Form 2220 2014

What is the Form 2220

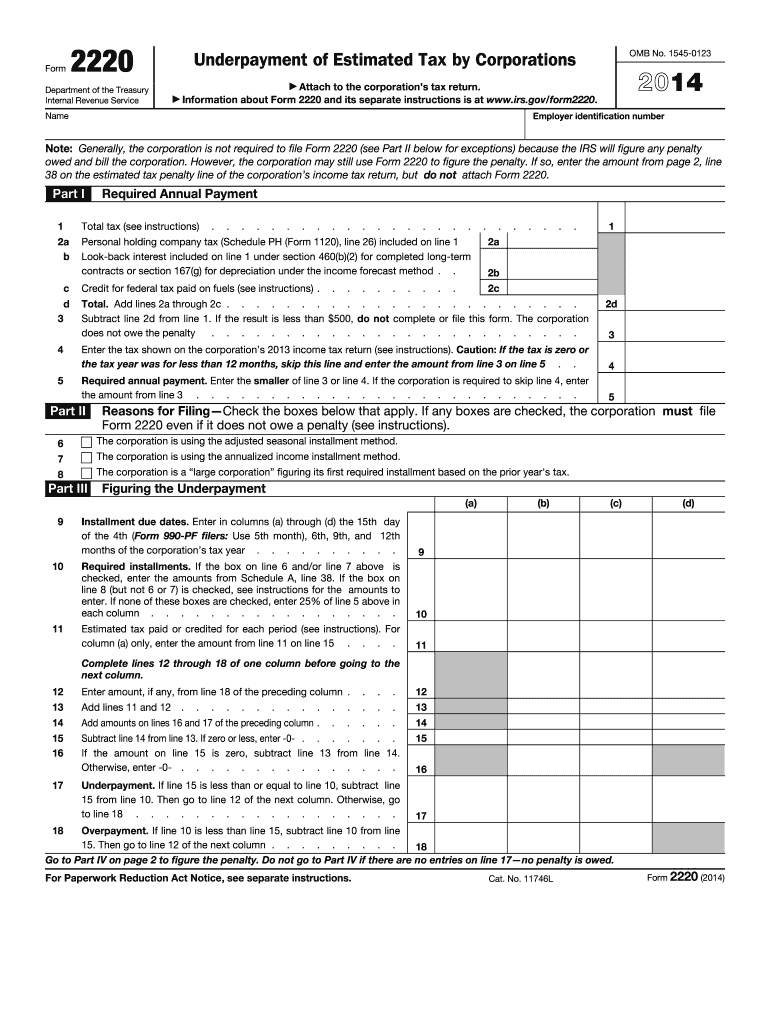

The Form 2220 is a tax form used by individuals and businesses to calculate and report any penalties for underpayment of estimated tax. This form is particularly relevant for taxpayers who do not pay enough tax throughout the year, either through withholding or estimated tax payments. The IRS requires this form to ensure compliance with tax obligations and to assess any penalties accurately. Understanding the purpose and requirements of Form 2220 is crucial for maintaining proper tax records and avoiding unnecessary fines.

How to use the Form 2220

Using Form 2220 involves several steps to accurately report underpayment penalties. First, gather all relevant financial information, including total income and estimated tax payments made throughout the year. Next, complete the form by following the instructions provided by the IRS. This includes calculating the required amounts based on your specific tax situation. Finally, submit the completed form along with your tax return to the IRS by the appropriate deadline. It is important to ensure that all information is accurate to avoid potential issues with the IRS.

Steps to complete the Form 2220

Completing Form 2220 requires careful attention to detail. Follow these steps:

- Gather your financial documents, including income statements and records of estimated tax payments.

- Begin filling out the form by entering your personal information, such as your name and taxpayer identification number.

- Calculate your total tax liability and compare it to the total estimated payments made during the year.

- Determine if you owe any penalties for underpayment by following the instructions on the form.

- Review your completed form for accuracy before submitting it with your tax return.

Filing Deadlines / Important Dates

It is essential to be aware of the deadlines associated with Form 2220 to avoid penalties. Generally, Form 2220 must be filed along with your annual tax return, which is typically due on April fifteenth. If you are unable to file by this date, you may request an extension, but you must still pay any taxes owed by the original deadline to avoid additional penalties. Staying informed about these dates helps ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failure to comply with the requirements of Form 2220 can result in significant penalties. Taxpayers who do not submit the form when required may face fines that increase based on the amount of underpayment. Additionally, interest may accrue on any unpaid taxes, further increasing the total amount owed. Understanding these penalties emphasizes the importance of timely and accurate filing of Form 2220.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 2220. These guidelines include detailed instructions on calculating penalties, determining eligibility for exceptions, and understanding the implications of underpayment. Taxpayers are encouraged to review these guidelines thoroughly to ensure compliance and to seek assistance if needed. Adhering to IRS guidelines can help prevent issues during the filing process.

Quick guide on how to complete form 2220 2014

Discover the simplest method to complete and endorse your Form 2220

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior approach to finish and sign your Form 2220 and associated forms for public services. Our advanced electronic signature system equips you with everything necessary to process documents swiftly and in compliance with official standards - robust PDF editing, managing, securing, signing, and sharing tools all available in a user-friendly interface.

Only a few steps are needed to fill out and endorse your Form 2220:

- Upload the editable template to the editor using the Get Form button.

- Determine what information you need to provide in your Form 2220.

- Move between the fields using the Next button to avoid missing anything.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Enhance the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Obscure parts that are no longer relevant.

- Click on Sign to create a legally valid electronic signature using any method you prefer.

- Add the Date next to your signature and conclude your task with the Done button.

Store your completed Form 2220 in the Documents folder within your account, download it, or export it to your chosen cloud storage. Our service also provides adaptable form sharing options. There’s no need to print your forms when you wish to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS delivery from your account. Give it a go now!

Create this form in 5 minutes or less

Find and fill out the correct form 2220 2014

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

What are the tips for filling out the IIFT CV FORM for 2014?

CV form is the first impression that you make on the interviewer when it comes to IIFT.Mathematically, resume + about yourself+career goal+ why MBA? + your life story =CV formSo make it genuine and interesting at the same time. Achievements need not be older than your 9th standard, if there aren't many after 9th then go for older ones.The last question "Anything else you want to include" which is an optional question should be answered with something very genuine and don't try to fake it.Keep a photocopy of your CV form and ask your friends to ask you cross questions on your answers and grill you for each one of them.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

Create this form in 5 minutes!

How to create an eSignature for the form 2220 2014

How to create an eSignature for the Form 2220 2014 online

How to create an eSignature for your Form 2220 2014 in Chrome

How to generate an eSignature for signing the Form 2220 2014 in Gmail

How to generate an electronic signature for the Form 2220 2014 straight from your mobile device

How to create an eSignature for the Form 2220 2014 on iOS

How to make an electronic signature for the Form 2220 2014 on Android OS

People also ask

-

What is Form 2220 and why is it important for businesses?

Form 2220 is a crucial IRS document that helps businesses calculate penalties for underpayment of estimated tax. Understanding and properly completing Form 2220 can ensure compliance and avoid unnecessary penalties. Using airSlate SignNow, you can easily eSign and send Form 2220 digitally, streamlining your tax process.

-

How does airSlate SignNow simplify the process of completing Form 2220?

airSlate SignNow simplifies the completion of Form 2220 by providing an easy-to-use platform for eSigning and sending documents. With customizable templates and intuitive interface, you can fill out Form 2220 quickly and accurately. This eliminates the hassle of paper forms and enhances efficiency in managing your tax documents.

-

Can I integrate airSlate SignNow with other software to manage Form 2220?

Yes, airSlate SignNow offers seamless integrations with various accounting and tax software, allowing you to manage Form 2220 alongside your other financial documents. This integration ensures that your data is synchronized and accessible, making it easier to prepare and file your taxes. Streamlining your workflow has never been easier!

-

Is there a cost associated with using airSlate SignNow for Form 2220?

airSlate SignNow provides various pricing plans tailored to meet your business needs, including options for individuals and teams. The cost of using airSlate SignNow for Form 2220 depends on the plan you choose, but it is designed to be a cost-effective solution for eSigning and document management. You can explore the pricing page for detailed information.

-

What features does airSlate SignNow offer for managing Form 2220?

airSlate SignNow offers a variety of features that enhance the management of Form 2220, including secure eSigning, document tracking, and customizable templates. These features help ensure that your Form 2220 is completed accurately and submitted on time. Additionally, real-time notifications keep you informed of any updates or changes.

-

How secure is my information when using airSlate SignNow for Form 2220?

Security is a top priority at airSlate SignNow. When you use our platform for Form 2220, your information is protected with advanced encryption and secure access controls. We comply with industry standards to ensure that your sensitive tax documents are safe and confidential throughout the signing process.

-

Can I access Form 2220 on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage Form 2220 anytime, anywhere. Whether you're on your smartphone or tablet, you can easily eSign documents and send them securely. This mobile accessibility empowers you to handle your tax responsibilities on the go.

Get more for Form 2220

Find out other Form 2220

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free