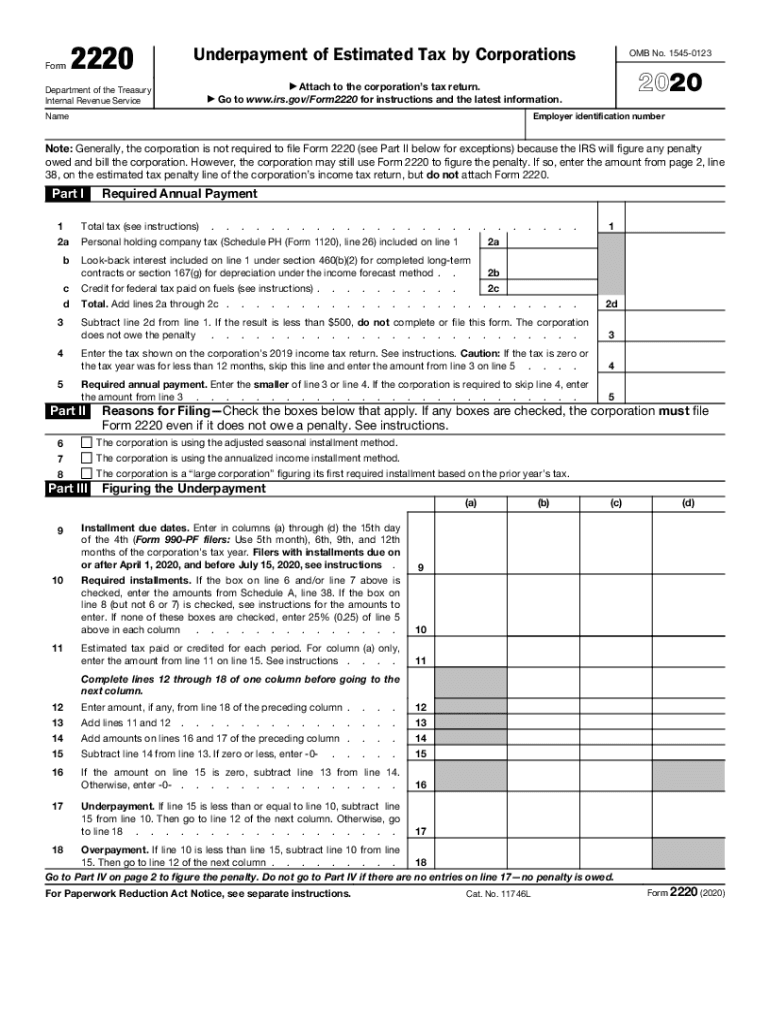

2220 Underpayment of Estimated Tax by Corporations Form 990 2020

Understanding the 2018 Form 2210 for Underpayment of Estimated Tax

The 2018 Form 2210 is utilized by individuals and corporations to determine if they have underpaid their estimated tax obligations. This form is essential for those who may not have withheld enough tax throughout the year, which can result in penalties. It helps taxpayers calculate their required estimated tax payments and assess any potential penalties for underpayment. Understanding this form is crucial for compliance with IRS regulations and avoiding unnecessary fines.

Steps to Complete the 2018 Form 2210

Completing the 2018 Form 2210 involves several key steps:

- Gather your financial documents, including income statements and previous tax returns.

- Determine your total tax liability for the year.

- Calculate your total payments made through withholding and estimated payments.

- Use the form to compute any underpayment and potential penalties.

- Review the completed form for accuracy before submission.

Each section of the form requires careful attention to detail to ensure compliance with IRS guidelines.

Filing Deadlines for the 2018 Form 2210

Timely filing of the 2018 Form 2210 is essential to avoid penalties. The form must be submitted along with your tax return, typically by April 15, unless you have filed for an extension. If you owe additional tax due to underpayment, it is advisable to pay any balance due by this deadline to minimize penalties and interest.

IRS Guidelines for the 2018 Form 2210

The IRS provides specific guidelines for completing and submitting the 2018 Form 2210. Taxpayers should refer to the IRS instructions for detailed information on eligibility, calculations, and filing procedures. Adhering to these guidelines ensures that the form is filled out correctly and submitted in compliance with IRS regulations.

Penalties for Non-Compliance with the 2018 Form 2210

Failure to file the 2018 Form 2210 or to pay the required estimated taxes can result in significant penalties. The IRS may impose a penalty based on the amount of underpayment and the duration of the underpayment period. Understanding these penalties can help taxpayers take proactive measures to avoid them, such as making timely estimated tax payments throughout the year.

Digital vs. Paper Version of the 2018 Form 2210

Taxpayers have the option to complete the 2018 Form 2210 either digitally or on paper. The digital version offers convenience and may include features that streamline the filing process, such as automatic calculations. However, some individuals may prefer the traditional paper method. Regardless of the method chosen, ensuring accuracy and compliance with IRS standards is paramount.

Quick guide on how to complete 2220 underpayment of estimated tax by corporations form 990

Set Up 2220 Underpayment Of Estimated Tax By Corporations Form 990 Effortlessly on Any Device

Digital document handling has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 2220 Underpayment Of Estimated Tax By Corporations Form 990 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign 2220 Underpayment Of Estimated Tax By Corporations Form 990 with Ease

- Find 2220 Underpayment Of Estimated Tax By Corporations Form 990 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to submit your form, via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign 2220 Underpayment Of Estimated Tax By Corporations Form 990 to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2220 underpayment of estimated tax by corporations form 990

Create this form in 5 minutes!

How to create an eSignature for the 2220 underpayment of estimated tax by corporations form 990

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the 2018 form 2210, and why do I need it?

The 2018 form 2210 is used by taxpayers to determine if they owe a penalty for underpayment of estimated tax. Understanding this form is essential to avoid unexpected penalties when filing your taxes. AirSlate SignNow simplifies the process of signing and submitting the 2018 form 2210 electronically, ensuring compliance and accuracy.

-

How can airSlate SignNow help me with the 2018 form 2210?

AirSlate SignNow offers a seamless electronic signature solution that allows you to fill out and sign the 2018 form 2210 quickly. Our platform is user-friendly, ensuring that you can complete your tax document efficiently and securely. Plus, eSigning with airSlate SignNow helps streamline your tax preparation process.

-

What features does airSlate SignNow provide for managing the 2018 form 2210?

AirSlate SignNow includes features such as document templates, multi-party signing, and secure storage, which are particularly useful for the 2018 form 2210. You can easily create templates for repeated use, track document statuses, and maintain compliance with tax submission requirements. Our features are designed to enhance your productivity during tax season.

-

Is airSlate SignNow affordable for small businesses handling the 2018 form 2210?

Yes, airSlate SignNow provides cost-effective pricing options that are ideal for small businesses who need to manage forms like the 2018 form 2210. Our competitive rates ensure that you can access professional eSigning capabilities without breaking the bank. There are various plans available to fit your business size and needs.

-

Can I integrate airSlate SignNow with my existing software for processing the 2018 form 2210?

Absolutely! AirSlate SignNow offers integrations with numerous business applications, allowing you to streamline operations when dealing with the 2018 form 2210. You can connect our platform with popular software like CRM systems, document management tools, and cloud storage services for enhanced efficiency.

-

What are the benefits of using airSlate SignNow for the 2018 form 2210?

Using airSlate SignNow for the 2018 form 2210 provides numerous benefits including increased speed, ease of use, and secure document handling. You can sign and send your tax forms in minutes rather than waiting for physical delivery. This convenience allows for faster processing and peace of mind during tax season.

-

How secure is my information with airSlate SignNow when filling out the 2018 form 2210?

Security is a top priority at airSlate SignNow. We use industry-standard encryption and secure access protocols to protect your information while you complete the 2018 form 2210. Our platform also complies with various data protection regulations to ensure your sensitive data remains confidential.

Get more for 2220 Underpayment Of Estimated Tax By Corporations Form 990

Find out other 2220 Underpayment Of Estimated Tax By Corporations Form 990

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease