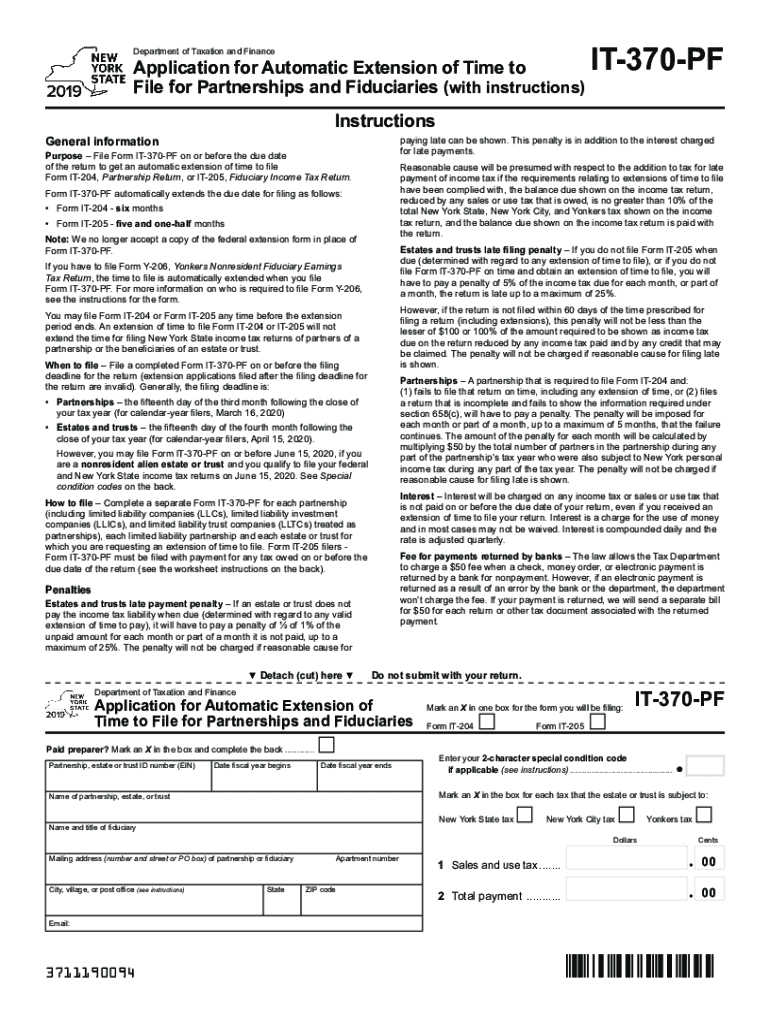

Form it 370 PF Department of Taxation and Finance NY Gov 2019

What is the Form IT 370 PF?

The Form IT 370 PF is a document issued by the New York State Department of Taxation and Finance. It is primarily used for requesting a refund of overpaid personal income tax. This form is essential for individuals who believe they have paid more tax than required and wish to reclaim the excess amount. The form collects personal information, tax details, and the reason for the refund request, ensuring that the process is clear and organized.

Steps to complete the Form IT 370 PF

Completing the Form IT 370 PF involves several key steps to ensure accuracy and compliance. Start by gathering all necessary documentation, including your tax returns and any supporting documents related to your refund claim. Next, fill out the personal information section, ensuring that your name, address, and Social Security number are correct. Proceed to the tax details section, where you will indicate the tax year and the amount you are claiming as a refund. Finally, review the form for completeness and accuracy before submitting it.

How to obtain the Form IT 370 PF

The Form IT 370 PF can be obtained directly from the New York State Department of Taxation and Finance website. It is available for download in a printable format, allowing users to fill it out by hand or electronically. Additionally, local tax offices may provide physical copies of the form for those who prefer in-person assistance. Ensure you are using the most current version of the form to avoid any issues during the submission process.

Legal use of the Form IT 370 PF

The legal use of the Form IT 370 PF is governed by New York State tax laws. This form must be filled out accurately to ensure that your refund request is valid. Submitting incorrect information can lead to delays or denial of your claim. It is important to keep copies of all submitted documents for your records, as they may be required for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 370 PF vary depending on the tax year. Generally, the form must be submitted within three years from the date the original tax return was filed or within two years from the date the tax was paid, whichever is later. It is crucial to be aware of these deadlines to ensure that your refund request is processed in a timely manner.

Required Documents

When completing the Form IT 370 PF, several documents may be required to support your refund claim. These typically include copies of your previous tax returns, W-2 forms, 1099 forms, and any other relevant financial documentation. Having these documents on hand will facilitate the completion of the form and help substantiate your request for a refund.

Form Submission Methods

The Form IT 370 PF can be submitted through various methods. Taxpayers have the option to file online through the New York State Department of Taxation and Finance website, which offers a secure and efficient way to submit your claim. Alternatively, you can mail the completed form to the appropriate address listed on the form or submit it in person at a local tax office. Ensure that you choose the method that best suits your needs and provides the necessary tracking for your submission.

Quick guide on how to complete form it 370 pf department of taxation and finance nygov

Effortlessly Prepare Form IT 370 PF Department Of Taxation And Finance NY gov on Any Device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage Form IT 370 PF Department Of Taxation And Finance NY gov on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to edit and eSign Form IT 370 PF Department Of Taxation And Finance NY gov with ease

- Find Form IT 370 PF Department Of Taxation And Finance NY gov and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to share your form, by email, text message (SMS), or through an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Form IT 370 PF Department Of Taxation And Finance NY gov to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 370 pf department of taxation and finance nygov

Create this form in 5 minutes!

How to create an eSignature for the form it 370 pf department of taxation and finance nygov

How to create an eSignature for your PDF document online

How to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is 'doc bis 645p atf 4522 53 blank' used for?

The 'doc bis 645p atf 4522 53 blank' is a standardized form utilized for various administrative and legal processes. It streamlines the collection and verification of necessary information. Using airSlate SignNow, you can efficiently eSign and send this document, ensuring compliance with relevant regulations.

-

How can I access the 'doc bis 645p atf 4522 53 blank' template?

You can easily access the 'doc bis 645p atf 4522 53 blank' template through the airSlate SignNow platform. Simply navigate to the template library, and you can find it readily available for use. This feature simplifies the document preparation process for your business.

-

What are the pricing options for using airSlate SignNow with 'doc bis 645p atf 4522 53 blank'?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses. With these plans, you can utilize features like eSigning, document management, and template creation for 'doc bis 645p atf 4522 53 blank'. The cost-effective solution is designed to fit companies of all sizes.

-

What key features does airSlate SignNow provide for handling 'doc bis 645p atf 4522 53 blank'?

airSlate SignNow provides advanced features for handling 'doc bis 645p atf 4522 53 blank', including customizable templates, user-friendly eSigning, and comprehensive document tracking. These tools enhance efficiency, reduce turnaround times, and improve workflow. You can tailor the platform to fit your specific document needs.

-

How does eSigning 'doc bis 645p atf 4522 53 blank' work?

eSigning 'doc bis 645p atf 4522 53 blank' with airSlate SignNow is simple and secure. Users can sign documents digitally, ensuring that they are legally binding and compliant. This process not only saves time but also streamlines operations for businesses.

-

What benefits does eSigning 'doc bis 645p atf 4522 53 blank' provide?

The benefits of eSigning 'doc bis 645p atf 4522 53 blank' include increased efficiency, reduced paper usage, and enhanced security. It allows businesses to manage documents from anywhere, promoting flexibility and productivity. With airSlate SignNow, your document processes can be automated and simplified.

-

Can I integrate other software with airSlate SignNow for 'doc bis 645p atf 4522 53 blank'?

Yes, airSlate SignNow offers seamless integrations with various software applications to enhance your document workflow for 'doc bis 645p atf 4522 53 blank'. Connect with tools like CRM systems or cloud storage solutions to further streamline processes. This flexibility allows you to use your preferred tools while managing documents efficiently.

Get more for Form IT 370 PF Department Of Taxation And Finance NY gov

- Time agreement form

- Advertising agreement between homegrocercom inc and amazoncom llc regarding advertising activities form

- Amended restated agreement form

- Conversion agreement form

- Security agreement regarding borrowing of funds and granting of security interest in assets form

- Computer agreement form

- Reciprocal license agreement form

- Software license agreement form

Find out other Form IT 370 PF Department Of Taxation And Finance NY gov

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure