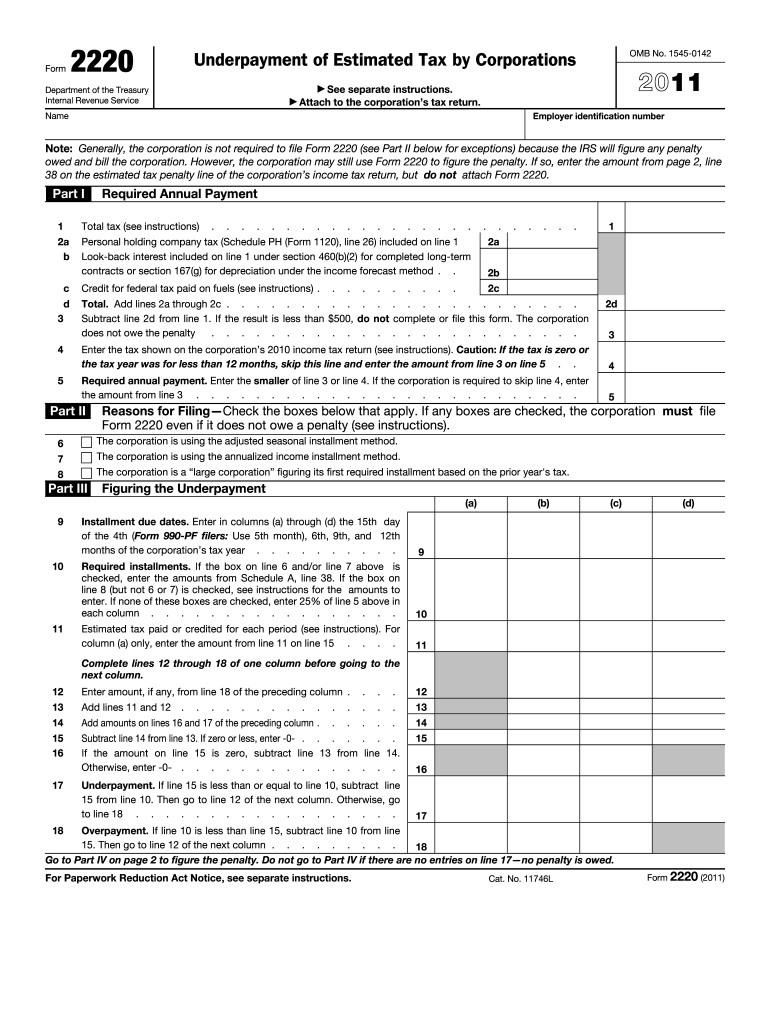

Irs Form Estimated Tax 2011

What is the IRS Form Estimated Tax

The IRS Form Estimated Tax is a crucial document for taxpayers who expect to owe tax of $1,000 or more when they file their annual return. This form allows individuals and businesses to calculate and pay their estimated tax liabilities quarterly throughout the year. The estimated tax is primarily applicable to self-employed individuals, investors, and those who receive income that is not subject to withholding, such as rental income or dividends.

How to use the IRS Form Estimated Tax

To effectively use the IRS Form Estimated Tax, taxpayers must first determine their expected income for the year. This includes wages, self-employment income, interest, and dividends. After estimating total income, taxpayers can use the IRS worksheets to calculate their expected tax liability. Once the estimated tax amount is determined, payments can be made using the form, either electronically or by mail.

Steps to complete the IRS Form Estimated Tax

Completing the IRS Form Estimated Tax involves several key steps:

- Gather income information, including all sources of revenue.

- Calculate the expected tax liability using the IRS tax tables or worksheets provided with the form.

- Determine the amount of estimated tax to pay for each quarter.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the form by the appropriate deadlines to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form Estimated Tax are crucial for compliance. Generally, estimated tax payments are due on the fifteenth day of April, June, September, and January of the following year. If these dates fall on a weekend or holiday, the due date is typically extended to the next business day. Taxpayers should mark these dates on their calendars to ensure timely payments.

Penalties for Non-Compliance

Failure to file the IRS Form Estimated Tax or to make timely payments can result in penalties and interest charges. The IRS may impose a penalty if the taxpayer owes more than $1,000 when filing their return, or if they do not pay at least 90% of their current year tax liability. Understanding these penalties is essential for maintaining compliance and avoiding unnecessary financial burdens.

Who Issues the Form

The IRS, or Internal Revenue Service, is the federal agency responsible for issuing the IRS Form Estimated Tax. This form is updated periodically to reflect changes in tax laws and regulations. Taxpayers should ensure they are using the most current version of the form to avoid issues with their estimated tax payments.

Quick guide on how to complete 2011 irs form estimated tax

Uncover the easiest method to complete and endorse your Irs Form Estimated Tax

Are you still spending time creating your official documents on paper instead of doing it digitally? airSlate SignNow presents a more efficient way to finalize and sign your Irs Form Estimated Tax as well as other forms for public services. Our advanced electronic signature solution equips you with all the tools necessary to handle paperwork swiftly and in compliance with official standards - comprehensive PDF editing, management, security, signing, and sharing resources are all available through an intuitive interface.

Only a few steps are needed to fill out and sign your Irs Form Estimated Tax:

- Insert the fillable form into the editor using the Get Form button.

- Verify what information you must provide in your Irs Form Estimated Tax.

- Move through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to input your information into the required areas.

- Enhance the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Hide sections that are irrelevant.

- Press Sign to generate a legally valid electronic signature using any method you prefer.

- Add the Date next to your signature and conclude your task with the Done button.

Store your finished Irs Form Estimated Tax in the Documents folder of your profile, download it, or export it to your chosen cloud storage. Our solution also facilitates versatile form sharing. There’s no requirement to print your documents when you need to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 2011 irs form estimated tax

FAQs

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

How many tax forms does a small startup usually have to fill for the IRS?

It depends. Have you set up a separate legal entity, such as a C corporation or an LLC? Are you operating as a sole proprietor? Are you referring specifically to income tax returns? Depending on what kind of business you have, you may include additional schedules, election statements, informational forms to supplement your income tax returns.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

Create this form in 5 minutes!

How to create an eSignature for the 2011 irs form estimated tax

How to generate an electronic signature for the 2011 Irs Form Estimated Tax online

How to generate an eSignature for your 2011 Irs Form Estimated Tax in Google Chrome

How to generate an eSignature for signing the 2011 Irs Form Estimated Tax in Gmail

How to create an electronic signature for the 2011 Irs Form Estimated Tax right from your smartphone

How to generate an eSignature for the 2011 Irs Form Estimated Tax on iOS

How to generate an electronic signature for the 2011 Irs Form Estimated Tax on Android OS

People also ask

-

What is the Irs Form Estimated Tax and why is it important?

The Irs Form Estimated Tax is used by individuals and businesses to report and pay estimated taxes on income that isn't subject to withholding. It is important to file this form to avoid underpayment penalties and ensure compliance with IRS regulations.

-

How can airSlate SignNow help me manage my Irs Form Estimated Tax documents?

airSlate SignNow allows you to easily send, eSign, and store your Irs Form Estimated Tax documents securely. Our platform streamlines the signing process, ensuring that you meet deadlines without the hassle of paper trails.

-

What features does airSlate SignNow offer for handling tax documents like the Irs Form Estimated Tax?

airSlate SignNow offers features such as customizable templates, real-time tracking, and cloud storage for your Irs Form Estimated Tax documents. These features enhance organization and efficiency in managing your tax submissions.

-

Can I integrate airSlate SignNow with accounting software for my Irs Form Estimated Tax?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, making it easier to prepare and submit your Irs Form Estimated Tax. Integration helps keep your financial data synchronized and up to date.

-

Is airSlate SignNow a cost-effective solution for managing Irs Form Estimated Tax?

Absolutely! airSlate SignNow offers competitive pricing plans designed to fit various budgets, making it a cost-effective solution for managing your Irs Form Estimated Tax documents and other important paperwork.

-

How secure is my information when using airSlate SignNow for Irs Form Estimated Tax?

The security of your information is our top priority. airSlate SignNow employs industry-standard encryption and compliance measures to ensure that your Irs Form Estimated Tax documents are kept safe and confidential.

-

Can I access my Irs Form Estimated Tax documents on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully compatible with mobile devices. You can easily access, sign, and manage your Irs Form Estimated Tax documents on the go using our mobile-friendly application.

Get more for Irs Form Estimated Tax

Find out other Irs Form Estimated Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors