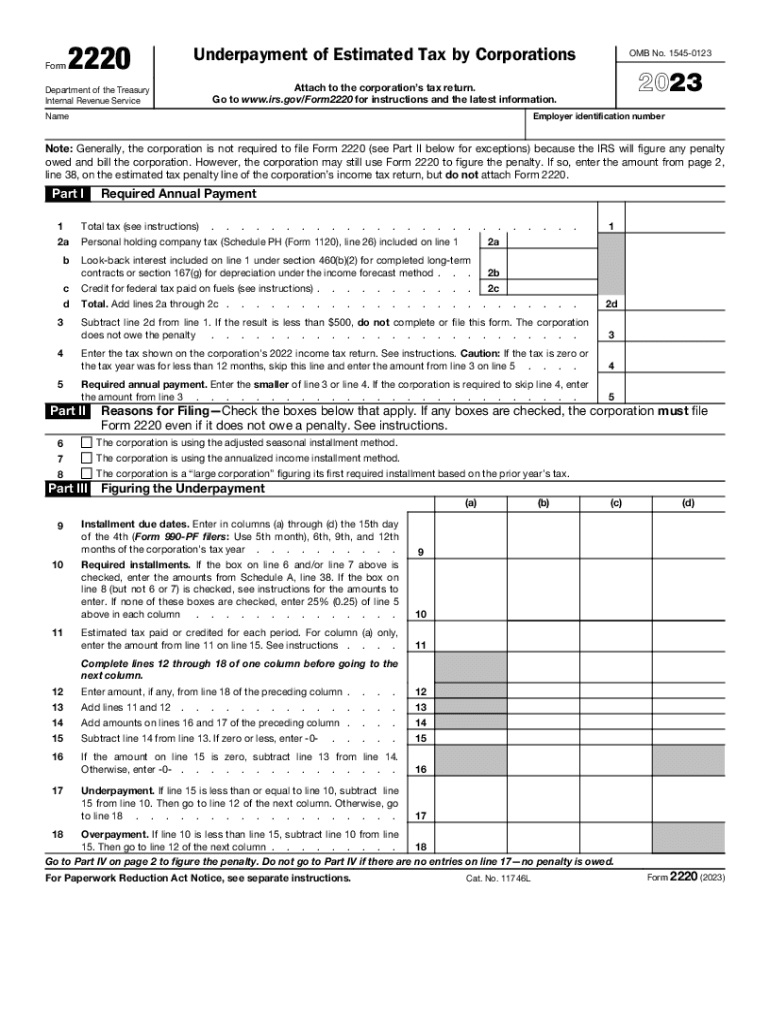

Form 2220, Underpayment of Estimated Tax by Corporations 2023

Understanding IRS Form 2210

IRS Form 2210 is used by individual taxpayers to determine if they owe a penalty for underpaying their estimated taxes. This form helps calculate whether the taxpayer has met the required payment thresholds throughout the tax year. If the total tax owed is not paid in full through withholding or estimated tax payments, the IRS may impose an underpayment penalty. Understanding this form is crucial for taxpayers who may not have withheld enough taxes during the year.

Steps to Complete IRS Form 2210

Completing IRS Form 2210 involves several steps:

- Gather your financial information, including total income, tax withheld, and any estimated tax payments made.

- Calculate your total tax liability for the year using the appropriate tax rates.

- Determine the required estimated tax payments based on your income and filing status.

- Fill out the form by providing your personal information and calculating any penalties for underpayment.

- Review the completed form for accuracy before submission.

IRS Guidelines for Form 2210

The IRS provides specific guidelines for completing Form 2210. Taxpayers should refer to the official instructions to ensure compliance with all requirements. Key points include understanding the different sections of the form, knowing the thresholds for estimated payments, and recognizing the exceptions that may apply. The IRS updates these guidelines annually, so it is important to refer to the instructions relevant to the tax year being filed.

Filing Deadlines for IRS Form 2210

IRS Form 2210 must be filed along with your income tax return by the tax filing deadline, which is typically April 15 for most taxpayers. If you file for an extension, the form is due by the extended deadline. It is essential to be aware of these deadlines to avoid additional penalties and interest on unpaid taxes.

Penalties for Non-Compliance with IRS Form 2210

Failing to file IRS Form 2210 when required can result in penalties. The IRS may impose an underpayment penalty based on the amount of tax owed and the period of underpayment. Understanding the potential penalties can help taxpayers avoid costly mistakes and ensure they remain compliant with tax laws.

Eligibility Criteria for Using IRS Form 2210

Not all taxpayers need to file Form 2210. Generally, it is required for individuals who owe a penalty for underpayment of estimated taxes. However, certain criteria exempt taxpayers from this requirement, such as those who had no tax liability in the previous year or those whose total tax owed is below a specific threshold. Reviewing the eligibility criteria can help determine if the form is necessary.

Quick guide on how to complete form 2220 underpayment of estimated tax by corporations

Complete Form 2220, Underpayment Of Estimated Tax By Corporations effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without interruptions. Manage Form 2220, Underpayment Of Estimated Tax By Corporations on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to adjust and eSign Form 2220, Underpayment Of Estimated Tax By Corporations with ease

- Locate Form 2220, Underpayment Of Estimated Tax By Corporations and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a standard wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Select how you want to send your form, either via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form navigation, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Adjust and eSign Form 2220, Underpayment Of Estimated Tax By Corporations to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2220 underpayment of estimated tax by corporations

Create this form in 5 minutes!

How to create an eSignature for the form 2220 underpayment of estimated tax by corporations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 2210?

IRS Form 2210 is a form used by taxpayers to calculate any penalty for underpayment of estimated tax. Understanding IRS Form 2210 is crucial for ensuring compliance with tax obligations. This form helps you determine if you owe a penalty and how much that penalty is, allowing you to avoid unexpected fees.

-

How can airSlate SignNow help with IRS Form 2210?

airSlate SignNow simplifies the process of sending and eSigning IRS Form 2210 and other tax-related documents. Our platform ensures that your documents are securely managed and easily accessible. By using airSlate SignNow, you can efficiently gather signatures and manage any necessary revisions.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features such as eSigning, document templates, and automated workflows that streamline the handling of IRS Form 2210. You can easily customize templates for quick access and modifications. These features enhance efficiency and ensure all necessary documentation is completed accurately.

-

Is airSlate SignNow cost-effective for businesses that require IRS Form 2210 submissions?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to submit IRS Form 2210. Our pricing plans are designed to accommodate various business sizes and requirements. Investing in airSlate SignNow can save you both time and money, especially during tax season.

-

Can I integrate airSlate SignNow with other software for IRS Form 2210 management?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and tax preparation software, making it easier to manage IRS Form 2210 and related documents. These integrations ensure a smooth workflow, reducing the hassle of switching between multiple platforms.

-

What are the benefits of using airSlate SignNow for IRS Form 2210?

Using airSlate SignNow for IRS Form 2210 offers several benefits, including improved turnaround times and enhanced security for your documents. The platform's user-friendly interface allows you to manage your tax forms efficiently. Additionally, eSigning provides a legally binding way to finalize these important documents.

-

What types of businesses benefit from using airSlate SignNow for IRS Form 2210?

Various types of businesses, from freelancers to large corporations, can benefit from airSlate SignNow when dealing with IRS Form 2210. Our platform caters to any entity that needs to manage important tax documents efficiently. Its flexibility and ease of use make it an ideal choice for businesses of all sizes.

Get more for Form 2220, Underpayment Of Estimated Tax By Corporations

Find out other Form 2220, Underpayment Of Estimated Tax By Corporations

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast